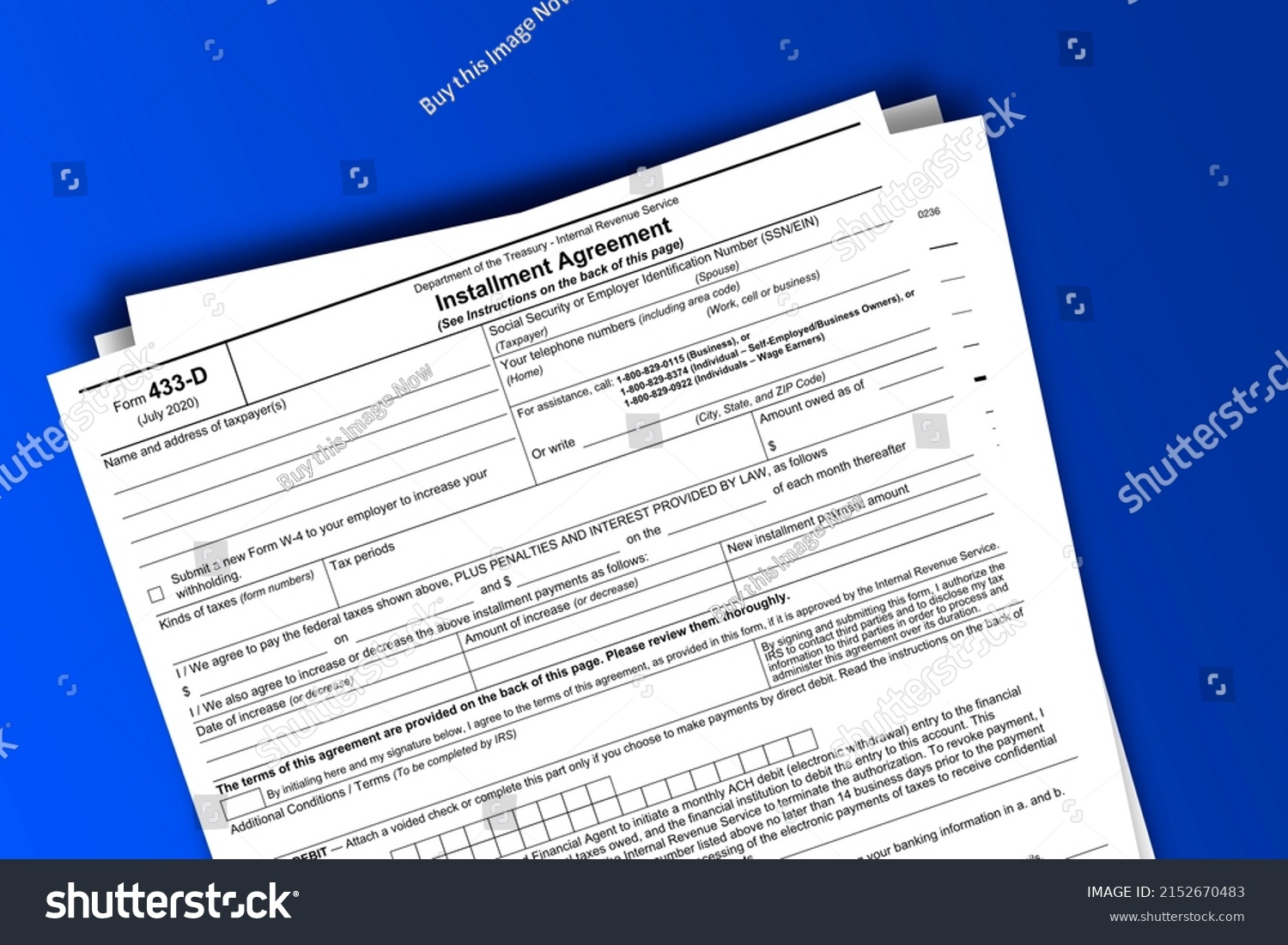

When dealing with tax debt, it’s important to be proactive and take the necessary steps to resolve the issue. One such step is filling out IRS Form 433-D, which is used to set up a payment plan for individuals who are unable to pay their tax debt in full. This form allows taxpayers to provide detailed information about their financial situation, including income, expenses, assets, and liabilities.

Form 433-D is a crucial document for those looking to negotiate a payment plan with the IRS. By providing accurate and thorough information on this form, taxpayers can demonstrate their willingness to cooperate and their ability to make regular payments towards their tax debt. It’s important to fill out this form correctly to avoid any delays or complications in the payment plan approval process.

When filling out Form 433-D, taxpayers will need to provide information such as their monthly income, expenses, assets, and liabilities. This information helps the IRS assess the taxpayer’s financial situation and determine an appropriate payment plan. It’s important to be honest and accurate when filling out this form to avoid any discrepancies that could lead to rejection of the payment plan.

Once Form 433-D is completed, it should be submitted to the IRS along with any required documentation. The IRS will review the information provided and determine the terms of the payment plan based on the taxpayer’s financial situation. It’s important to follow up with the IRS to ensure that the payment plan is approved and to make sure that all payments are made on time.

In conclusion, IRS Form 433-D is an essential tool for individuals looking to set up a payment plan for their tax debt. By providing detailed information about their financial situation, taxpayers can demonstrate their willingness to cooperate with the IRS and work towards resolving their tax debt. It’s important to fill out this form accurately and honestly to avoid any issues with the payment plan approval process.