Form W-9 is a document used in the United States for tax purposes. It is used by individuals or businesses to provide their taxpayer identification number to entities that will be paying them income during the year. The form is used to certify that the taxpayer is a U.S. person and is not subject to backup withholding.

Form W-9 is typically used by freelancers, independent contractors, and other self-employed individuals who need to report their income to the IRS. It is also commonly used by businesses that need to report payments made to vendors, consultants, or other service providers.

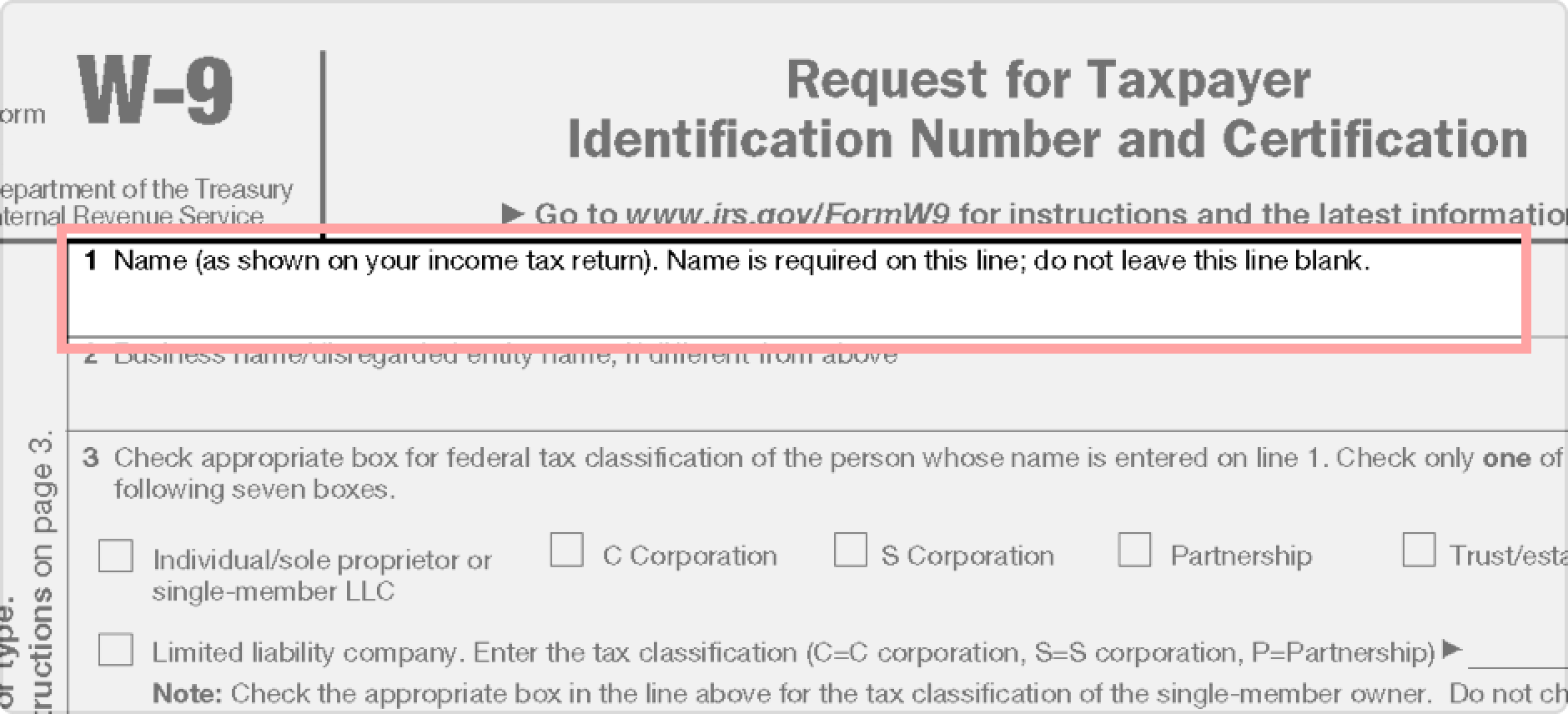

When it comes to filling out Form W-9, there are a few key pieces of information that you will need to provide. This includes your name, business name (if applicable), address, taxpayer identification number (usually your Social Security number), and any exemptions that may apply. The form must be signed and dated to be considered valid.

Form W-9 is an important document that helps ensure compliance with tax laws and regulations. It is essential for both individuals and businesses to keep accurate records and provide the necessary information to the IRS when required. Failure to do so could result in penalties or other consequences.

Fortunately, Form W-9 is readily available online in a printable format. This makes it easy for individuals and businesses to access the form, fill it out, and submit it as needed. By having a printable version of the form, you can quickly and conveniently provide the required information without any hassle.

In conclusion, Form W-9 is a crucial document for tax reporting purposes in the United States. Whether you are an individual or a business, it is important to understand the requirements of the form and ensure that you are in compliance with IRS regulations. By utilizing a printable version of Form W-9, you can streamline the process and ensure that you are providing accurate information to the IRS.