As tax season approaches, many individuals and businesses are gearing up to file their taxes. One of the first steps in the process is obtaining the necessary tax forms. Fortunately, the IRS provides printable versions of these forms online, making it easier for taxpayers to access and fill them out.

Whether you are an individual taxpayer or a business owner, having access to printable tax forms can save you time and hassle. Instead of having to pick up forms from a local IRS office or wait for them to arrive in the mail, you can simply download and print them from the comfort of your own home.

When it comes to filing your taxes, accuracy is key. Using the IRS’s printable tax forms ensures that you are working with the most up-to-date and accurate forms available. This can help you avoid errors and potential delays in processing your tax return.

Additionally, having printable tax forms at your fingertips allows you to start the tax preparation process sooner rather than later. By getting an early start on your taxes, you can avoid the stress and rush that often comes with waiting until the last minute to file.

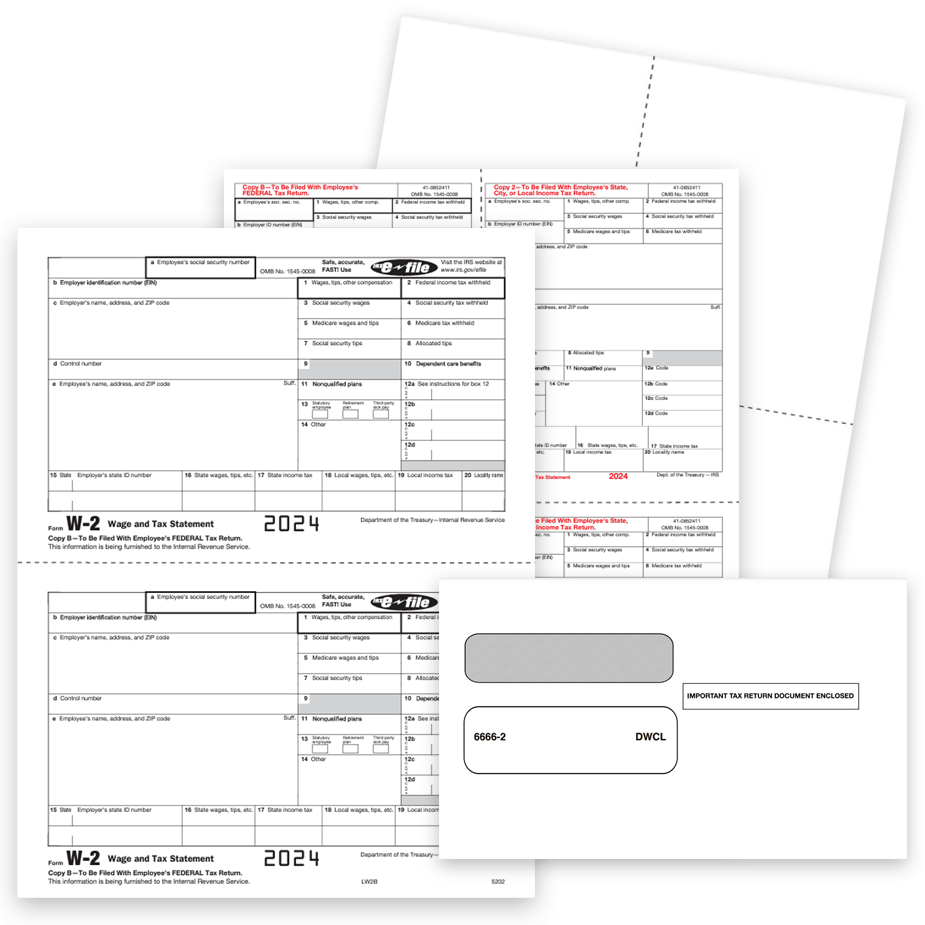

Whether you are filing a simple individual tax return or a more complex business tax return, having access to printable tax forms for the 2024 tax year can make the process smoother and more efficient. Take advantage of this convenient resource and get started on your taxes today.

As tax season comes around, it’s important to be prepared with all the necessary forms and documents. By utilizing the IRS’s printable tax forms for the 2024 tax year, you can ensure that you have everything you need to file your taxes accurately and on time. Don’t wait until the last minute – start gathering your information and filling out your forms now to make the tax filing process as smooth as possible.