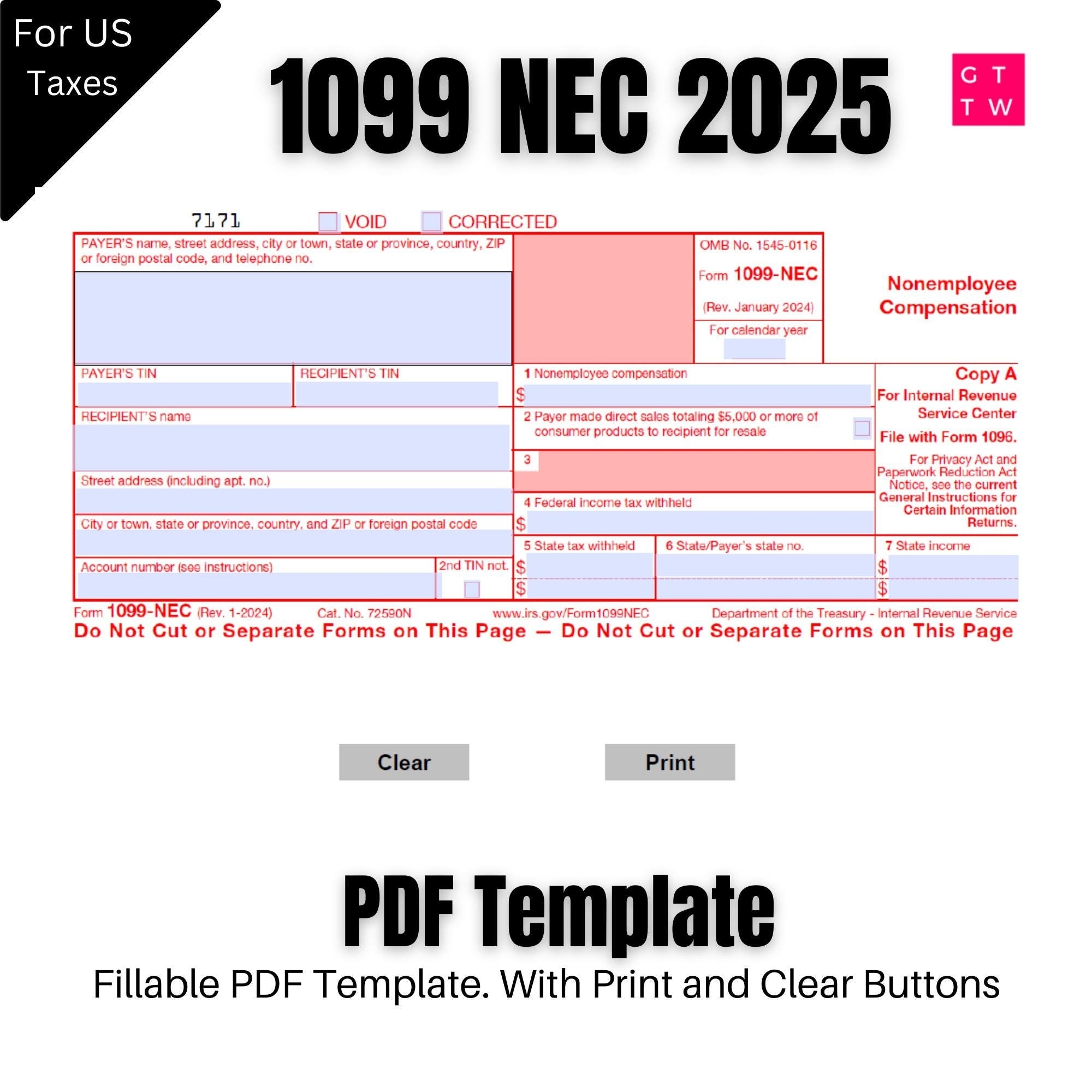

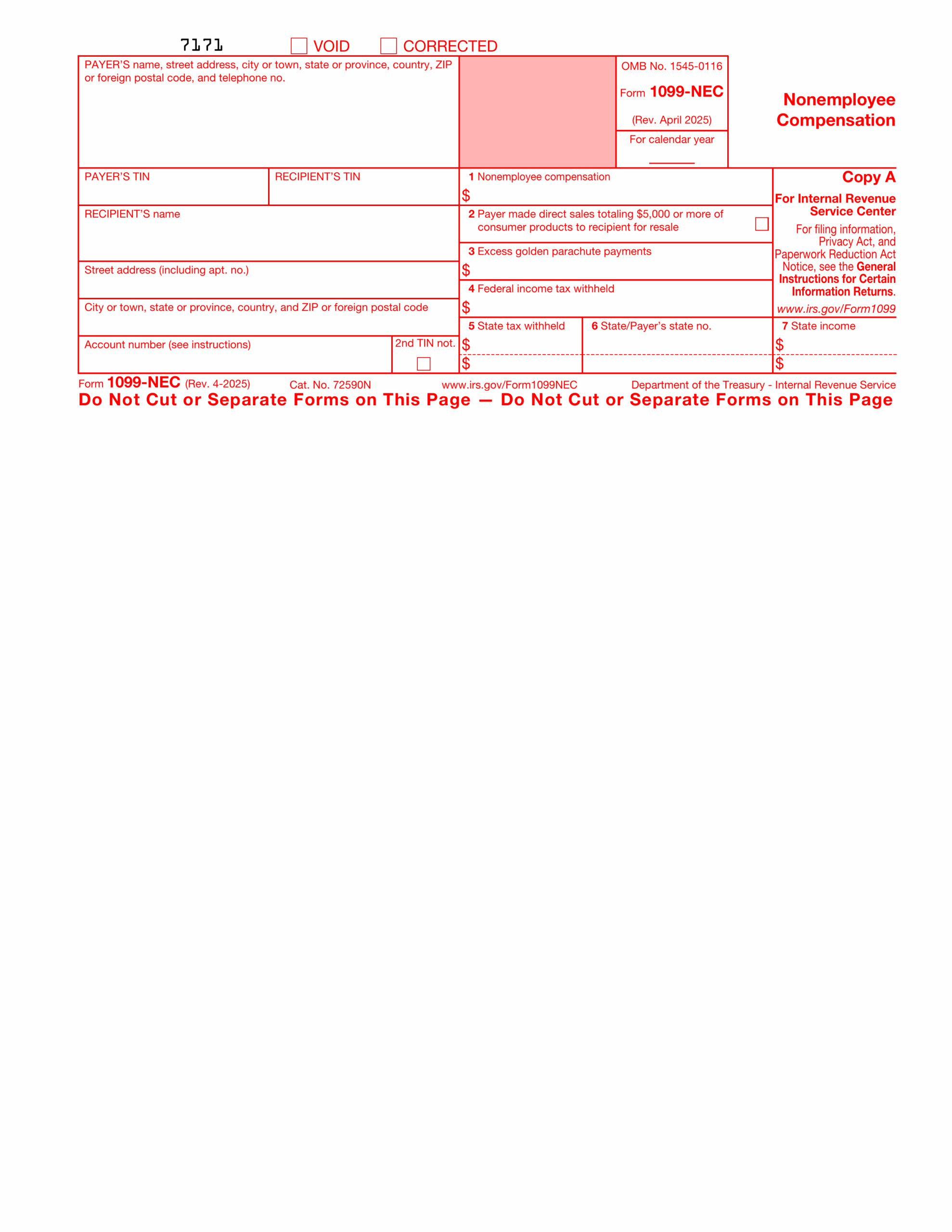

1099-Nec Printable Form

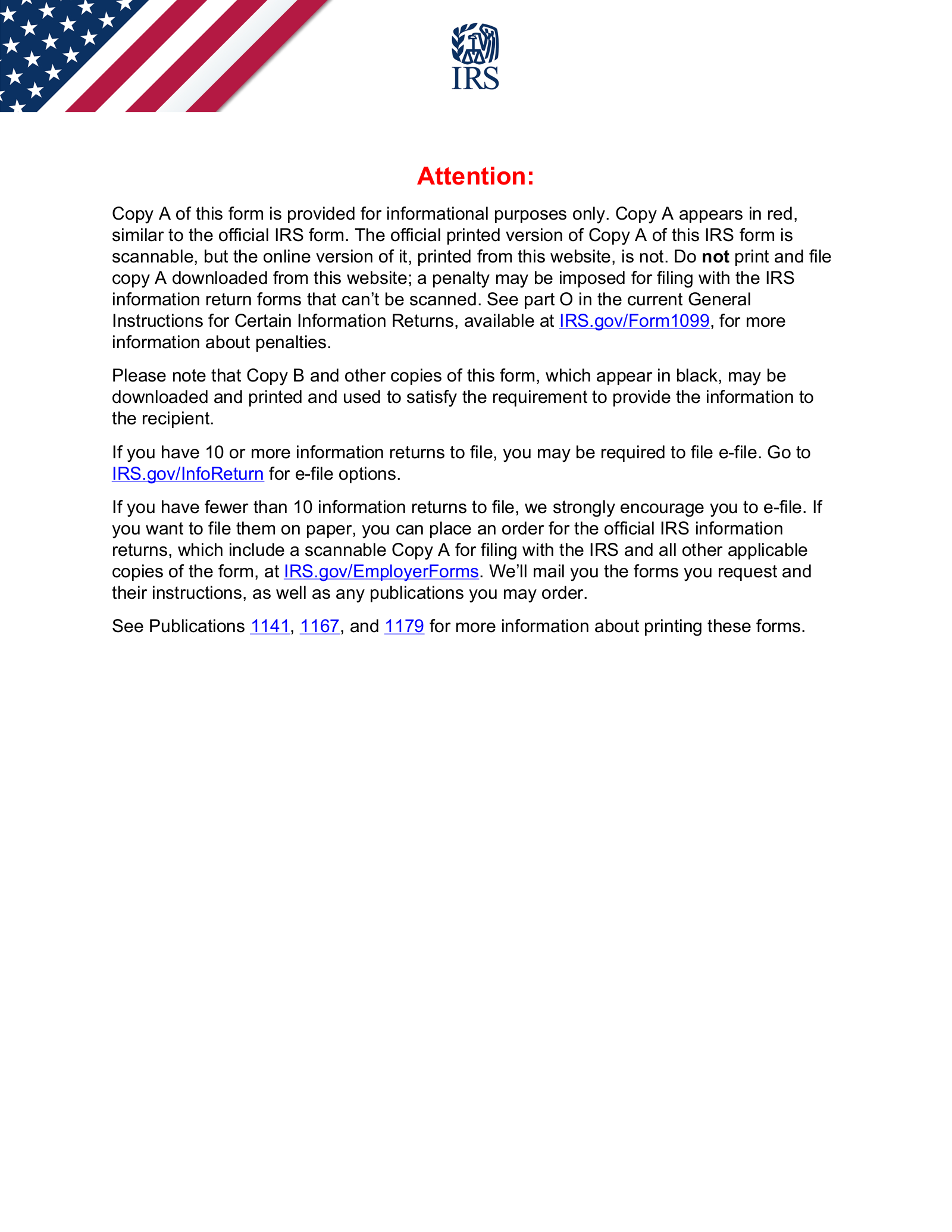

The 1099-NEC form is used to report non-employee compensation, such as payments made to independent contractors or freelancers. This form is crucial for businesses that have hired individuals to perform services for them and have paid them $600 or more during the year. It is important to accurately fill out this form to report this income to the IRS and to provide a copy to the recipient.

The 1099-NEC form was reintroduced by the IRS in 2020 after being replaced by the 1099-MISC form for reporting non-employee compensation. The form must be filed by businesses by January 31st each year, along with a copy to the recipient. Failure to file the form correctly and on time can result in penalties from the IRS.

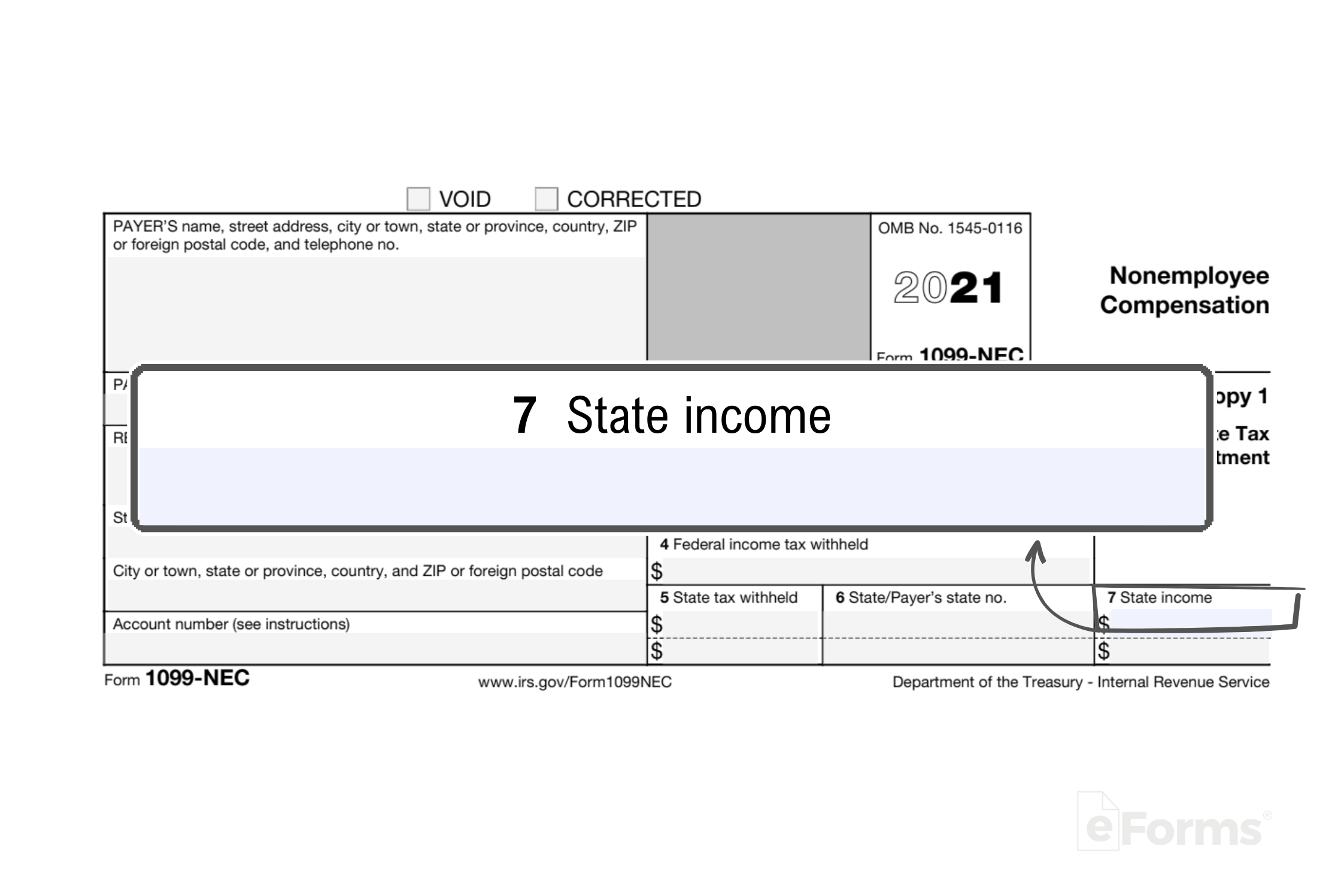

When filling out the 1099-NEC form, you will need to provide information such as the recipient’s name, address, and taxpayer identification number, as well as the total amount of non-employee compensation paid during the year. This form is essential for both businesses and individuals to accurately report income and comply with IRS regulations.

It is important to note that the 1099-NEC form is not used for reporting employee wages, which are reported on a W-2 form. This form is specifically for reporting payments made to non-employees for services rendered. Businesses should keep detailed records of payments made to independent contractors throughout the year to ensure accurate reporting on the 1099-NEC form.

In conclusion, the 1099-NEC form is a vital tool for businesses to report non-employee compensation to the IRS and provide recipients with the necessary tax information. By accurately filling out and filing this form by the deadline, businesses can avoid penalties and ensure compliance with IRS regulations. It is important to stay informed about tax requirements and to seek professional guidance if needed when preparing and filing tax forms.

Save and Print 1099-Nec Printable Form

Printable payroll template are ideal for companies that prefer non-digital systems or need hard copies for staff files. Most forms include fields for staff name, date range, total earnings, withholdings, and final salary—making them both detailed and user-friendly.

Start simplifying your payroll system today with a trusted payroll printable. Reduce admin effort, reduce errors, and stay organized—all while keeping your financial logs clear.

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

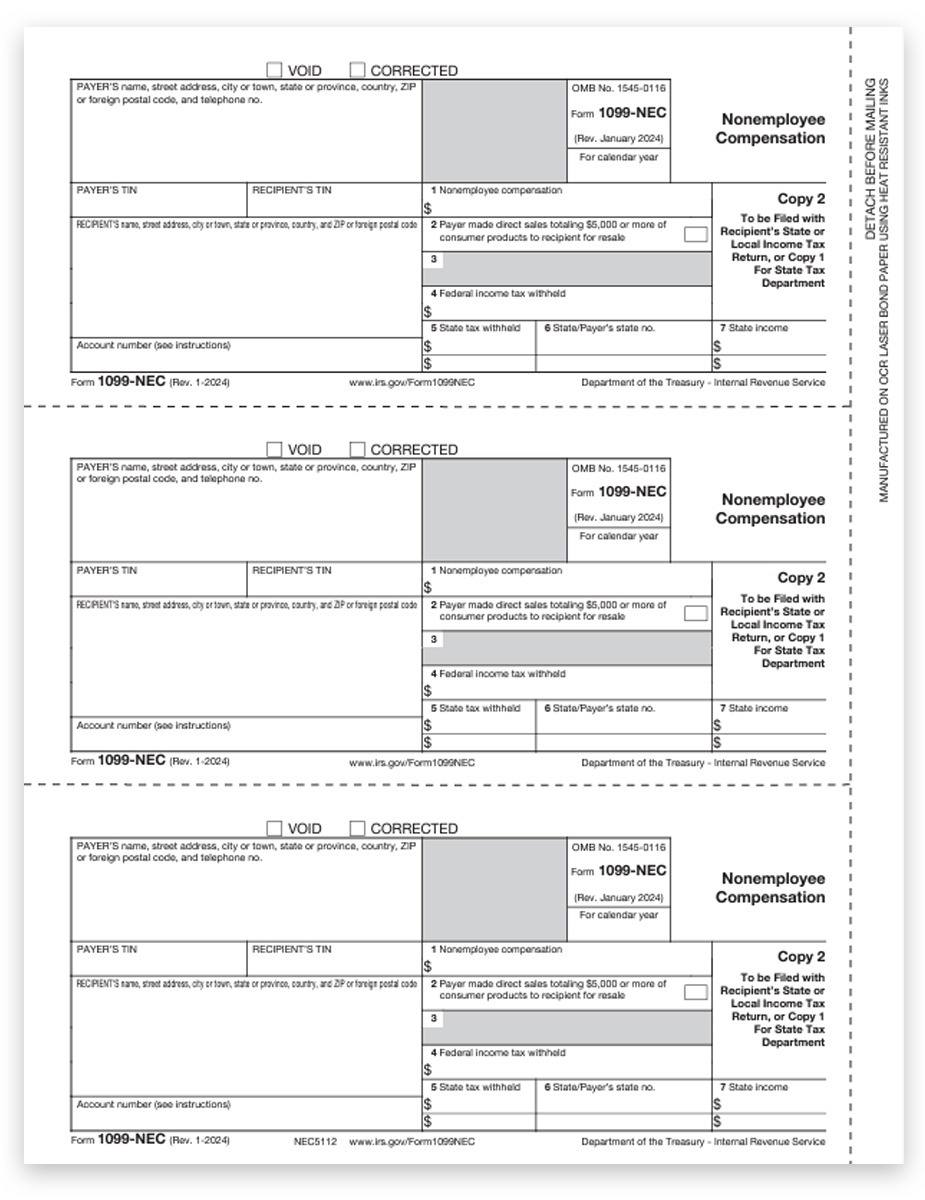

1099 NEC 3 Up Individual Fed Copy A Formstax

1099 NEC 3 Up Individual Fed Copy A Formstax

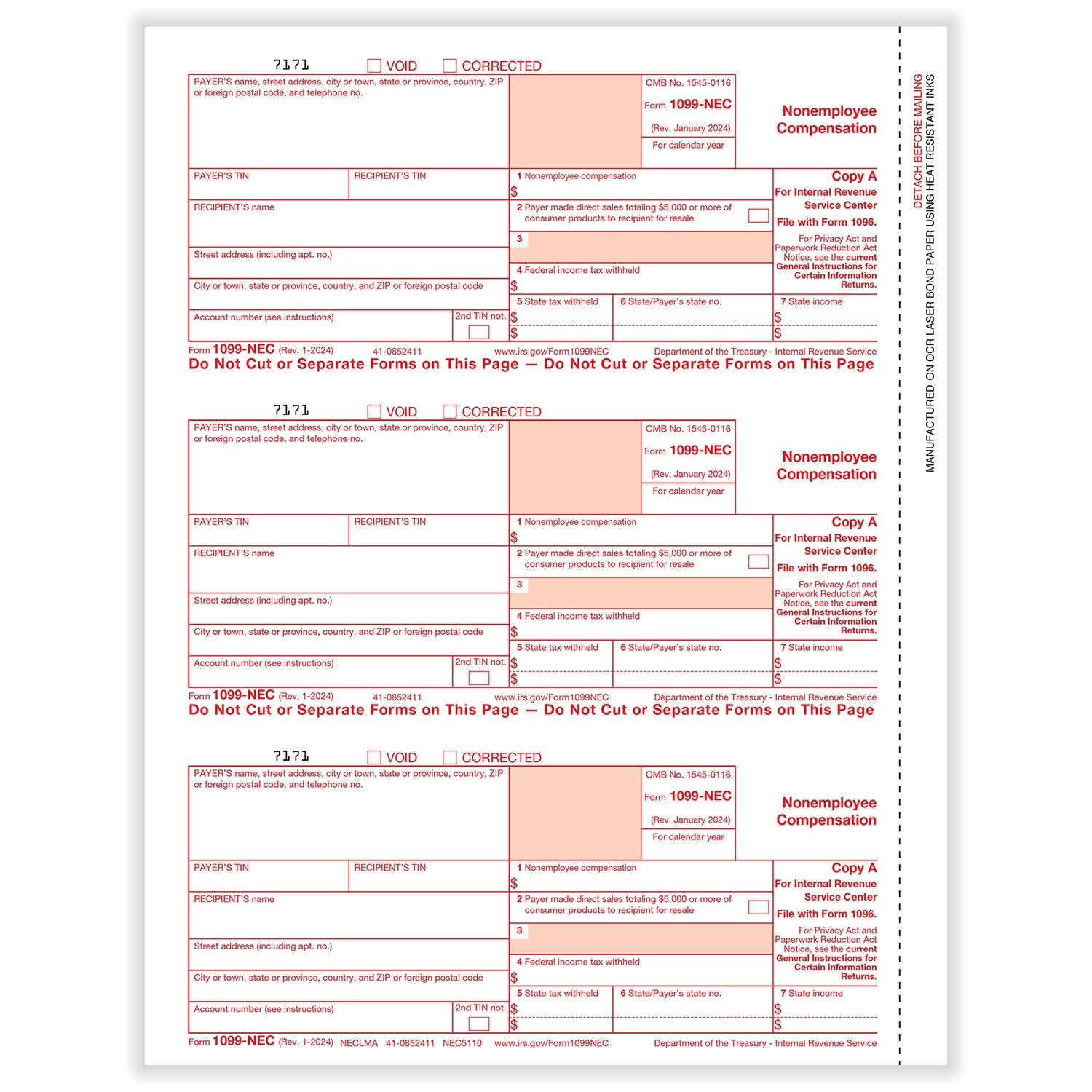

Form 1099 NEC 2024 2025 Fill And Download With Ease PDF Guru

Form 1099 NEC 2024 2025 Fill And Download With Ease PDF Guru

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Processing staff wages doesn’t have to be difficult. A payroll printable offers a quick, accurate, and user-friendly method for tracking employee pay, shifts, and deductions—without the need for complex software.

Whether you’re a freelancer, administrator, or independent contractor, using apayroll printable helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.