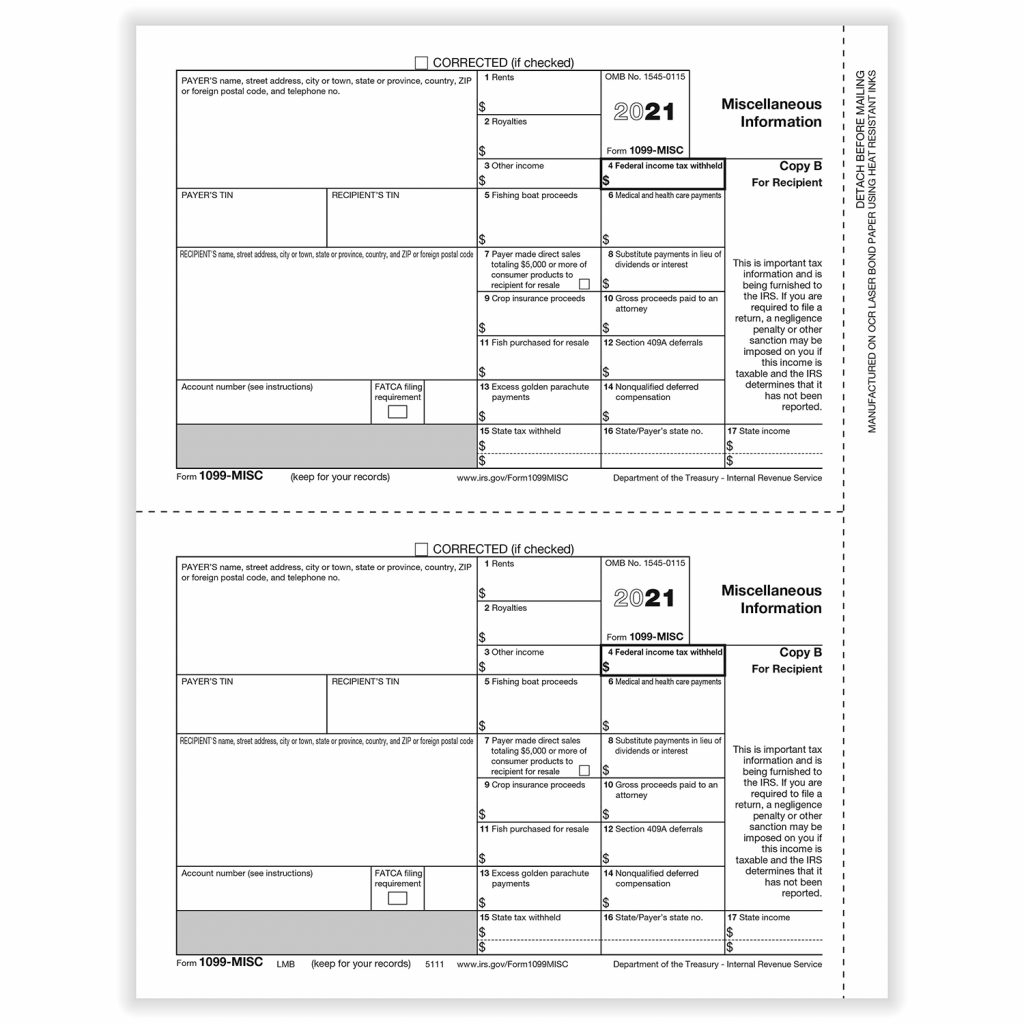

As an independent contractor, it is important to keep track of your income and taxes. One crucial document you will need is the 1099 form, which reports income earned as a contractor. Having a printable version of this form can make tax season much easier for you.

With a printable 1099 form, you can easily fill out the necessary information, such as your name, address, and Social Security number, as well as the income you earned as an independent contractor. This form is essential for reporting your earnings to the IRS and ensuring that you are compliant with tax laws.

Printable 1099 Form Independent Contractor

Printable 1099 Form Independent Contractor

Printable 1099 Form for Independent Contractor

Printable 1099 forms are readily available online from various sources, including tax preparation websites and the IRS website. You can choose from different formats, such as PDF or editable forms, to suit your needs. Having a printable form allows you to easily access and fill out the necessary information without the hassle of having to visit an office or request a physical form.

When filling out your printable 1099 form, be sure to double-check all the information you provide, as any errors could result in penalties or delays in processing your taxes. It is also important to keep accurate records of your income and expenses throughout the year to ensure that you are reporting everything correctly on your tax return.

By utilizing a printable 1099 form for independent contractors, you can streamline the process of reporting your income and taxes. This form is an essential tool for staying compliant with tax laws and ensuring that you are properly documenting your earnings as a contractor.

In conclusion, having a printable 1099 form for independent contractors is a valuable resource for simplifying the tax reporting process. By utilizing this form, you can accurately report your income and expenses, stay compliant with tax laws, and avoid potential penalties. Make sure to take advantage of this convenient tool to make tax season a little less stressful.