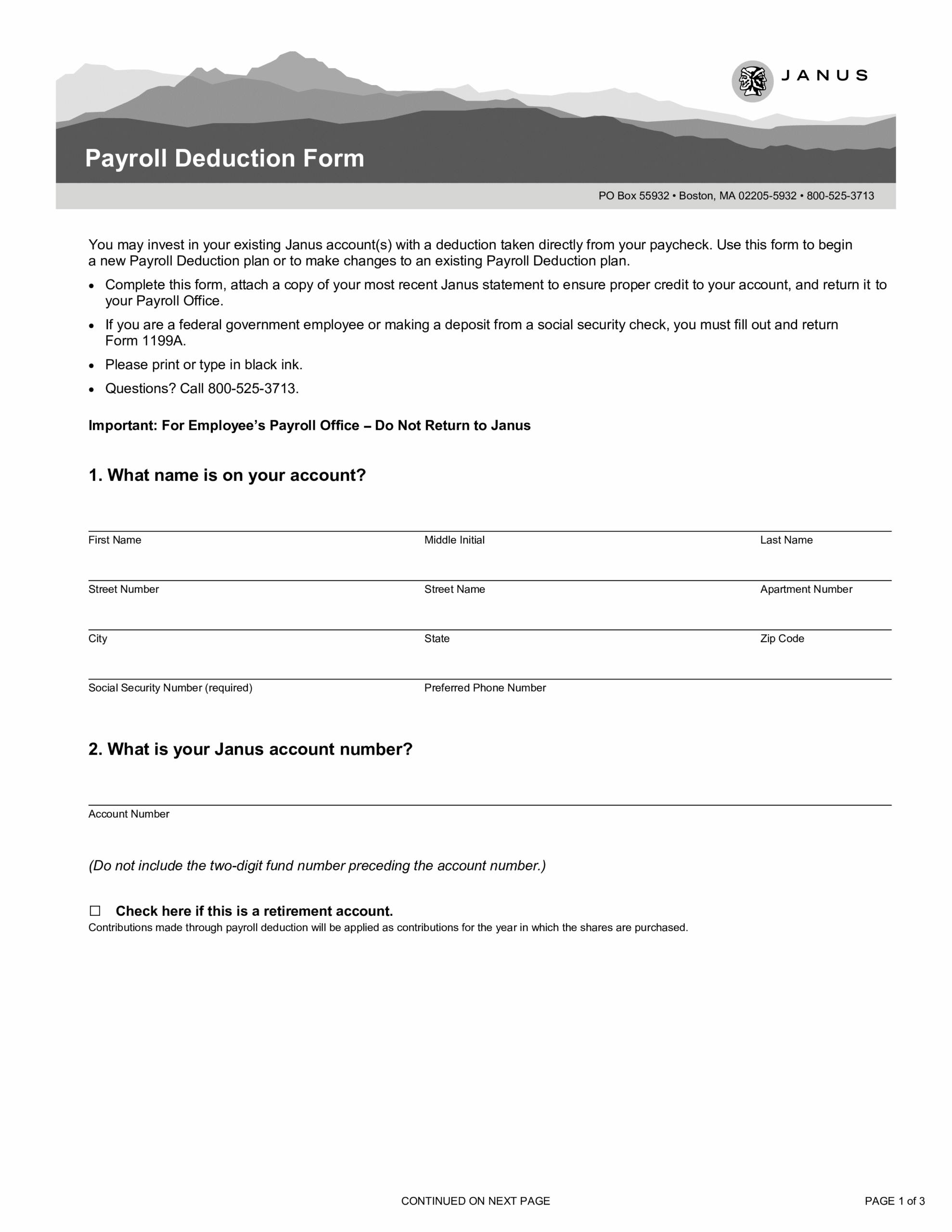

Printable payroll deduction sheets are essential documents for businesses to track and manage employee deductions. These sheets provide a detailed breakdown of the various deductions taken from an employee’s paycheck, such as taxes, benefits, and other withholdings.

By using printable payroll deduction sheets, businesses can ensure accuracy in calculating employee pay and deductions. These sheets can also serve as a record for both the employer and employee, helping to maintain transparency and accountability in the payroll process.

Printable Payroll Deduction Sheets

Printable Payroll Deduction Sheets

Handling payroll tasks doesn’t have to be overwhelming. A printable payroll template offers a speedy, accurate, and straightforward method for tracking wages, hours, and taxes—without the need for digital systems.

Stay Organized with a Payroll Printable – Easy & Effective Solution!

Whether you’re a small business owner, HR professional, or sole proprietor, using apayroll printable helps ensure proper documentation. Simply access the template, print it, and complete it by hand or edit it digitally before printing.

One of the key benefits of printable payroll deduction sheets is their convenience and ease of use. Employers can easily customize these sheets to fit their specific needs and requirements, making it simple to track and manage deductions for each employee.

Additionally, printable payroll deduction sheets can help businesses stay organized and compliant with relevant laws and regulations. By accurately documenting employee deductions, businesses can avoid potential issues with payroll audits and ensure compliance with tax laws.

In conclusion, printable payroll deduction sheets are valuable tools for businesses to effectively manage and track employee deductions. By utilizing these sheets, businesses can streamline their payroll processes, maintain accurate records, and ensure compliance with relevant laws and regulations.