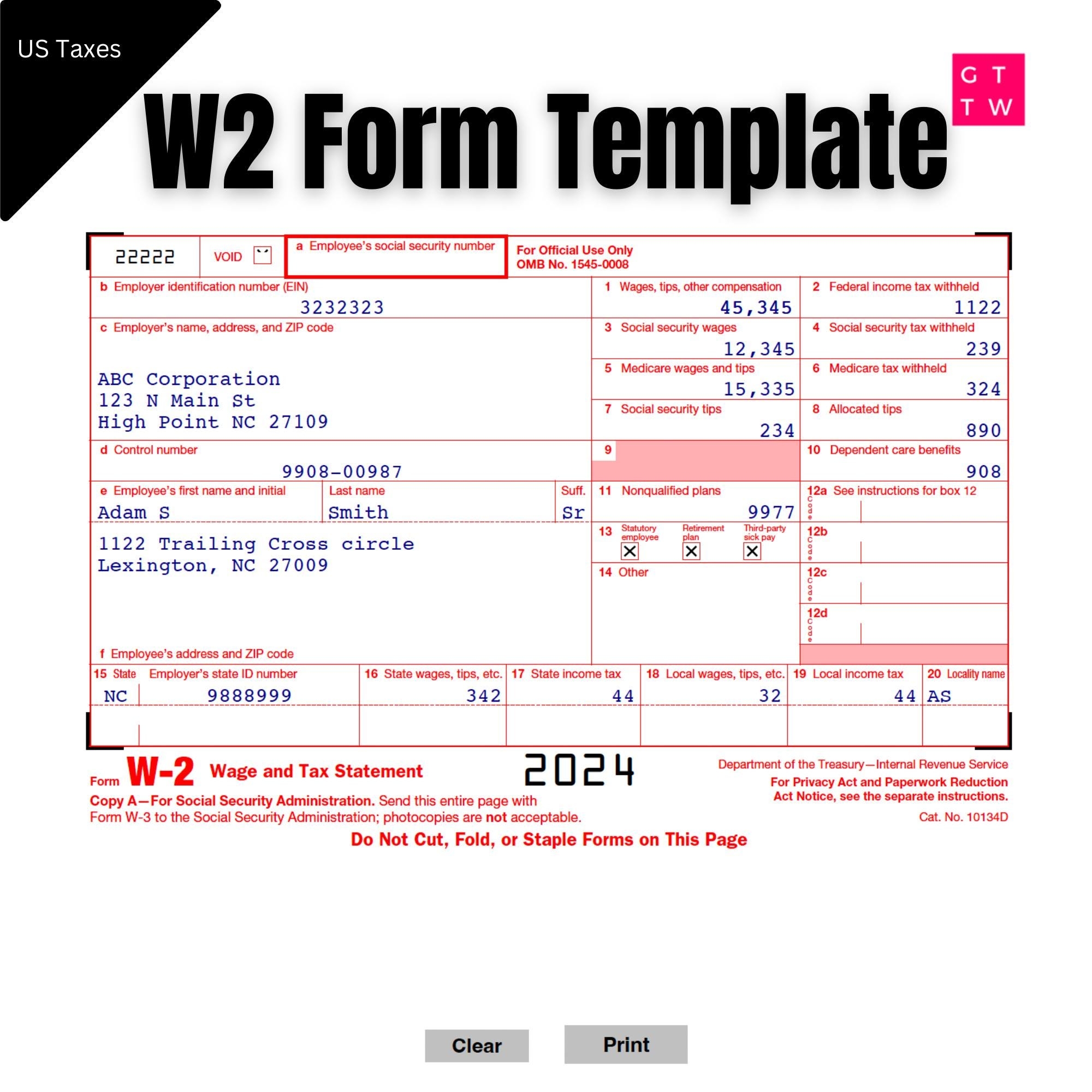

When tax season rolls around, one of the most important documents you’ll need is your W-2 form. This form, provided by your employer, outlines your earnings and taxes withheld throughout the year. It’s crucial for accurately filing your taxes and ensuring you receive any refunds you may be entitled to.

While many employers now provide electronic versions of the W-2 form, sometimes you may need a physical copy. This is where a printable W-2 form comes in handy. Having a printable version allows you to easily access and reference your tax information without having to rely on a digital copy.

Printable W-2 forms are widely available online from reputable sources such as the IRS website or tax preparation software platforms. These forms typically come in a PDF format that can be easily printed from your computer or mobile device. It’s important to ensure that the form you download is an official version to avoid any discrepancies with your tax filing.

Once you have your printable W-2 form in hand, take the time to review it carefully. Check that all your personal information, earnings, and tax withholdings are accurate and up to date. Any errors or discrepancies should be addressed with your employer before filing your taxes to avoid any potential issues with the IRS.

When it comes time to file your taxes, you can use the information from your printable W-2 form to accurately complete your tax return. Whether you choose to file electronically or by mail, having a hard copy of your W-2 form ensures that you have all the necessary information at your fingertips.

In conclusion, a printable W-2 form is a valuable tool for managing your tax information and filing your taxes accurately. By obtaining a printable version of your W-2 form, you can easily access and reference your tax information whenever needed. Be sure to review your form carefully and address any errors with your employer to avoid any potential issues with your tax filing.