W2 printable forms are essential documents used by employers to report wages paid to employees and taxes withheld from their paychecks. These forms are typically issued at the beginning of each year and must be submitted to both the employee and the Internal Revenue Service (IRS) by the end of January.

Employers are required to provide a W2 form to each employee who received wages during the previous year, regardless of whether taxes were withheld. This form is crucial for employees to accurately report their income and file their tax returns.

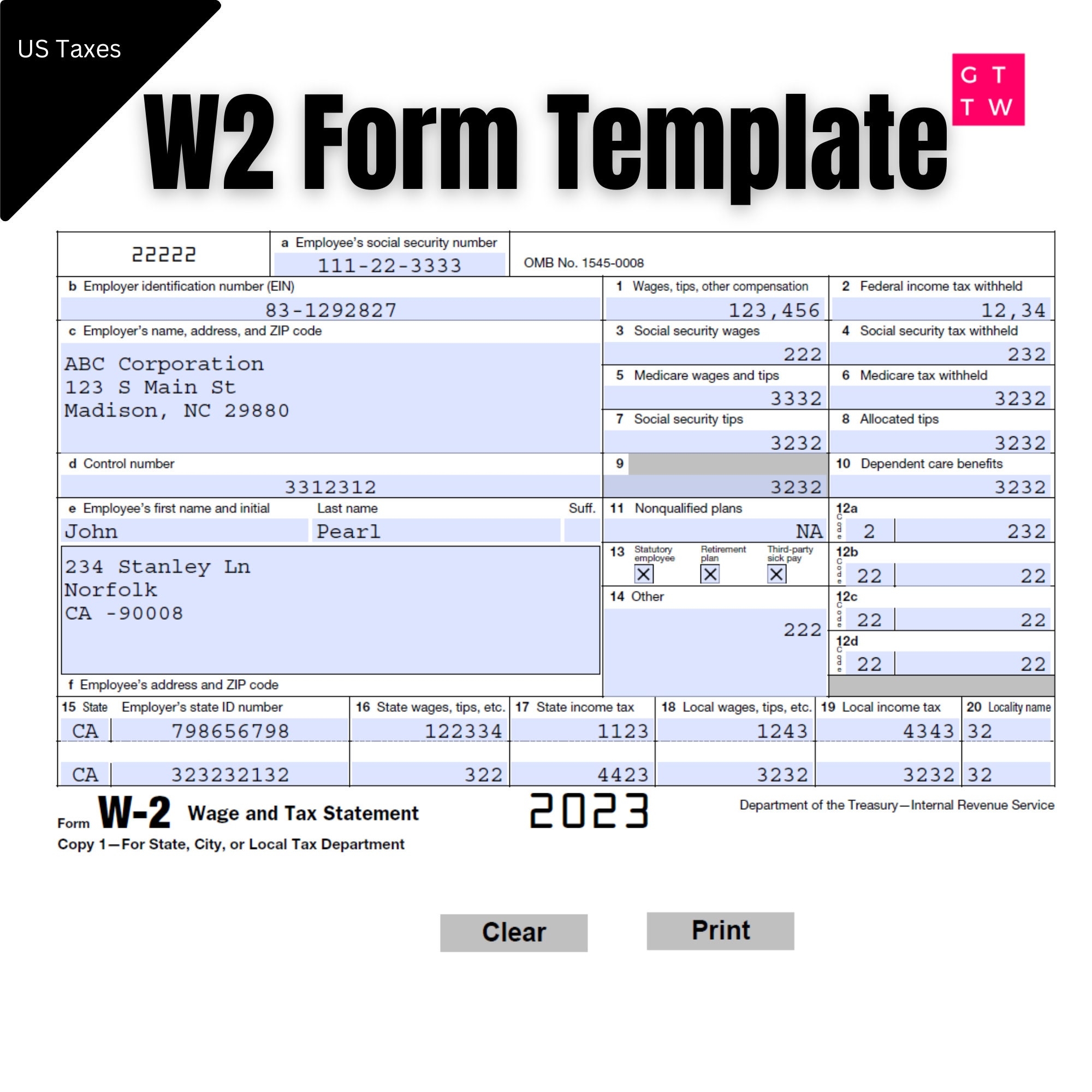

W2 printable forms contain important information such as the employee’s name, address, Social Security number, wages earned, taxes withheld, and other relevant details. It is essential for employers to accurately fill out these forms to avoid any discrepancies or penalties from the IRS.

Employees should carefully review their W2 form to ensure that all information is correct and matches their records. Any errors or discrepancies should be promptly addressed with the employer to avoid any potential issues with the IRS.

Employers can easily obtain and print W2 forms from various online sources or payroll software providers. These forms are typically available in a printable format that can be filled out manually or electronically, depending on the employer’s preference.

In conclusion, W2 printable forms play a crucial role in the annual tax reporting process for both employers and employees. It is important for employers to accurately complete and distribute these forms to ensure compliance with IRS regulations. Employees should carefully review their W2 forms for accuracy and address any discrepancies promptly. By following these guidelines, both employers and employees can streamline the tax reporting process and avoid any potential issues with the IRS.