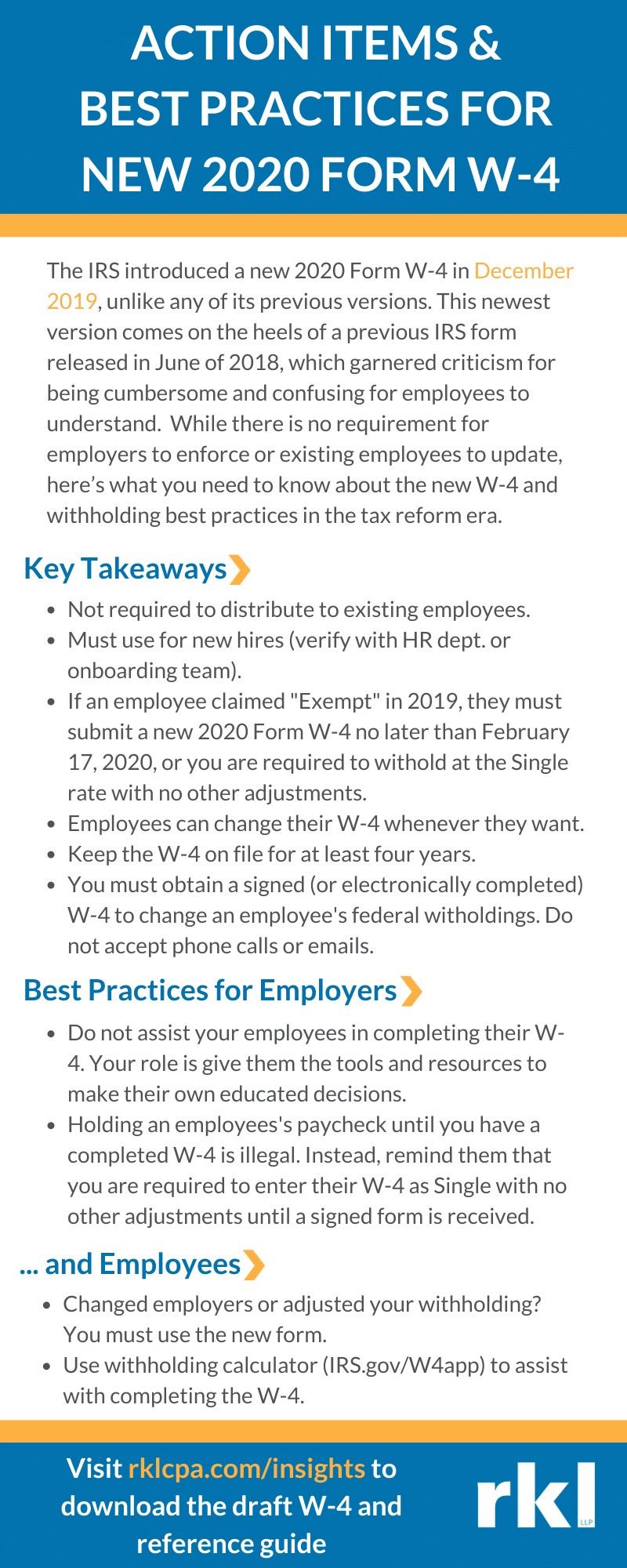

When starting a new job, one of the first things you will need to do is fill out a W-4 form. This form is used by your employer to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form correctly to ensure that the right amount of taxes are being withheld.

Many people prefer to have a printable version of the W-4 form so they can easily fill it out at their convenience. Having a printable form allows you to take your time and make sure you understand each section before submitting it to your employer.

W 4 Form Printable

There are several websites where you can find a printable version of the W-4 form. The IRS website is a reliable source for the most up-to-date version of the form. You can simply search for “W-4 form printable” on the IRS website and download the form in PDF format.

When filling out the W-4 form, you will need to provide information such as your name, address, filing status, and the number of allowances you are claiming. It’s important to be accurate when filling out this form, as any mistakes could result in having too much or too little tax withheld from your paycheck.

If you are unsure about how to properly fill out the W-4 form, you can always seek help from a tax professional or your employer’s HR department. They can provide guidance and answer any questions you may have about the form.

Once you have completed the W-4 form, you will need to submit it to your employer. They will use the information you provided to calculate the amount of federal income tax to withhold from your paycheck. It’s important to review your pay stubs regularly to ensure that the correct amount of tax is being withheld.

In conclusion, having a printable version of the W-4 form can make the process of filling out this important document much easier. By taking the time to accurately complete the form, you can ensure that you are having the right amount of taxes withheld from your paycheck.