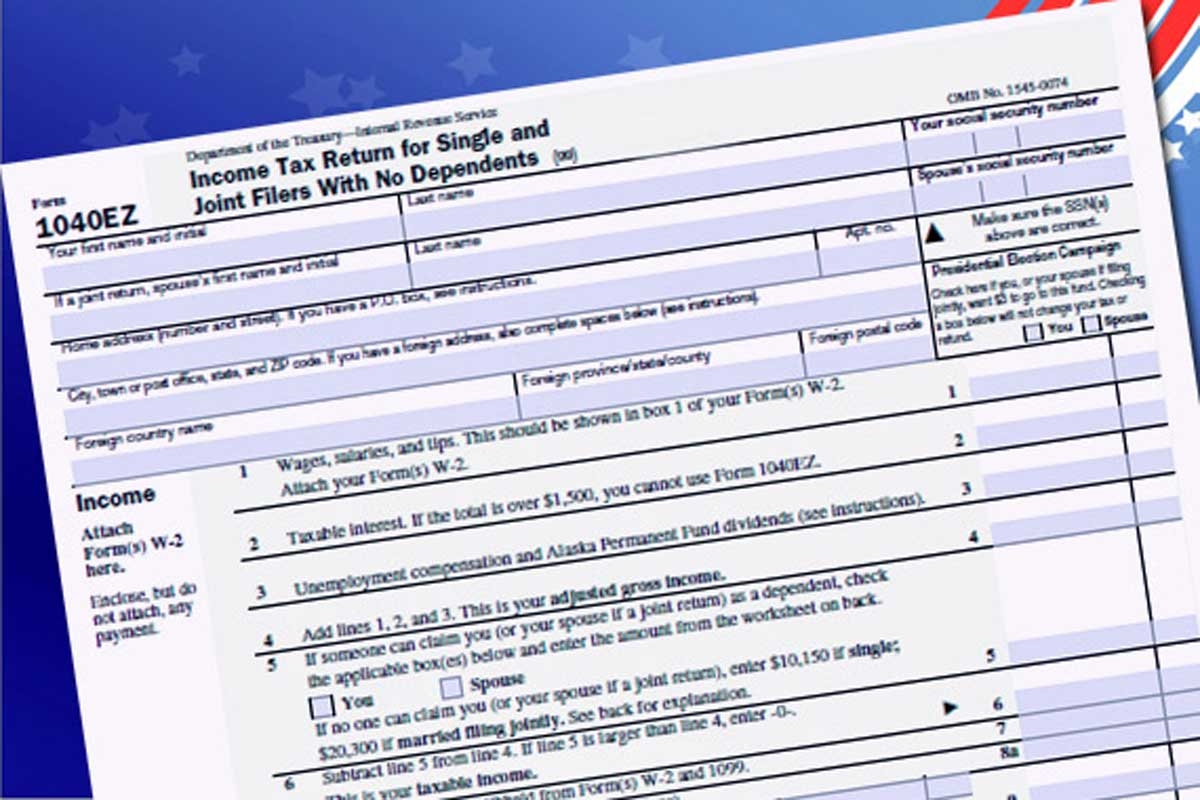

Completing your federal income tax return can be a daunting task, but having the right tools can make the process much easier. One option for individuals with simple tax situations is the Federal Income Tax Form 1040a. This form is shorter and simpler than the standard Form 1040, making it a popular choice for many taxpayers.

Form 1040a is designed for individuals who have income from wages, salaries, tips, interest, dividends, capital gains, IRA distributions, pensions, and annuities. It is also suitable for those claiming certain tax credits, such as the Earned Income Credit or the Child Tax Credit. If you don’t have many deductions or credits to claim, Form 1040a may be the right choice for you.

Federal Income Tax Form 1040a Printable

Federal Income Tax Form 1040a Printable

When using Form 1040a, you will need to provide information about your income, deductions, and credits. This includes details about your sources of income, such as W-2 forms from your employer, as well as any deductions you plan to claim, such as student loan interest or IRA contributions. Once you have completed the form, you can either file it electronically or mail it to the IRS.

One advantage of Form 1040a is that it is available for download and print from the IRS website. This means you can easily access the form at any time and complete it at your convenience. Having a printable version of the form allows you to work on your taxes offline, which can be helpful if you prefer to do your taxes without an internet connection.

Overall, Federal Income Tax Form 1040a Printable is a convenient option for individuals with straightforward tax situations. By using this form, you can simplify the tax filing process and ensure that you are reporting your income and claiming any deductions or credits accurately. Whether you choose to file electronically or by mail, Form 1040a can help you meet your tax obligations efficiently and effectively.