Filing your taxes can be a daunting task, but having the right forms can make the process much smoother. When it comes to federal taxes, there are specific forms that you need to fill out to report your income, deductions, and credits accurately.

For the year 2023, the IRS has released updated versions of the federal tax forms that you can easily access and print from their website. These forms are essential for individuals and businesses to report their financial information to the government and determine how much tax they owe or are owed.

Federal Tax Forms 2023 Printable

Federal Tax Forms 2023 Printable

Federal Tax Forms 2023 Printable

One of the most common forms that individuals need to fill out is the Form 1040, which is used to report your annual income and calculate your tax liability. This form has several variations depending on your filing status and sources of income, such as Form 1040-ES for estimated tax payments and Form 1040-SS for self-employed individuals.

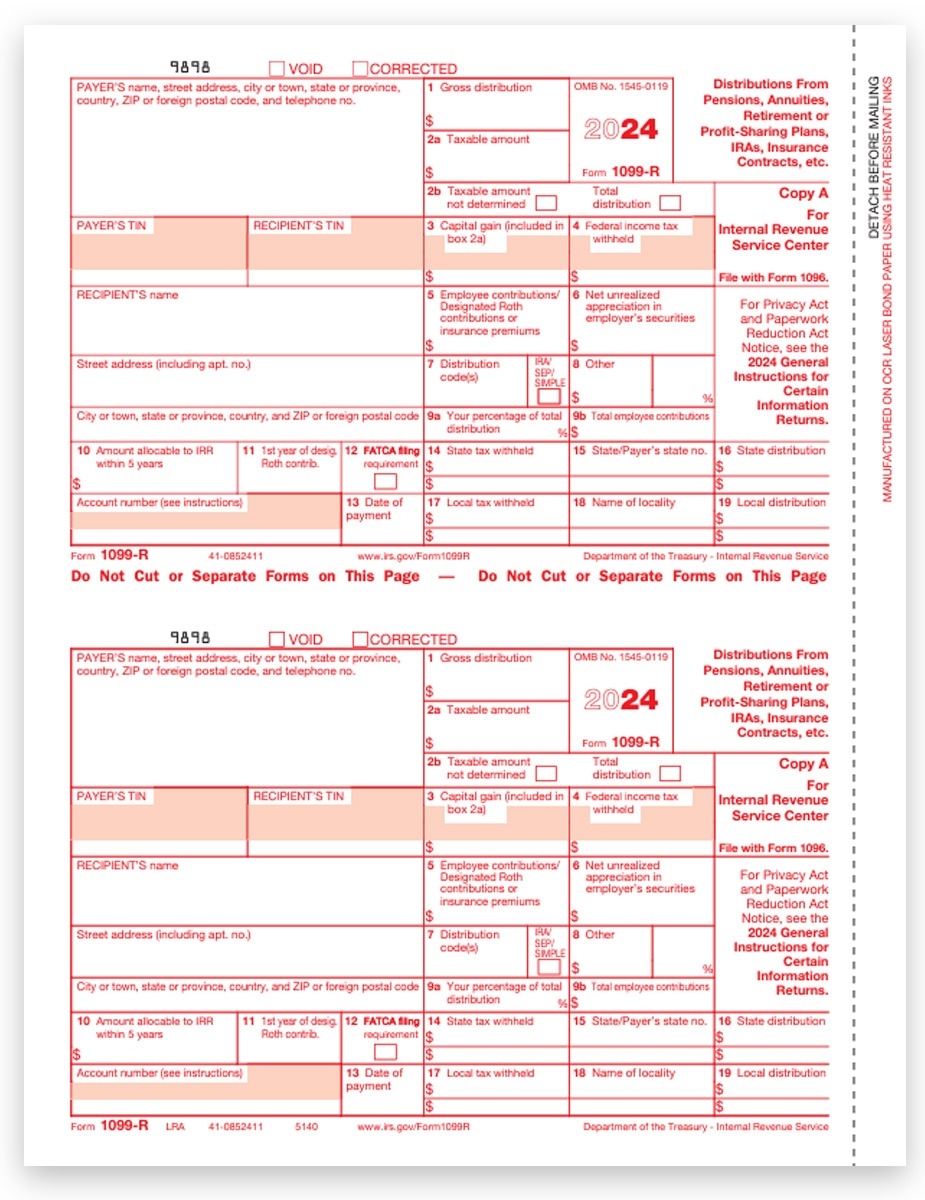

In addition to Form 1040, there are other forms that you may need to include with your tax return, such as Form 1099 for reporting income from interest, dividends, or self-employment, and Form W-2 for reporting wages and salary income. These forms are crucial for accurately reporting your income and ensuring that you are not missing out on any deductions or credits that you may be eligible for.

It is important to carefully review each form and follow the instructions provided by the IRS to avoid any errors or delays in processing your tax return. You can also seek assistance from tax professionals or use tax preparation software to help you navigate through the forms and ensure that you are completing them correctly.

By utilizing the federal tax forms 2023 printable, you can easily access the necessary documents to file your taxes accurately and on time. Make sure to gather all the required information and documentation before filling out the forms to streamline the process and avoid any potential issues with your tax return.

Overall, having the right federal tax forms for the year 2023 is essential for fulfilling your tax obligations and avoiding any penalties or interest charges. Take the time to familiarize yourself with the forms and seek assistance if needed to ensure that you are complying with the tax laws and maximizing your tax benefits.