When tax season rolls around, it’s important to have all the necessary forms ready to file your taxes accurately. One of the most commonly used forms is the IRS Printable Tax Form 1040. This form is used by individuals to report their annual income and calculate their tax liability. It’s important to fill out this form correctly to avoid any issues with the IRS.

Form 1040 is used by millions of Americans each year to report their income, deductions, and credits. This form is essential for individuals who have income from sources other than wages, such as self-employment income, rental income, or investment income. It’s important to gather all the necessary documents, such as W-2s, 1099s, and receipts for deductions, before filling out Form 1040.

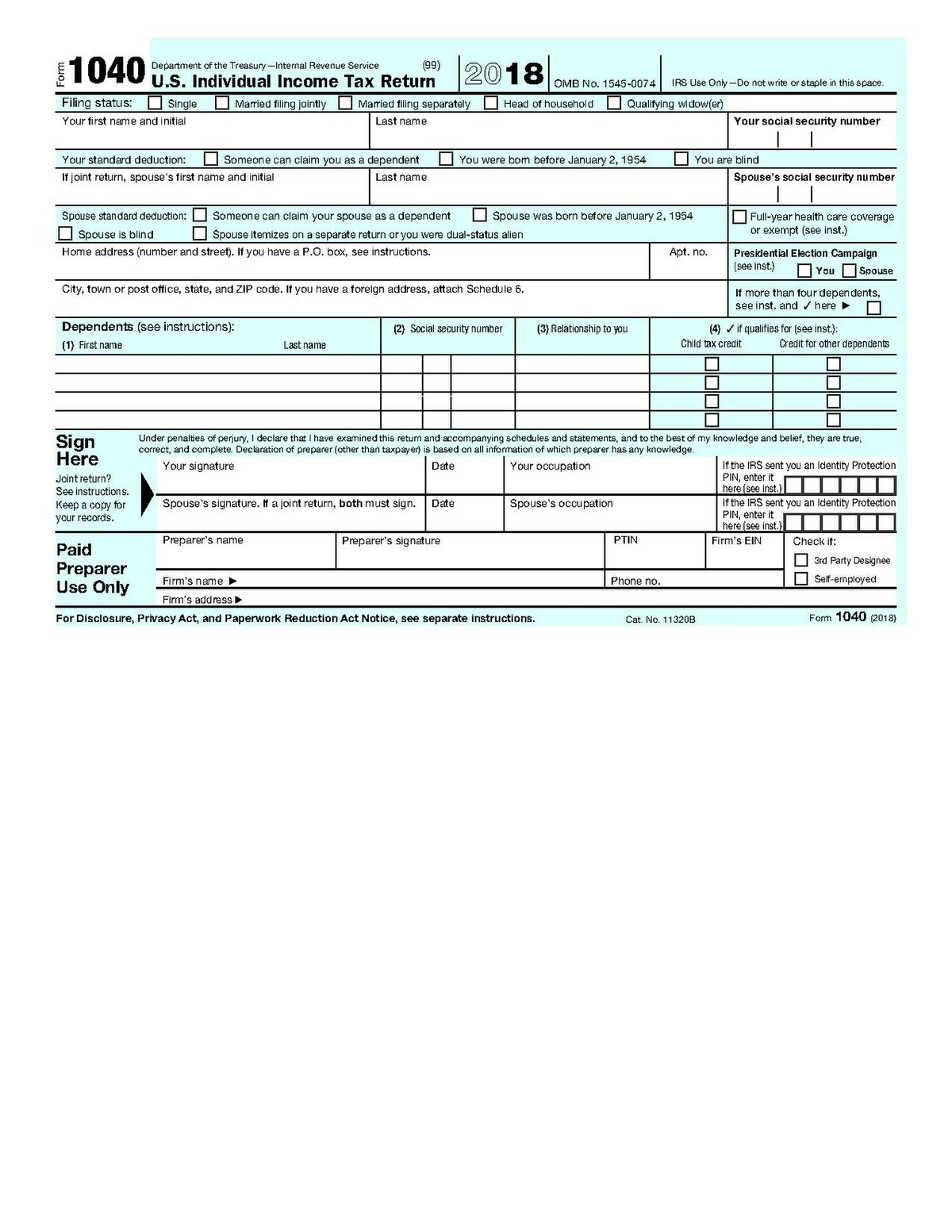

When filling out Form 1040, you’ll need to provide information such as your name, address, Social Security number, and filing status. You’ll also need to report your income from various sources, such as wages, interest, dividends, and capital gains. Additionally, you’ll need to report any deductions and credits you’re eligible for, such as mortgage interest, student loan interest, and child tax credits.

Once you’ve filled out Form 1040, you’ll need to double-check all the information for accuracy. Any errors or omissions could delay the processing of your tax return or result in penalties from the IRS. It’s important to review your completed form carefully before submitting it to ensure that everything is correct.

After completing Form 1040, you have the option to file your taxes electronically or by mail. Many taxpayers choose to e-file their taxes for faster processing and confirmation of receipt. However, if you prefer to file by mail, you can download and print Form 1040 from the IRS website. Make sure to include any additional schedules or forms that are required based on your individual tax situation.

In conclusion, Form 1040 is an essential document for individuals to report their income and calculate their tax liability. By gathering all the necessary documents and filling out the form accurately, you can ensure a smooth tax filing process. Whether you choose to e-file or mail your tax return, it’s important to submit your taxes on time to avoid any penalties or interest charges from the IRS.

Quickly Access and Print Irs Printable Tax Forms 1040

Printable payroll form are ideal for teams that prefer paper documentation or need hard copies for audit purposes. Most forms include fields for staff name, date range, total earnings, taxes, and final salary—making them both detailed and user-friendly.

Begin streamlining your payment tracking today with a trusted payroll printable. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your financial logs clear.

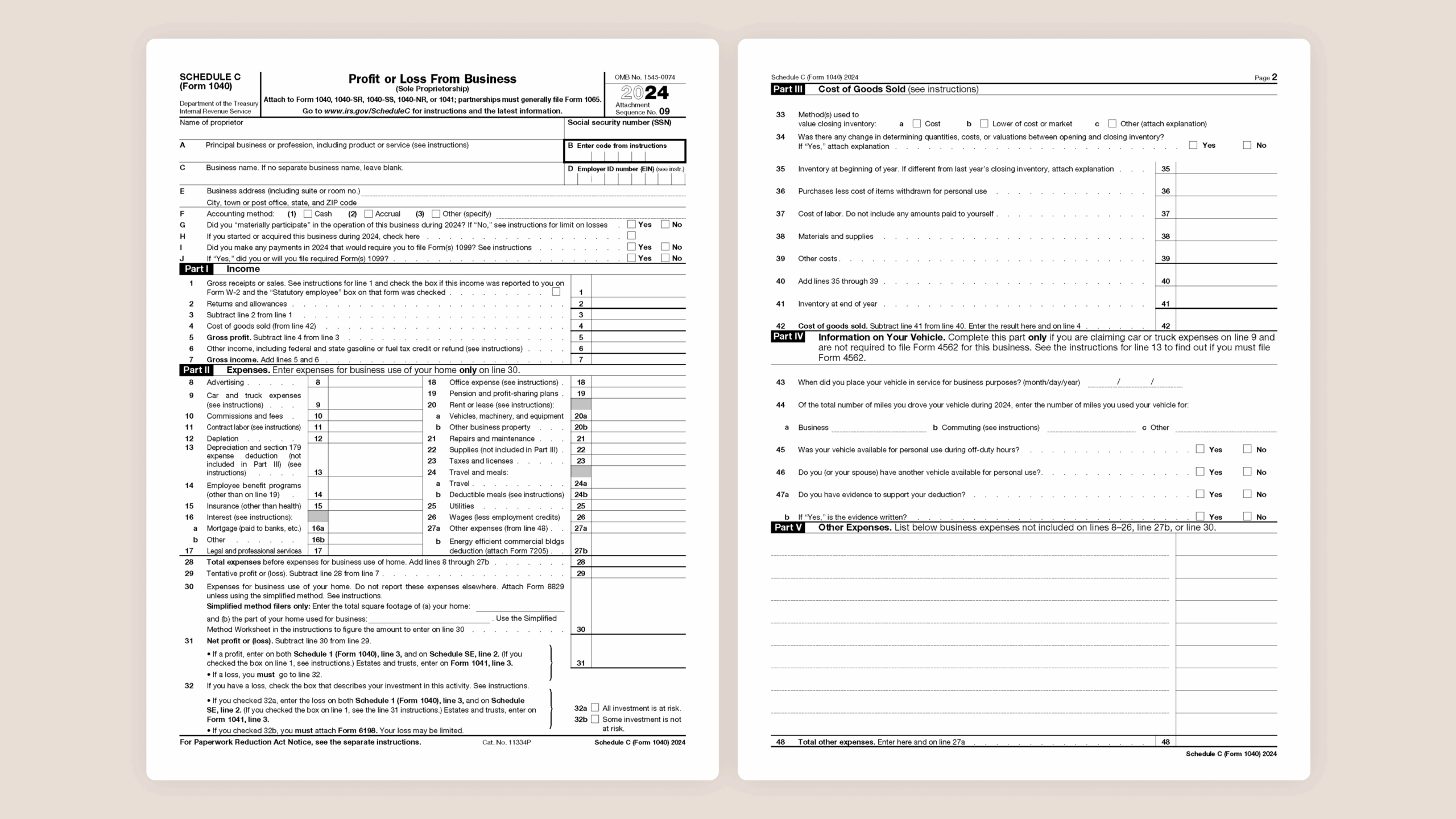

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

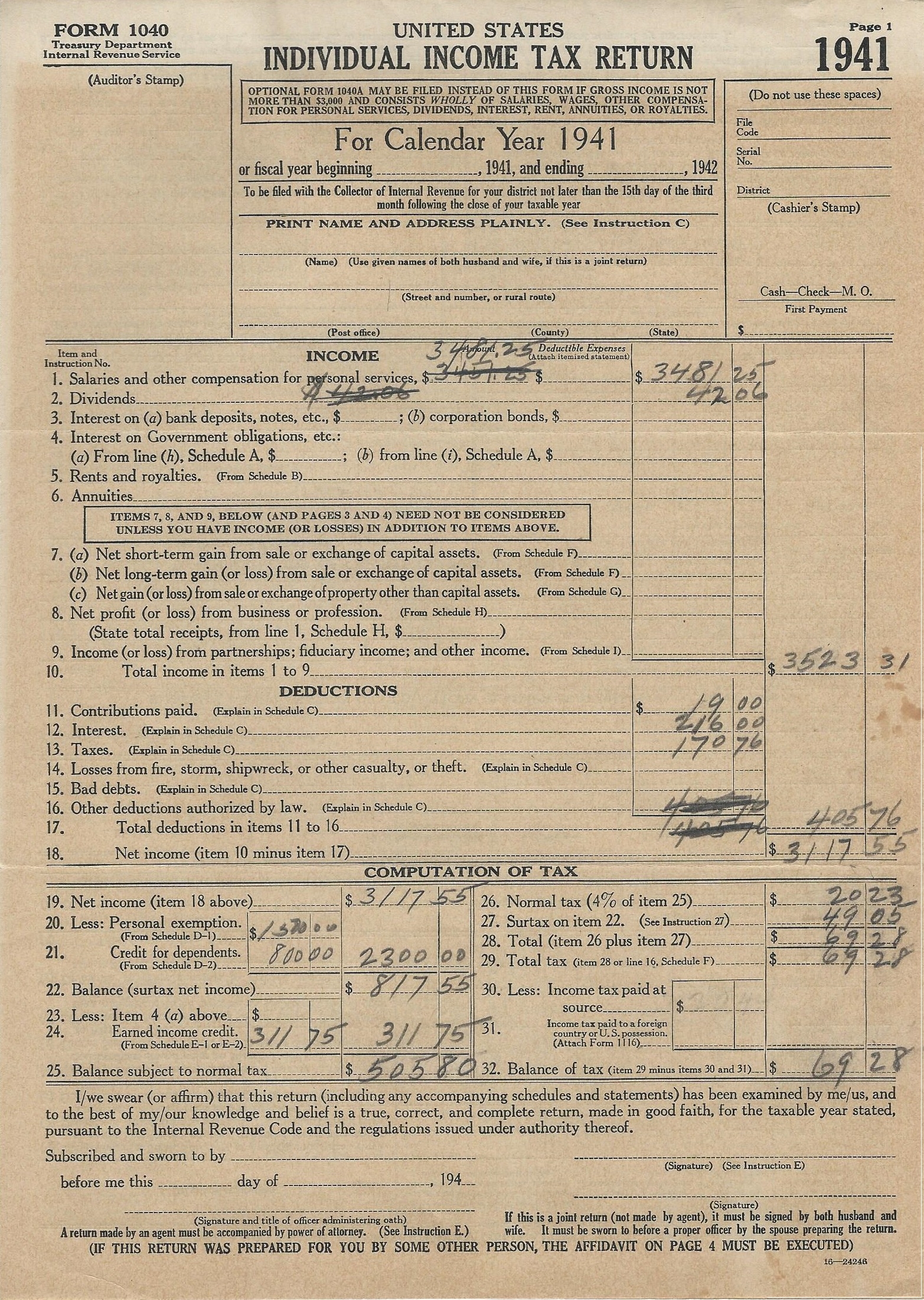

File Form 1040 1941 Jpg Wikimedia Commons

File Form 1040 1941 Jpg Wikimedia Commons

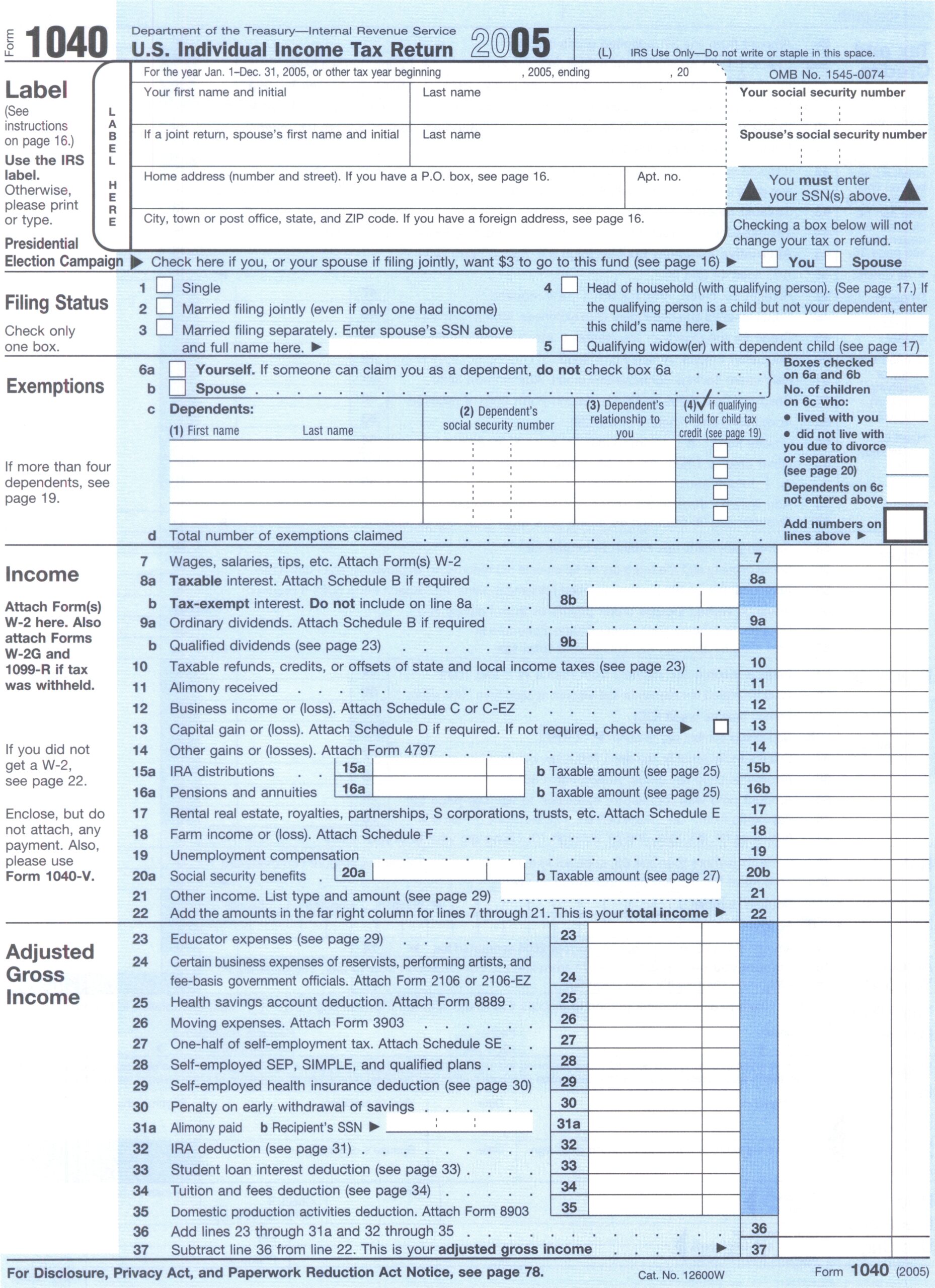

File Form 1040 2005 Jpg Wikimedia Commons

File Form 1040 2005 Jpg Wikimedia Commons

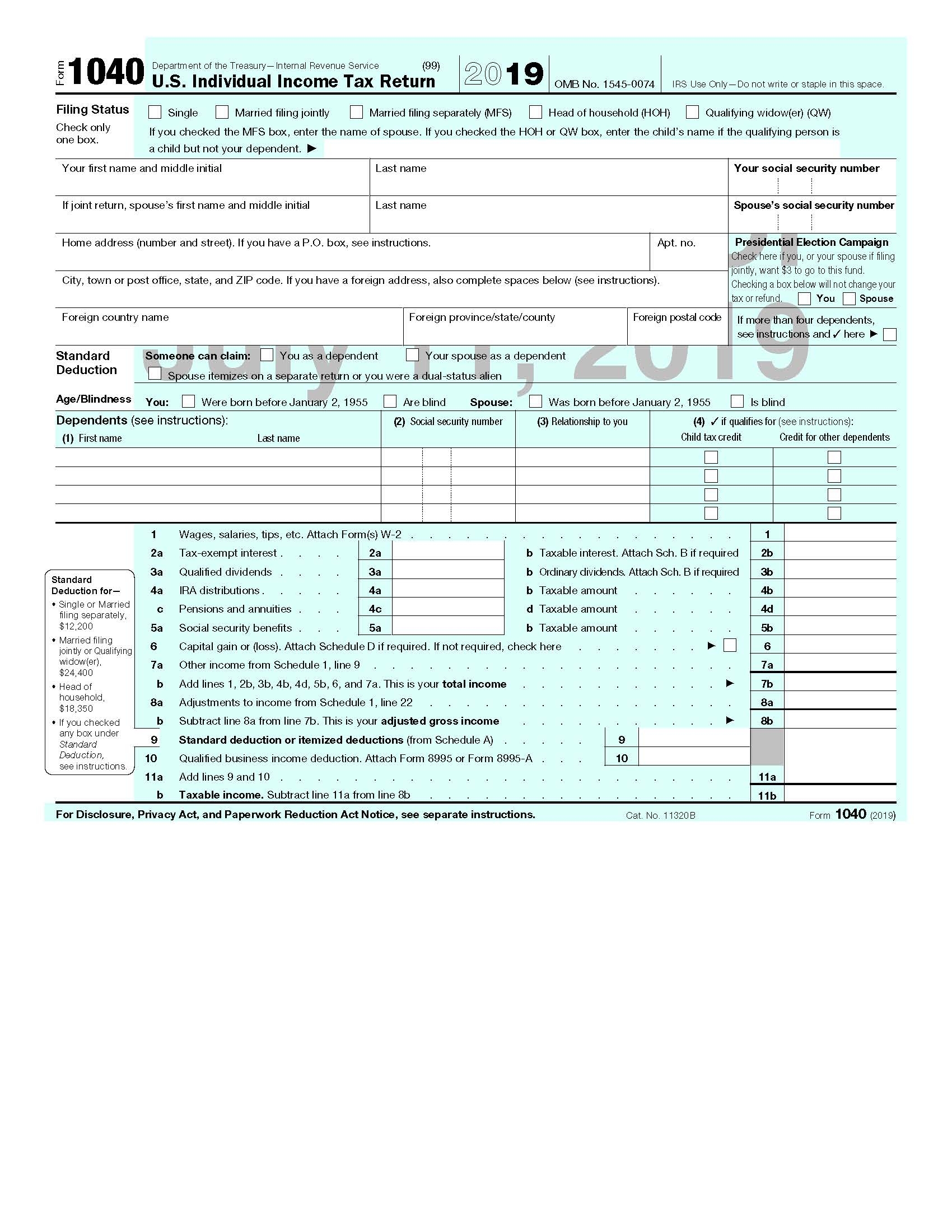

File IRS Form 1040 2018 Pdf Wikimedia Commons

File IRS Form 1040 2018 Pdf Wikimedia Commons

Processing payroll tasks doesn’t have to be overwhelming. A printable payroll form offers a quick, accurate, and user-friendly method for tracking salaries, shifts, and taxes—without the need for complex software.

Whether you’re a freelancer, payroll manager, or independent contractor, using apayroll printable helps ensure proper documentation. Simply download the template, produce a hard copy, and complete it by hand or type directly into the file before printing.