As tax season approaches, it’s important to be prepared with all the necessary forms and documents to file your federal income taxes accurately. One crucial aspect of this process is having access to the 2024 federal income tax forms that are required for submission. These forms are essential for reporting your income, deductions, and credits to the IRS.

Fortunately, the IRS provides printable versions of the necessary tax forms on their website for easy access and download. Whether you file your taxes online or prefer to submit a paper return, having these forms on hand is essential for a smooth and successful tax filing process.

2024 Federal Income Tax Forms Printable

2024 Federal Income Tax Forms Printable

When it comes to filing your federal income taxes, there are several key forms that you may need to fill out, depending on your individual tax situation. Some of the most common forms include the 1040, 1040A, and 1040EZ, which are used for reporting various types of income and deductions.

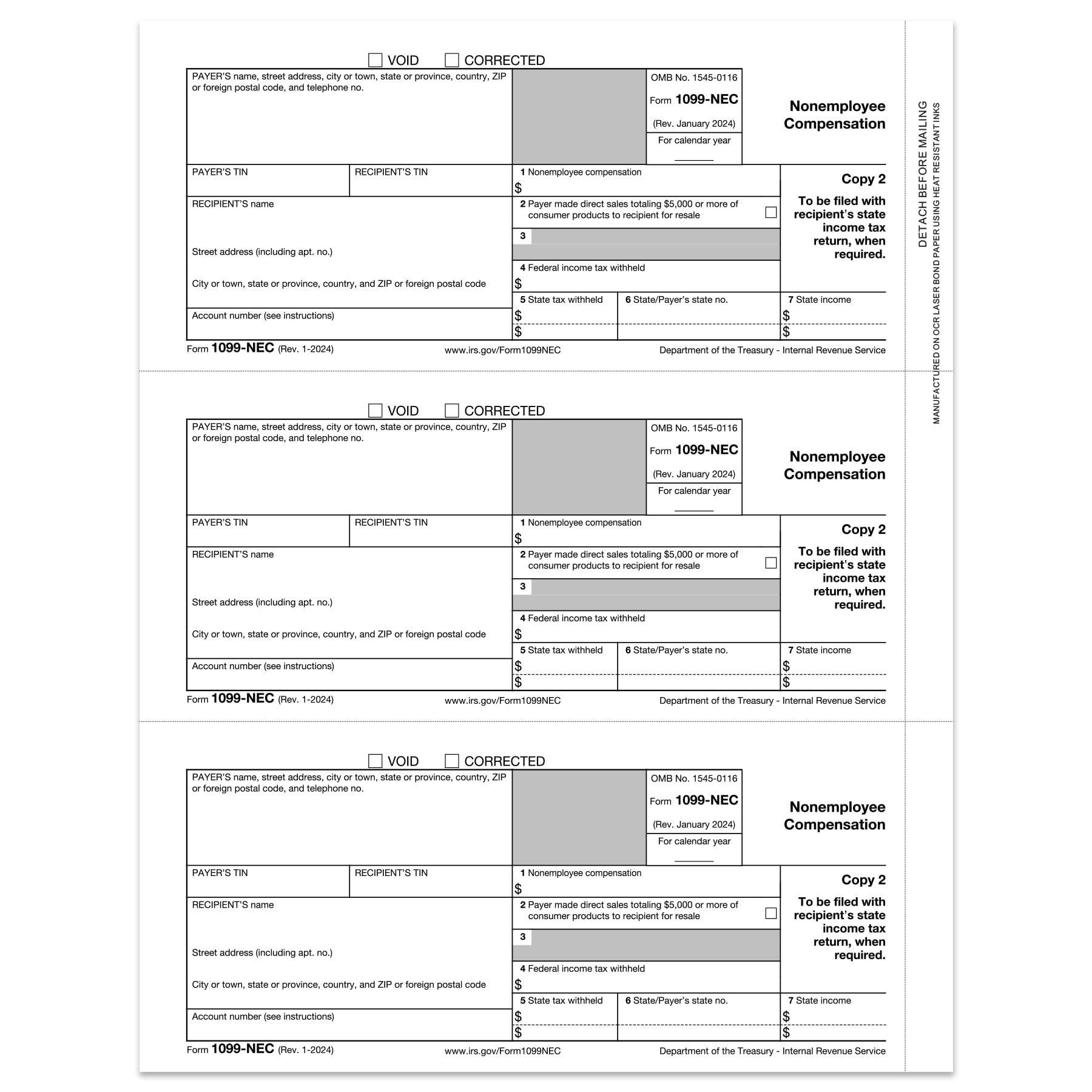

In addition to these basic forms, you may also need to include additional schedules and worksheets to provide more detailed information about your tax situation. These forms can include schedules for reporting self-employment income, investment income, and more. It’s important to carefully review the instructions for each form to ensure that you are filling them out correctly.

As you gather your documents and prepare to file your federal income taxes for the 2024 tax year, be sure to download and print the necessary forms from the IRS website. Having these forms readily available will make the tax filing process much smoother and help you avoid any potential delays or errors in your return.

Overall, having access to the 2024 federal income tax forms printable is essential for a successful tax filing season. By being organized and prepared with all the necessary forms and documents, you can ensure that your taxes are filed accurately and on time. Don’t wait until the last minute to gather your information – start preparing now to make the process as stress-free as possible.