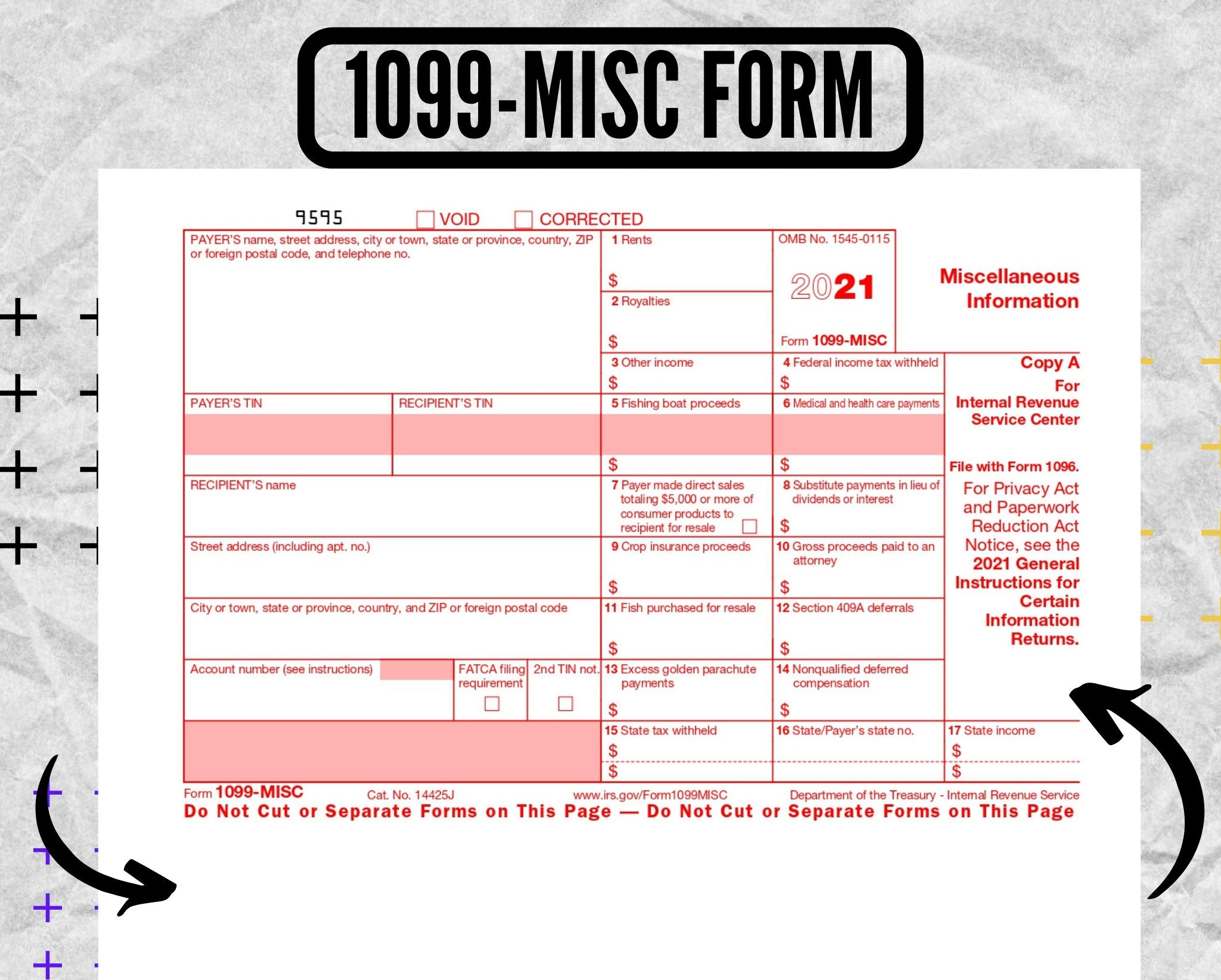

When tax season rolls around, it’s important for businesses and independent contractors to have the necessary forms to report income to the IRS. One of the most common forms used for this purpose is the 1099 form. This form is used to report various types of income, such as freelance work, rental income, and investment earnings.

For those who prefer to handle their taxes manually, having printable 1099 forms can be incredibly convenient. With printable forms, individuals can easily fill out the necessary information and submit them to the IRS without the need for expensive software or professional assistance.

There are several websites that offer free printable 1099 forms. These forms typically come in PDF format, making them easy to download and print. Some websites even offer interactive forms that can be filled out online before printing, saving time and reducing errors.

When using printable 1099 forms, it’s important to ensure that all information is filled out accurately and legibly. Any mistakes or missing information could result in delays or penalties from the IRS. Double-checking all information before submission is crucial to avoiding any issues.

Overall, printable 1099 forms can be a valuable tool for businesses and independent contractors during tax season. By having access to these forms, individuals can easily report their income and stay compliant with IRS regulations. Whether printed from a website or obtained from a tax professional, 1099 forms are essential for accurately reporting income and avoiding potential penalties.

So, if you’re in need of 1099 forms for tax purposes, consider utilizing printable versions for a convenient and efficient way to report your income to the IRS.