Keeping track of your finances is essential for managing your budget effectively. One useful tool to help you stay organized is a check register. A check register is a document used to record all transactions, including checks written, deposits made, and any other withdrawals or payments. By keeping an accurate record of your finances, you can avoid overdraft fees, track your spending, and ensure that you have enough funds to cover your expenses.

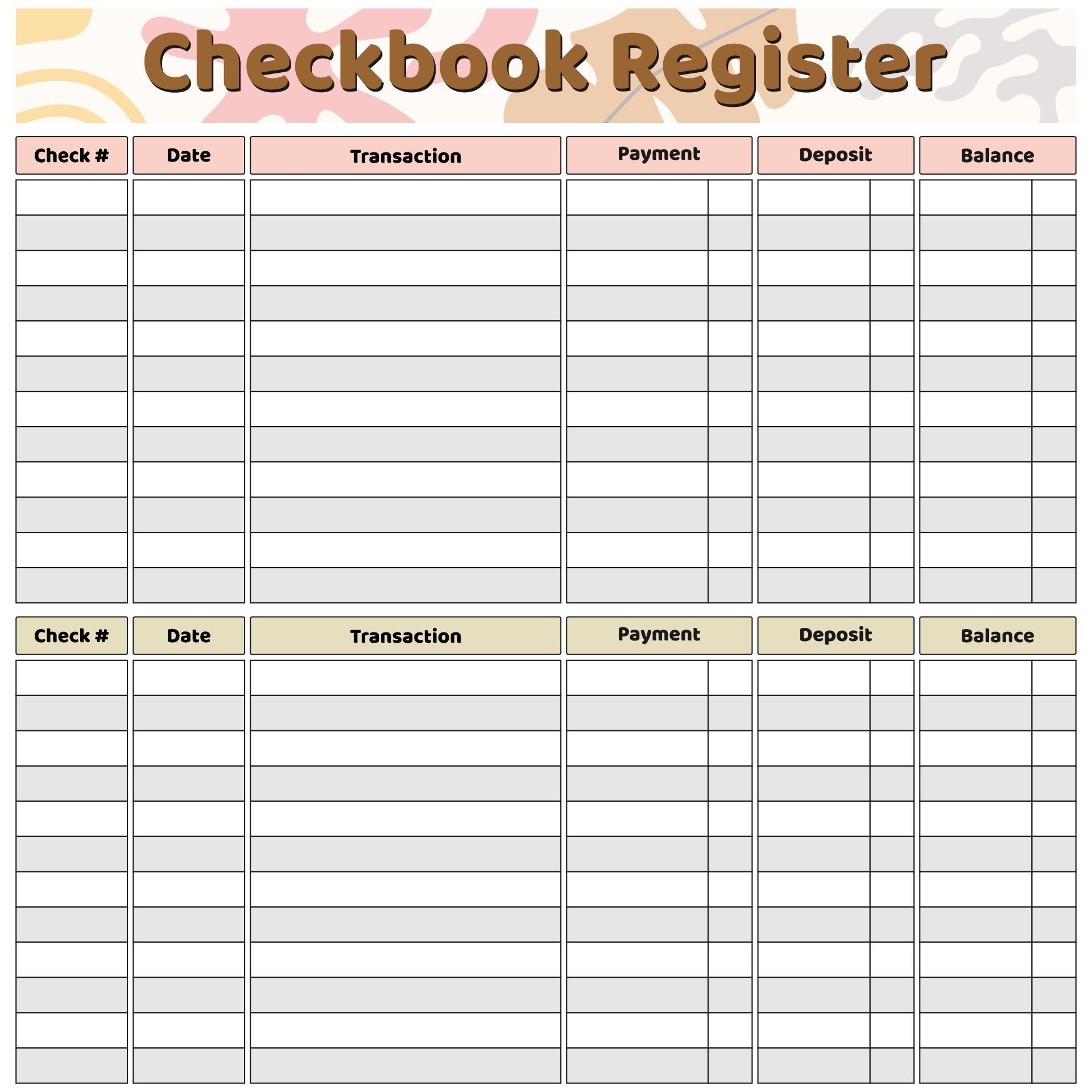

Printable double-sided check registers are convenient tools that allow you to easily keep track of your financial transactions. With the ability to print on both sides of the paper, you can save space and keep all of your financial information in one place. These registers typically include columns for the date, check number, description of the transaction, debit or credit amount, and running balance. By using a printable double-sided check register, you can stay organized and maintain a clear overview of your finances.

Printable Double Sided Check Register

Printable Double Sided Check Register

Handling employee payments doesn’t have to be complicated. A printable payroll form offers a speedy, dependable, and straightforward method for tracking salaries, hours, and withholdings—without the need for complicated tools.

Keep Payroll in Order with a Printable Payroll – Straightforward & Effective Method!

Whether you’re a startup founder, administrator, or independent contractor, using aPrintable Double Sided Check Register helps ensure proper documentation. Simply download the template, produce a hard copy, and complete it by hand or type directly into the file before printing.

One of the benefits of using a printable double-sided check register is that you can customize it to fit your specific needs. Whether you prefer a simple layout or want to add additional columns for specific categories or notes, you have the flexibility to design a register that works best for you. Additionally, printable double-sided registers can be easily printed and stored in a binder or folder for quick access whenever you need to review your financial records.

Another advantage of using a printable double-sided check register is that it can help you identify any errors or discrepancies in your account. By regularly updating your register with each transaction, you can compare it to your bank statements and identify any unauthorized charges, missing deposits, or other issues that may arise. This proactive approach to managing your finances can help you avoid potential problems and ensure that your account is accurate and up to date.

In conclusion, a printable double-sided check register is a valuable tool for managing your finances and staying organized. By keeping a detailed record of your transactions, you can track your spending, avoid overdraft fees, and maintain an accurate account balance. With the flexibility to customize the register to fit your needs and the convenience of printing on both sides of the paper, a printable double-sided check register is a practical solution for maintaining financial stability.