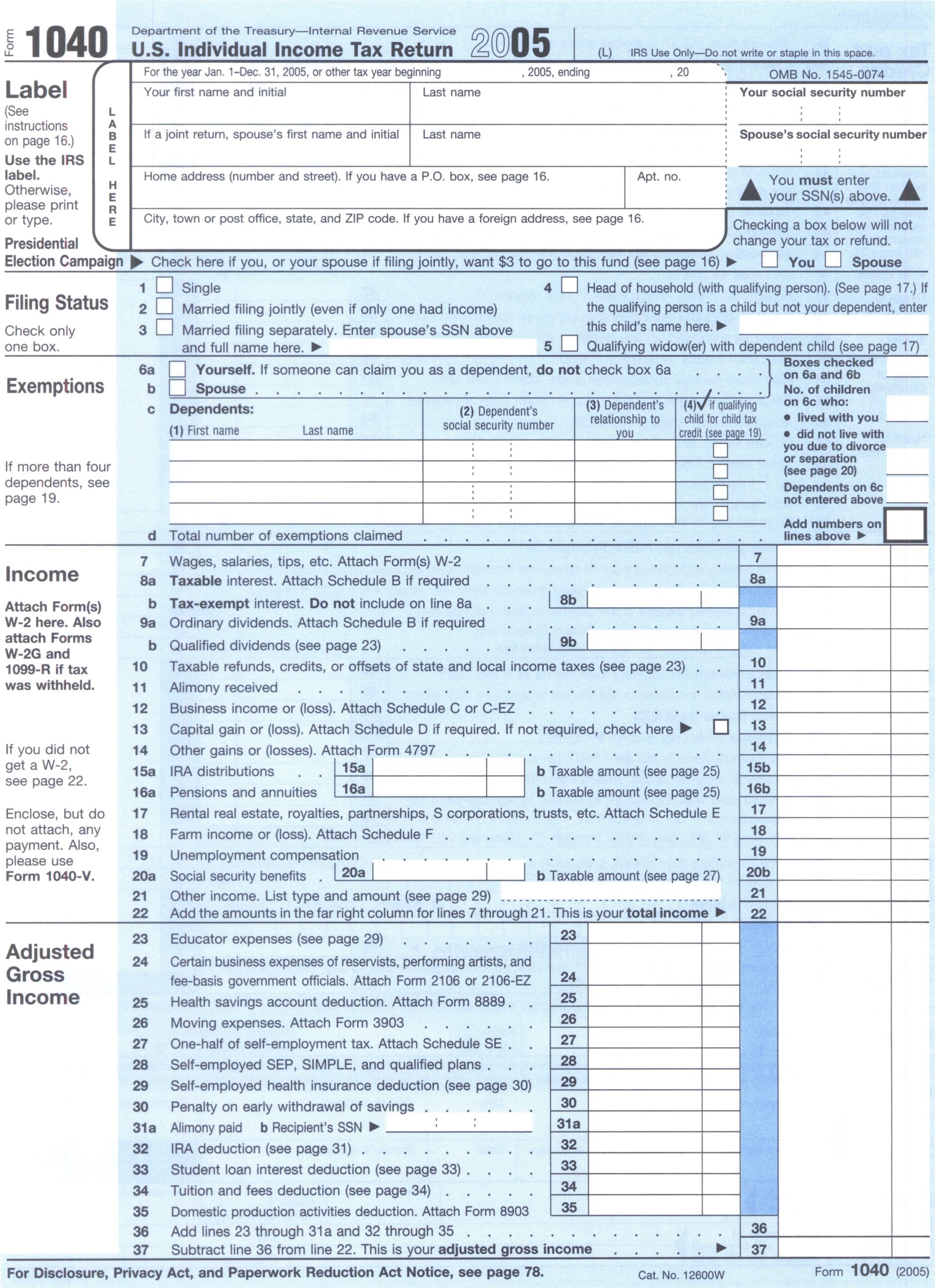

As tax season approaches, it’s important to have all the necessary forms ready to file your taxes accurately and on time. One of the most common tax forms used by individuals is the Form 1040, also known as the U.S. Individual Income Tax Return. This form is used to report income, deductions, and credits to determine the amount of tax owed or refund due to the taxpayer.

For those who prefer to file their taxes the old-fashioned way, printable tax forms 1040 are readily available online. These forms can be easily downloaded, printed, and filled out by hand. Whether you’re a seasoned pro at filing taxes or a first-time filer, having a physical copy of the form can make the process smoother and more organized.

When filling out your Form 1040, be sure to have all necessary documents on hand, such as W-2s, 1099s, and receipts for deductions. It’s important to double-check your entries and calculations to ensure accuracy and avoid any potential errors that could delay your refund or result in penalties.

Once you’ve completed your Form 1040, you can either mail it to the IRS or submit it electronically through e-file. Many taxpayers opt to e-file their returns for faster processing and confirmation of receipt. However, if you prefer the traditional method of mailing in your forms, be sure to send them to the correct address listed on the IRS website.

Remember, tax laws and regulations can change from year to year, so it’s important to stay informed and up-to-date on any updates that may affect your tax return. Consulting with a tax professional or utilizing online resources can help ensure that you’re taking advantage of all available deductions and credits to maximize your refund or minimize your tax liability.

So, don’t wait until the last minute to gather your tax documents and start the filing process. Download your printable tax forms 1040 today and get a head start on preparing your return. With careful attention to detail and timely submission, you can navigate tax season with ease and peace of mind.