The IRS 1040 Form is a crucial document for individuals to file their annual income tax returns with the Internal Revenue Service (IRS). It is used to report income, deductions, and credits for the tax year. For the year 2024, the IRS has made the 1040 Form available in a printable format for taxpayers to easily fill out and submit.

It is important for taxpayers to accurately complete the IRS 1040 Form to avoid any penalties or issues with the IRS. The form includes sections for personal information, income, deductions, credits, and tax calculations. Taxpayers must carefully review all information before submitting the form to ensure compliance with tax laws.

Instructions for Completing the IRS 1040 Form 2024

When filling out the IRS 1040 Form for the year 2024, taxpayers should carefully follow the instructions provided by the IRS. It is important to accurately report all income, deductions, and credits to calculate the correct tax liability. Taxpayers can refer to the IRS website for additional guidance and resources on completing the form.

Additionally, taxpayers should keep all relevant documents and records, such as W-2 forms, 1099 forms, receipts, and statements, to support the information reported on the 1040 Form. This will help ensure that the tax return is accurate and complete. Taxpayers can also seek assistance from tax professionals or use tax preparation software to help with the filing process.

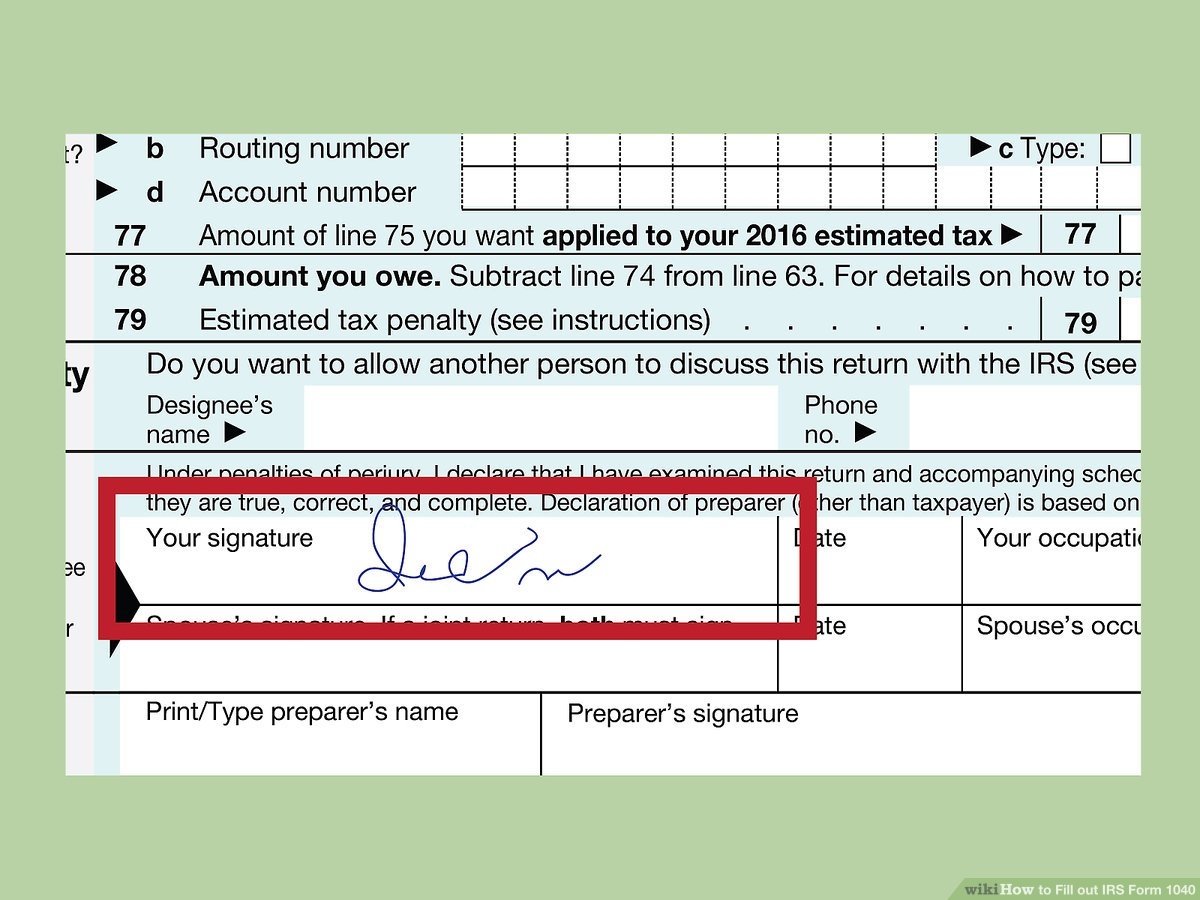

After completing the IRS 1040 Form for the year 2024, taxpayers must sign and date the form before submitting it to the IRS. The form can be filed electronically or mailed to the appropriate IRS address. Taxpayers should keep a copy of the completed form and any supporting documents for their records.

In conclusion, the IRS 1040 Form for the year 2024 is an essential document for individuals to report their income and pay taxes to the government. By accurately completing the form and following the instructions provided by the IRS, taxpayers can ensure compliance with tax laws and avoid any issues with the IRS. It is important for taxpayers to take the time to review and complete the form carefully to prevent any errors or omissions.