IRS forms are essential documents that individuals and businesses need to file their taxes accurately. These forms are used to report income, deductions, credits, and other financial information to the Internal Revenue Service (IRS). While some forms can be filed electronically, there are instances where you may need to submit a physical copy of the form. In such cases, having access to printable IRS forms can be very convenient.

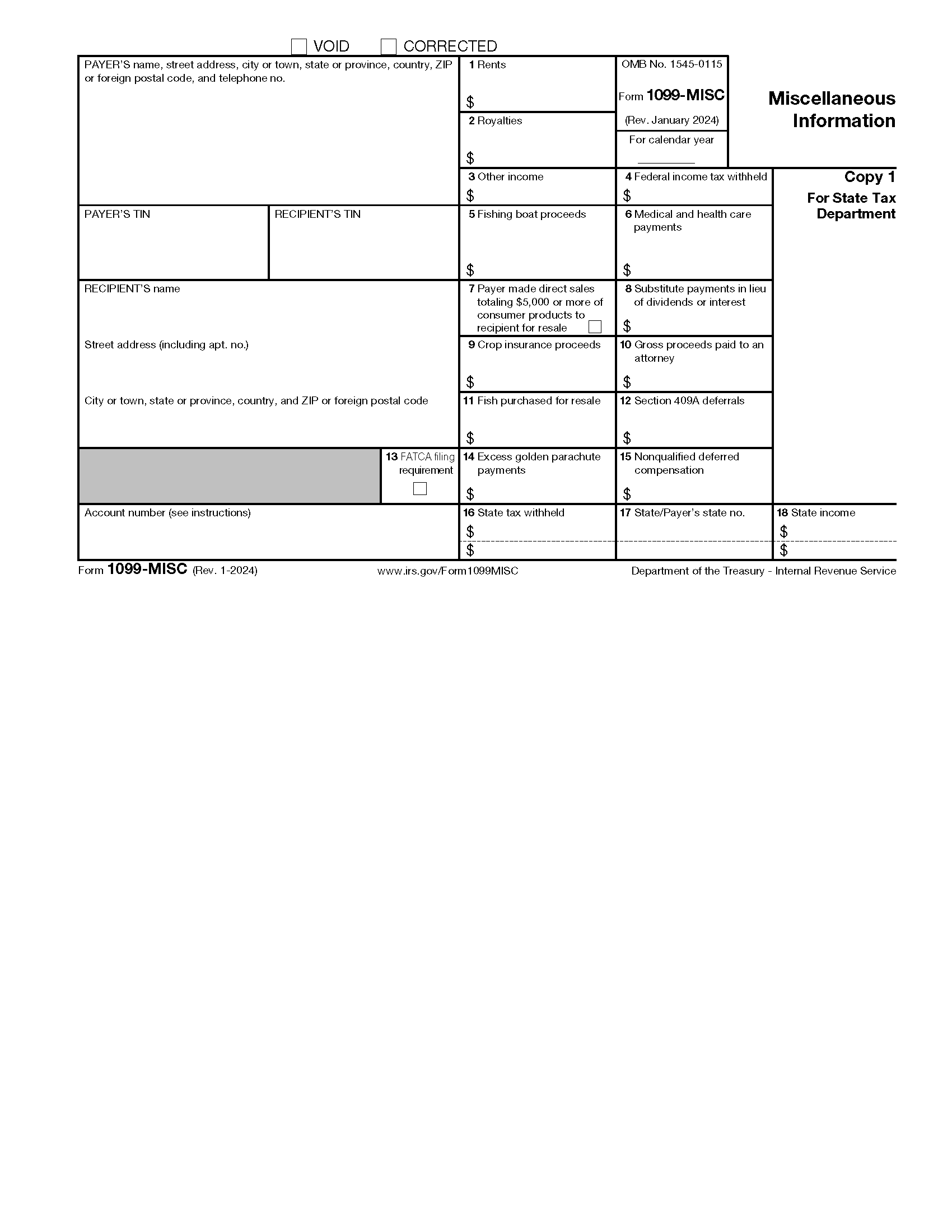

There are a variety of IRS forms that are available for download and printing from the IRS website. These forms cover a wide range of tax-related topics, including income tax returns, payroll taxes, self-employment taxes, and more. Some of the most commonly used IRS forms that can be printed include Form 1040 for individual income tax returns, Form 941 for employer’s quarterly federal tax returns, and Form W-9 for requesting taxpayer identification numbers and certifications.

When using printable IRS forms, it is important to ensure that you are using the most up-to-date version of the form. The IRS regularly updates its forms to reflect changes in tax laws and regulations, so using an outdated form could result in errors or delays in processing your tax return. You can check the IRS website for the latest versions of the forms you need, or consult with a tax professional for assistance.

Printing IRS forms is easy and convenient. Simply visit the IRS website, locate the form you need, and download the PDF file. Once the file is downloaded, you can open it and print it using your home printer. Make sure to follow the instructions on the form carefully and fill out all required information accurately before submitting it to the IRS.

In conclusion, having access to printable IRS forms can be a valuable resource when it comes to filing your taxes. Whether you are an individual taxpayer or a business owner, being able to print the forms you need can save you time and hassle. Just remember to double-check that you are using the most current version of the form to avoid any potential issues with your tax return.