When it comes to filing taxes, having the necessary forms is crucial. The IRS provides a variety of printable forms that taxpayers can use to report their income, deductions, and credits. These forms are essential for accurately reporting financial information to the government and ensuring compliance with tax laws.

Whether you are an individual taxpayer, a business owner, or a tax professional, having access to IRS printable forms can make the tax filing process much easier. These forms are available on the IRS website and can be easily downloaded and printed for use. From Form 1040 for individual tax returns to Form 941 for employment tax returns, there is a form for every type of taxpayer.

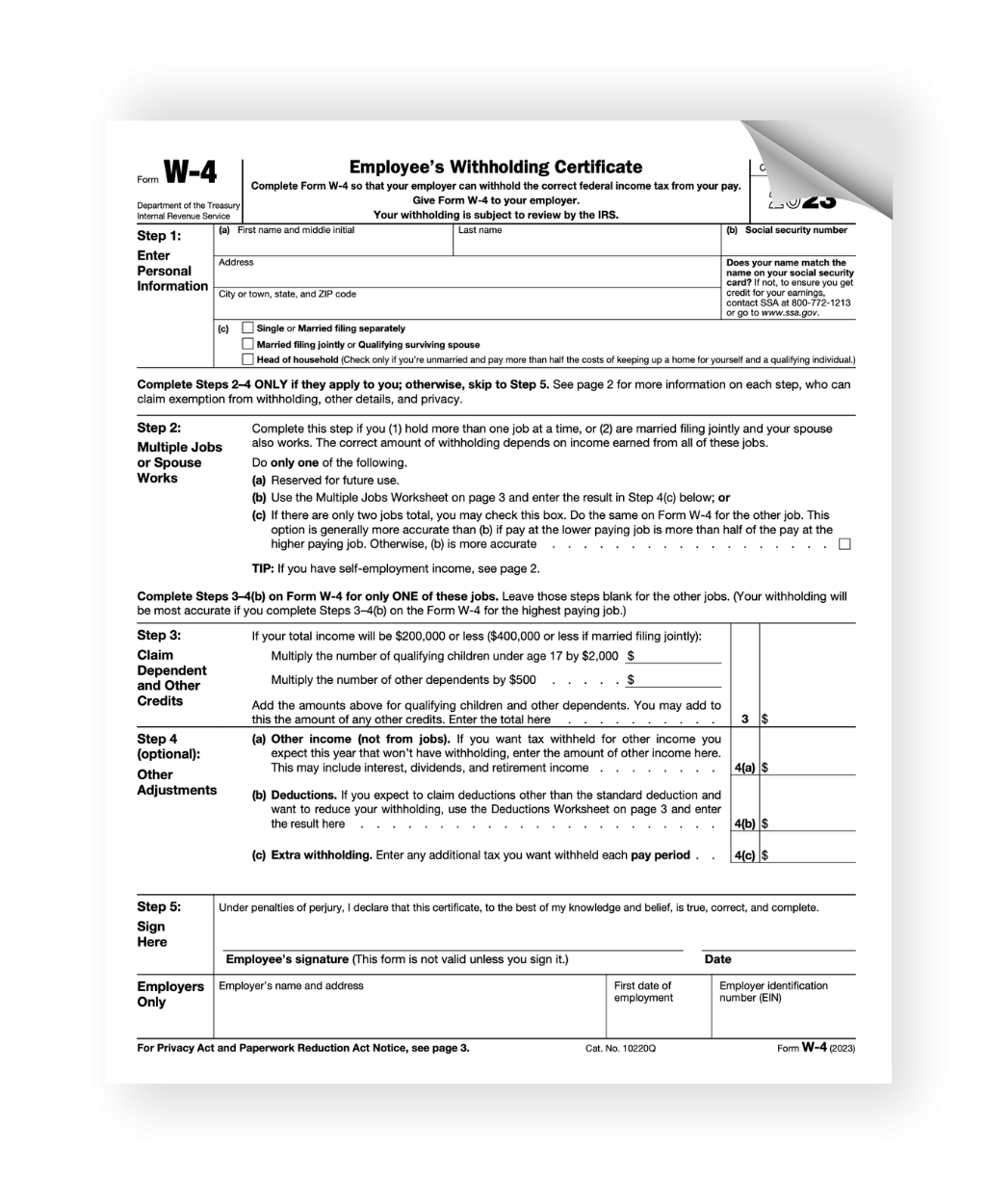

One of the most commonly used IRS printable forms is Form W-4, which is used to determine the amount of federal income tax that is withheld from an employee’s paycheck. This form is typically filled out by employees when they start a new job and can be updated as needed to reflect changes in their tax situation. Having a printable copy of Form W-4 on hand ensures that employees can easily adjust their tax withholding to avoid any surprises come tax time.

In addition to individual tax forms, the IRS also provides printable forms for businesses, including Form 1120 for corporate tax returns and Form 1065 for partnership tax returns. These forms are essential for businesses to accurately report their income and expenses and calculate their tax liability. By having access to printable forms, business owners can ensure that they are meeting their tax obligations and avoiding any potential penalties for non-compliance.

Overall, having access to IRS printable forms is essential for taxpayers to accurately report their financial information and comply with tax laws. Whether you are an individual taxpayer or a business owner, these forms provide a simple and convenient way to report your income, deductions, and credits to the government. Make sure to visit the IRS website to download and print the forms you need for your tax filing needs.

Don’t wait until the last minute to gather your tax documents – start downloading and printing IRS forms today to ensure a smooth and stress-free tax filing process!