When it comes to tax season, one of the most important forms that individuals and businesses must fill out is the W9 form. This form is used to gather information from independent contractors or freelancers that will be used to report income to the IRS. It is crucial for both parties to fill out this form accurately to avoid any potential issues with the IRS.

For those who need to fill out the W9 form for the year 2024, having access to a printable version can make the process much easier. Being able to print out the form and fill it out by hand can be more convenient for some individuals, especially those who may not have easy access to a computer or printer.

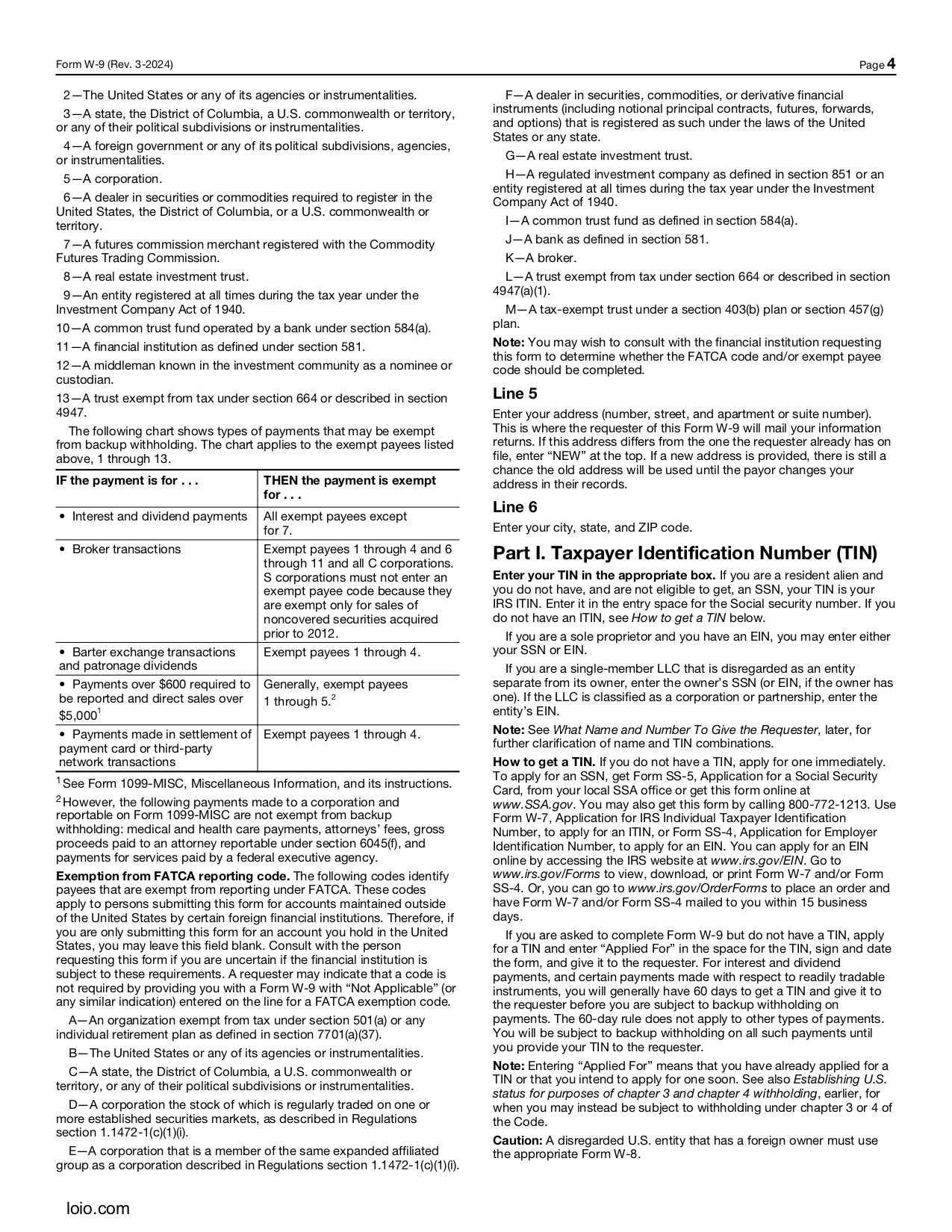

When filling out the W9 form, it is important to provide accurate information such as your name, address, and taxpayer identification number. Failing to do so could result in delays in payment or potential penalties from the IRS. It is also important to keep a copy of the completed form for your records.

It is recommended to review the instructions for the W9 form before filling it out to ensure that all information is provided correctly. If you have any questions or are unsure about how to fill out the form, it may be helpful to seek guidance from a tax professional or accountant.

Once the W9 form is completed, it should be submitted to the payer as soon as possible. This will ensure that there are no delays in processing payments or reporting income to the IRS. It is always better to be proactive and thorough when it comes to tax-related forms to avoid any potential issues down the road.

Overall, having access to a printable version of the W9 form for the year 2024 can make the process of filling out this important tax form much easier. By providing accurate information and submitting the form in a timely manner, individuals and businesses can ensure that they are in compliance with IRS regulations and avoid any potential penalties.