When it comes to managing payroll for your employees, it’s important to have a system in place to handle any changes that may arise. Whether it’s a change in salary, hours worked, or tax withholding information, having a standardized form can help streamline the process and ensure accuracy.

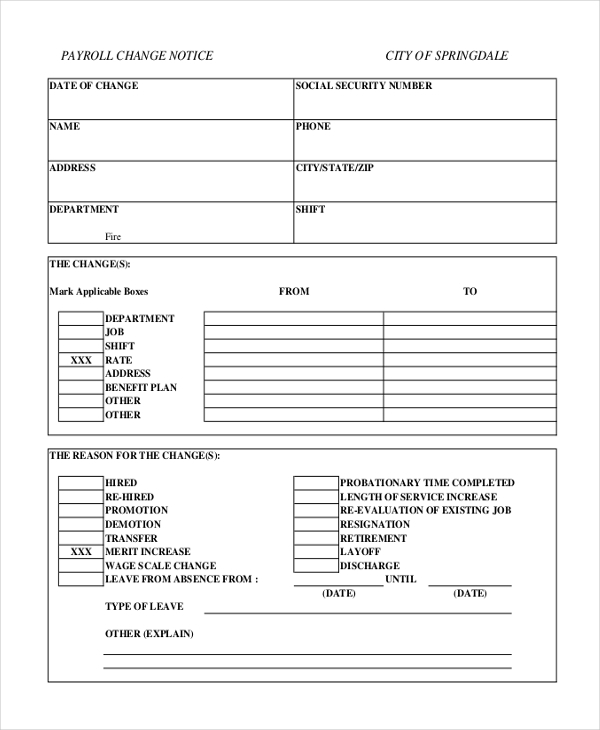

One way to make this process easier is by using a printable payroll change form. This form can be used by both employees and employers to document any changes to an employee’s payroll information. By having a standardized form, both parties can ensure that all necessary information is captured and processed correctly.

Handling staff wages doesn’t have to be difficult. A printable payroll form offers a speedy, reliable, and straightforward method for tracking employee pay, hours, and withholdings—without the need for digital systems.

Manage Finances Efficiently with a Printable Payroll Change Form – Straightforward & Efficient Method!

Whether you’re a startup founder, administrator, or sole proprietor, using aprintable payroll helps ensure compliance with regulations. Simply download the template, print it, and complete it by hand or edit it digitally before printing.

Using a printable payroll change form can help eliminate confusion and errors when it comes to making changes to an employee’s payroll information. This form can be used to document changes such as a new salary amount, updated tax withholding information, or changes to benefits eligibility.

Having a standardized form also makes it easier to track changes over time and ensure that all necessary approvals are obtained before any changes are made. This can help protect both the employer and the employee by ensuring that all changes are properly documented and authorized.

In conclusion, using a printable payroll change form can help simplify the process of making changes to an employee’s payroll information. By having a standardized form in place, both employees and employers can ensure that all changes are accurately documented and processed. This can help streamline the payroll process and reduce the risk of errors or confusion when it comes to managing payroll changes.