Printable Form 1099 is a crucial document used for reporting various types of income to the Internal Revenue Service (IRS). It is typically issued by employers, financial institutions, and other entities to individuals who have received certain types of income throughout the year.

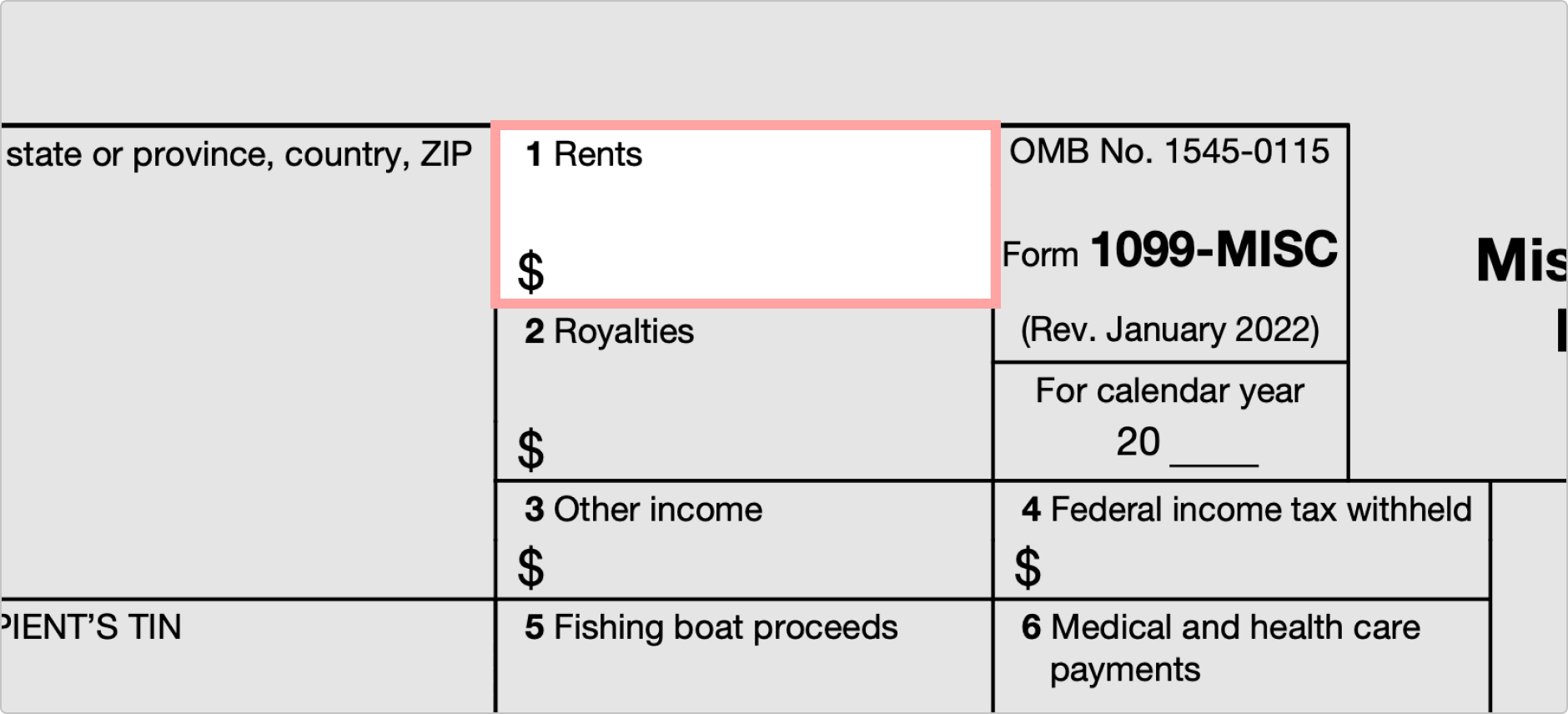

Form 1099 comes in different variants depending on the type of income being reported, such as 1099-INT for interest income, 1099-DIV for dividends, and 1099-MISC for miscellaneous income. These forms are essential for taxpayers to accurately report their income and ensure compliance with tax laws.

Having access to printable Form 1099 makes it easier for individuals to fill out their tax returns accurately and on time. Many websites and tax preparation software offer downloadable versions of Form 1099, allowing taxpayers to easily print and submit them along with their tax returns.

It is important to note that not all income may be reported on Form 1099. Taxpayers are responsible for reporting all income, even if they do not receive a Form 1099 for it. This includes income from freelance work, rental properties, and other sources that may not be reported by a third party.

Printable Form 1099 serves as a valuable tool for both taxpayers and the IRS to ensure that all income is accurately reported and taxes are paid accordingly. By utilizing these forms, individuals can streamline the tax filing process and avoid potential penalties for underreporting income.

In conclusion, Printable Form 1099 is an essential document for reporting various types of income to the IRS. It provides taxpayers with a convenient way to accurately report their income and comply with tax laws. By utilizing printable versions of Form 1099, individuals can simplify the tax filing process and ensure they are meeting their tax obligations.