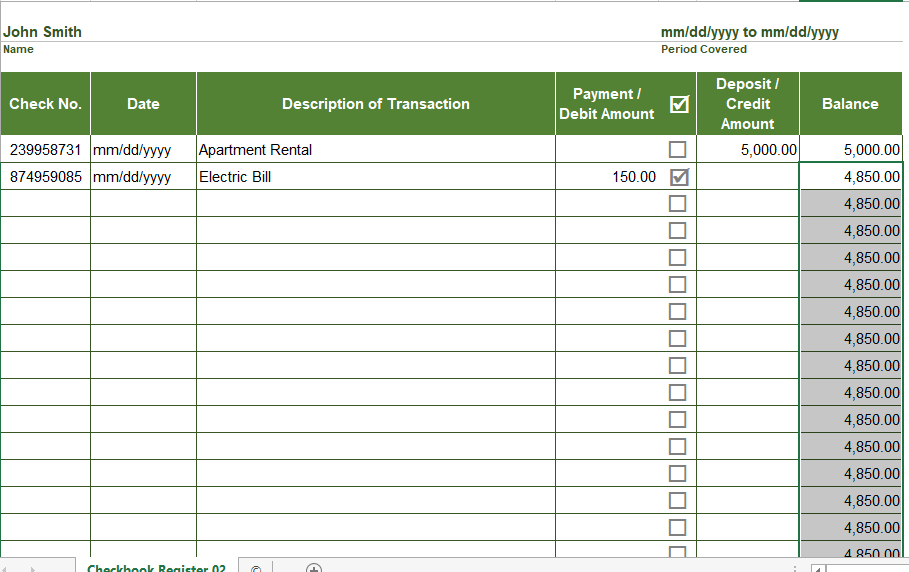

Keeping track of your expenses and payments is essential for maintaining financial stability. One useful tool for managing your finances is a printable check log. This document allows you to record details of each check you write, helping you stay organized and monitor your spending.

By using a printable check log, you can easily track your payments, deposits, and account balances. This simple yet effective tool can help you avoid overdrawing your account, prevent fraudulent activity, and ensure that your financial records are accurate and up-to-date.

Managing payroll tasks doesn’t have to be overwhelming. A payroll template offers a quick, accurate, and straightforward method for tracking wages, hours, and deductions—without the need for complicated tools.

Manage Finances Efficiently with a Payroll Template – Simple & Effective Method!

Whether you’re a freelancer, HR professional, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.

Benefits of Using a Printable Check Log

1. Organization: A printable check log provides a centralized location to record all your check transactions, making it easy to reference and track your spending.

2. Budgeting: By keeping a detailed record of your checks, you can analyze your spending habits and identify areas where you can cut costs or save money.

3. Fraud Prevention: Monitoring your check transactions can help you detect any unauthorized or fraudulent activity on your account, allowing you to take immediate action to protect your finances.

4. Accuracy: By documenting each check you write, you can ensure that your financial records are precise and error-free, helping you avoid any discrepancies or confusion.

5. Peace of Mind: Having a clear overview of your check transactions can give you peace of mind and confidence in your financial decisions, knowing that you are in control of your money.

In conclusion, a printable check log is a valuable tool for managing your finances and staying on top of your expenses. By using this document to record your check transactions, you can improve your financial organization, budget effectively, prevent fraud, maintain accuracy in your records, and achieve peace of mind in your financial affairs.