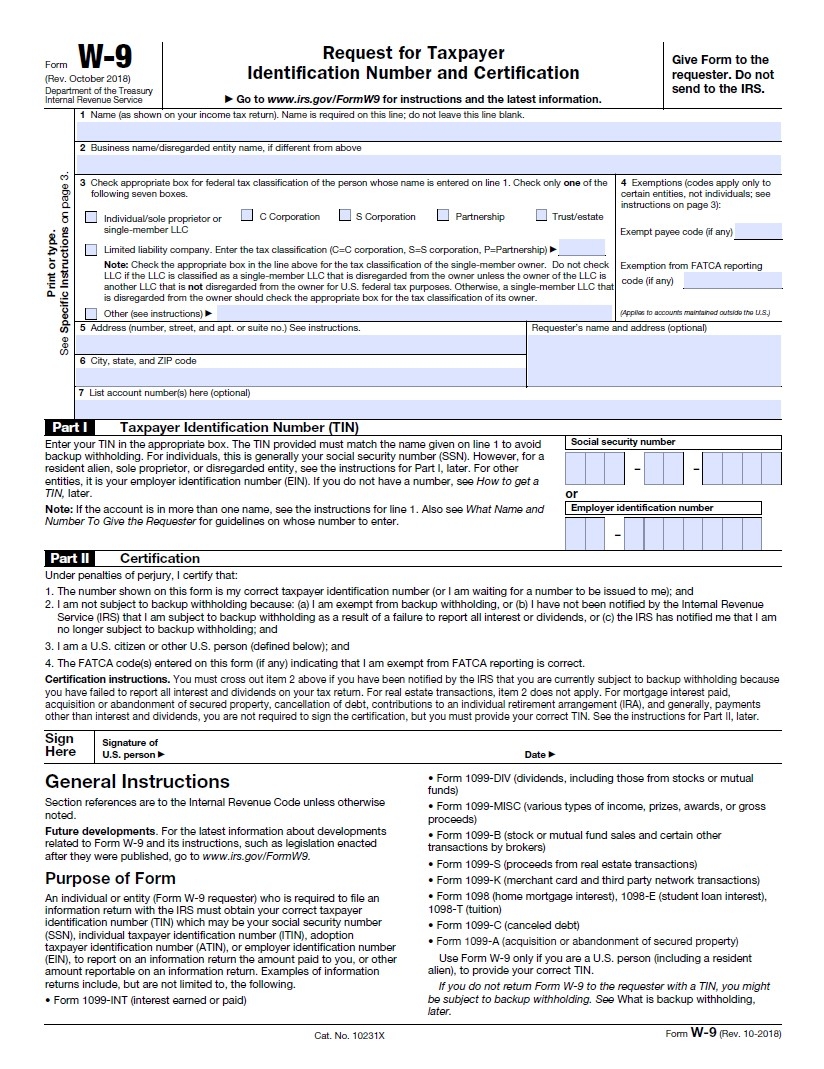

When tax season rolls around, it’s important to make sure you have all the necessary forms to file your state income tax in Arkansas. Luckily, the Arkansas Department of Finance and Administration provides printable forms on their website for easy access. These forms cover a range of tax-related topics, from individual income tax to business tax filings.

One of the most common forms you may need is the AR1000F, which is the individual income tax return form for Arkansas residents. This form allows you to report your income, deductions, and credits to determine how much you owe or are owed in taxes. By filling out this form accurately and completely, you can ensure that you are meeting your tax obligations and potentially maximizing your refund.

State Income Tax Arkansas Forms Printable

State Income Tax Arkansas Forms Printable

In addition to the AR1000F, there are other forms available for specific situations, such as the AR1000NR for non-residents or part-year residents, and the AR1000F-ADJ for filing an amended return. It’s important to carefully review the instructions for each form to make sure you are filling them out correctly and including all necessary documentation.

For businesses operating in Arkansas, there are also printable tax forms available, such as the AR3, which is used to report income and deductions for corporations, partnerships, and other entities. By filing these forms accurately and on time, you can avoid penalties and ensure that your business is in compliance with Arkansas tax laws.

Overall, having access to printable state income tax forms in Arkansas makes it easier for individuals and businesses to file their taxes accurately and on time. By taking the time to fill out these forms carefully and double-checking your work, you can avoid costly mistakes and ensure that you are meeting your tax obligations. So be sure to visit the Arkansas Department of Finance and Administration website to download the forms you need for this tax season.

In conclusion, having access to printable state income tax forms in Arkansas is a valuable resource for taxpayers. By utilizing these forms and following the instructions carefully, you can make the tax filing process smoother and more efficient. So don’t wait until the last minute – start gathering your documents and filling out your forms today to stay ahead of the game.

Download and Print State Income Tax Arkansas Forms Printable

Printable payroll are ideal for businesses that prefer non-digital systems or need physical copies for audit purposes. Most forms include fields for staff name, pay period, total earnings, taxes, and net pay—making them both comprehensive and easy to use.

Take control of your payment tracking today with a trusted printable payroll. Save time, minimize mistakes, and maintain clear records—all while keeping your payroll records organized.

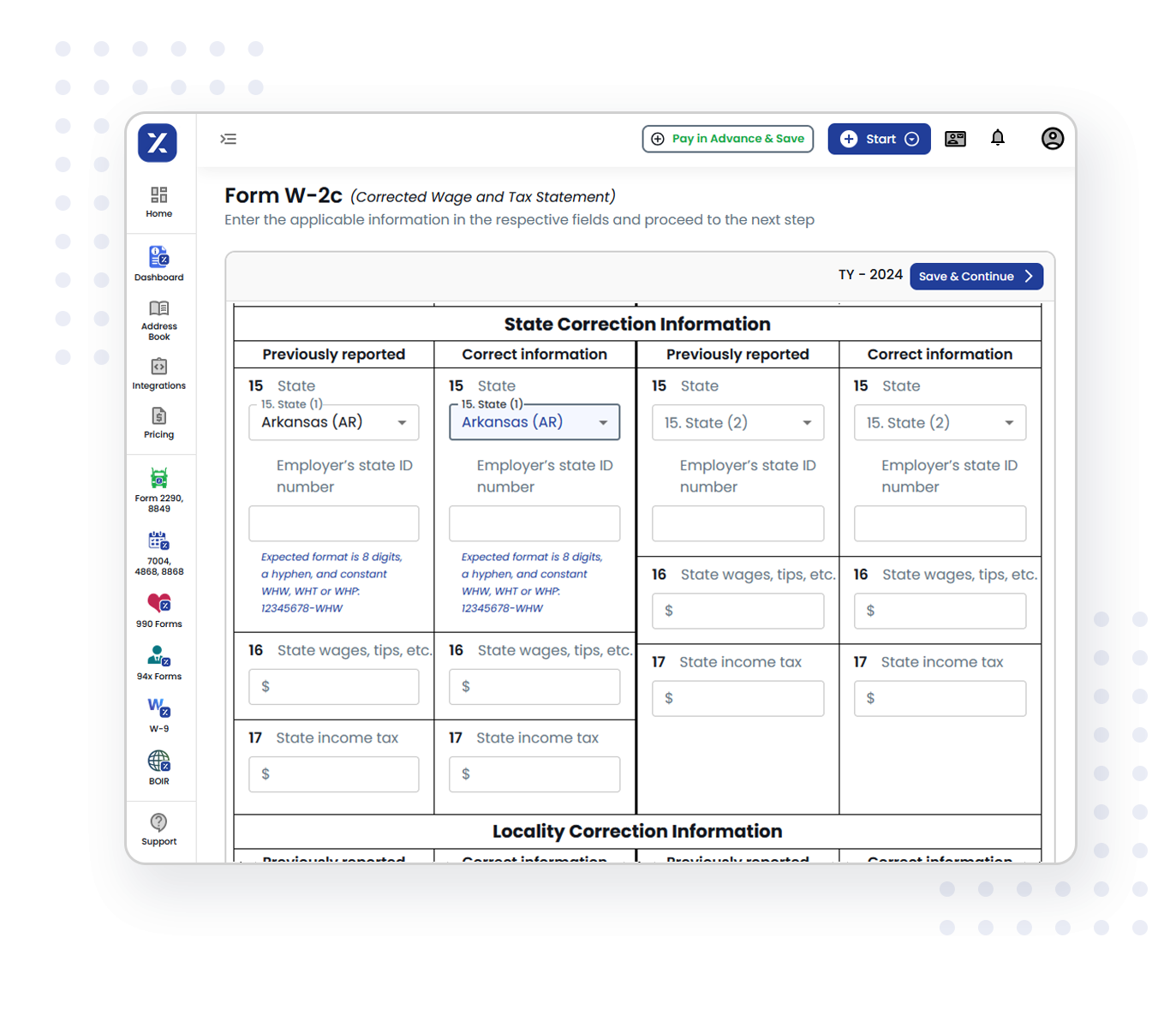

Arkansas W 2 U0026 AR3MAR Filing Requirements For 2024

Arkansas W 2 U0026 AR3MAR Filing Requirements For 2024

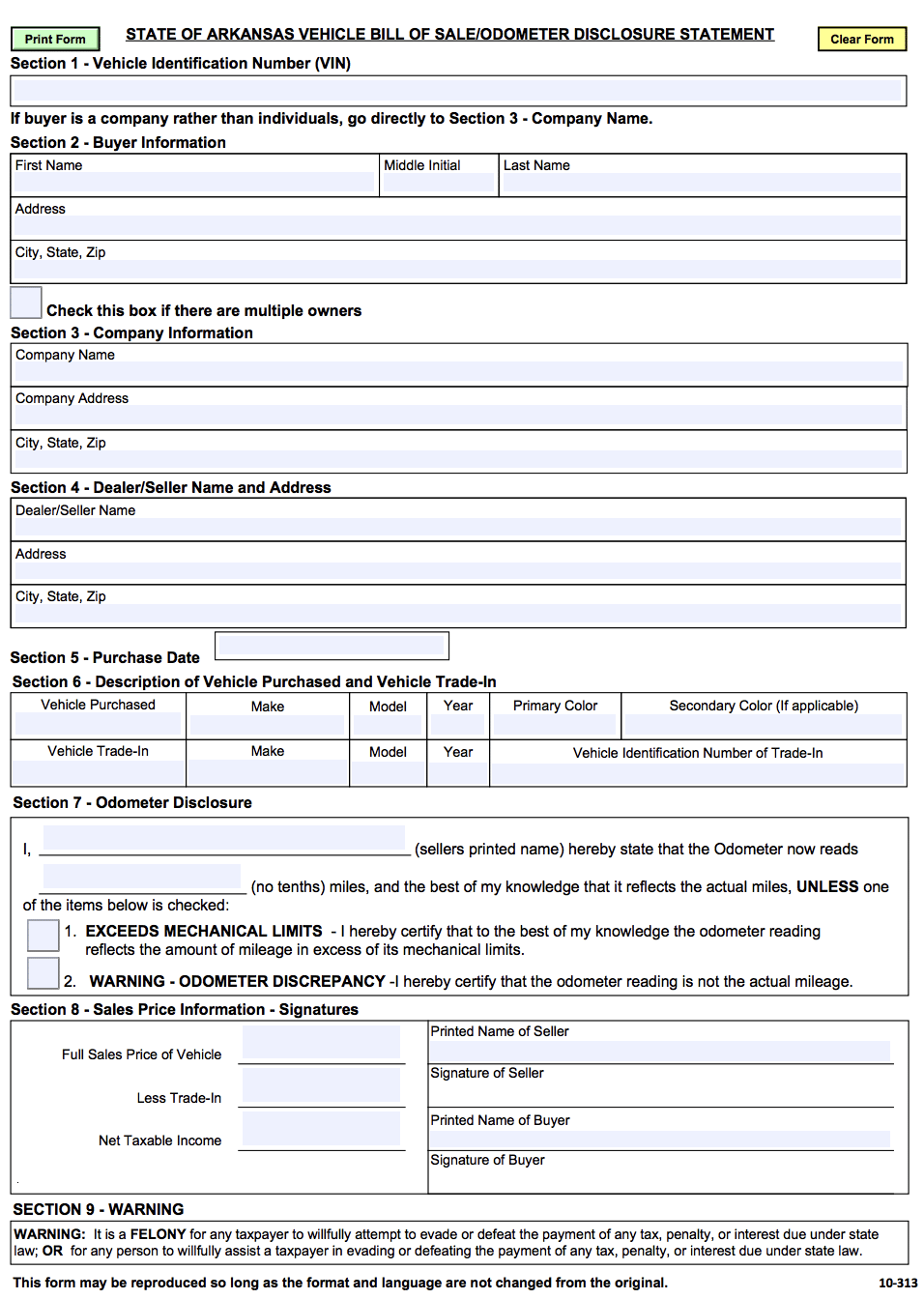

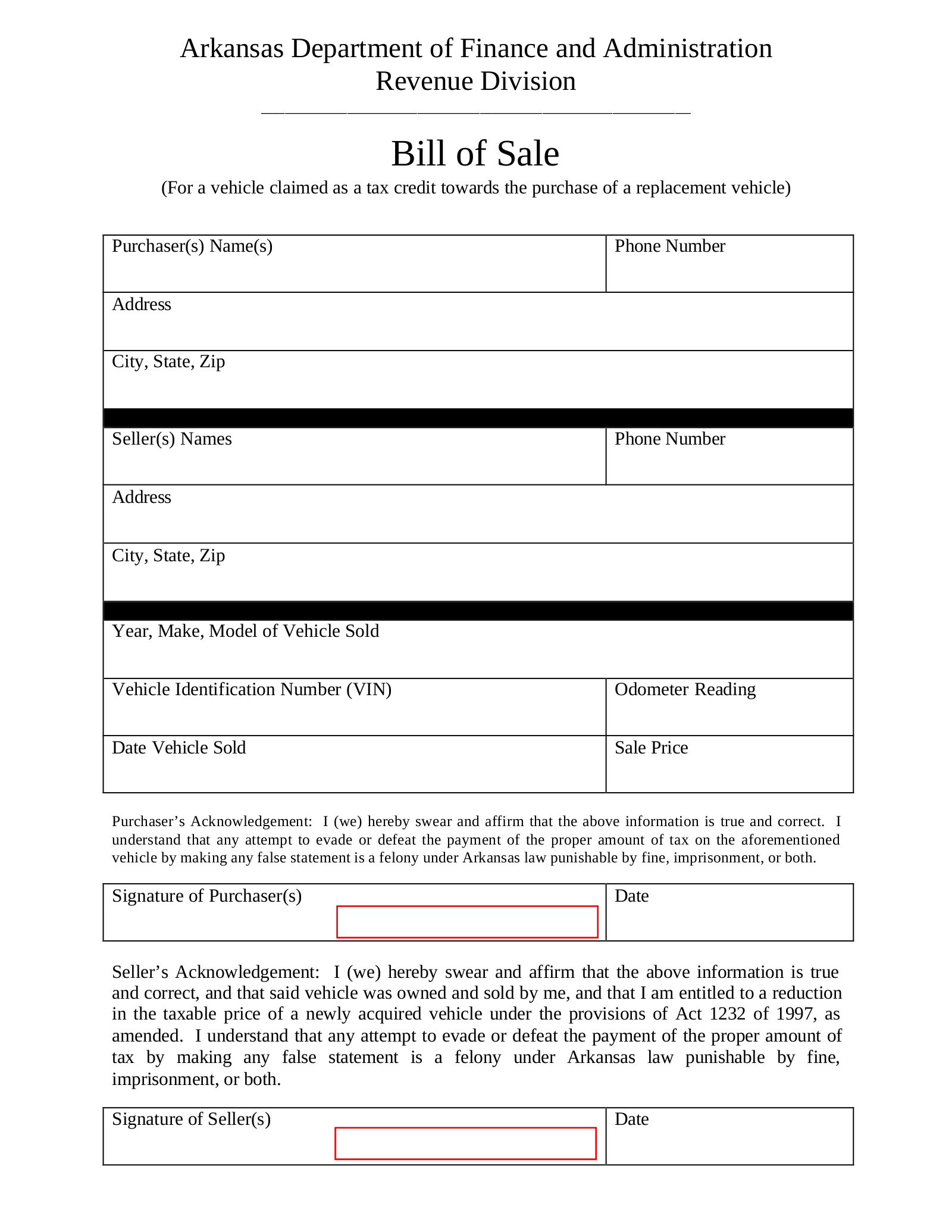

Free Arkansas Bill Of Sale Forms PDF

Free Arkansas Bill Of Sale Forms PDF

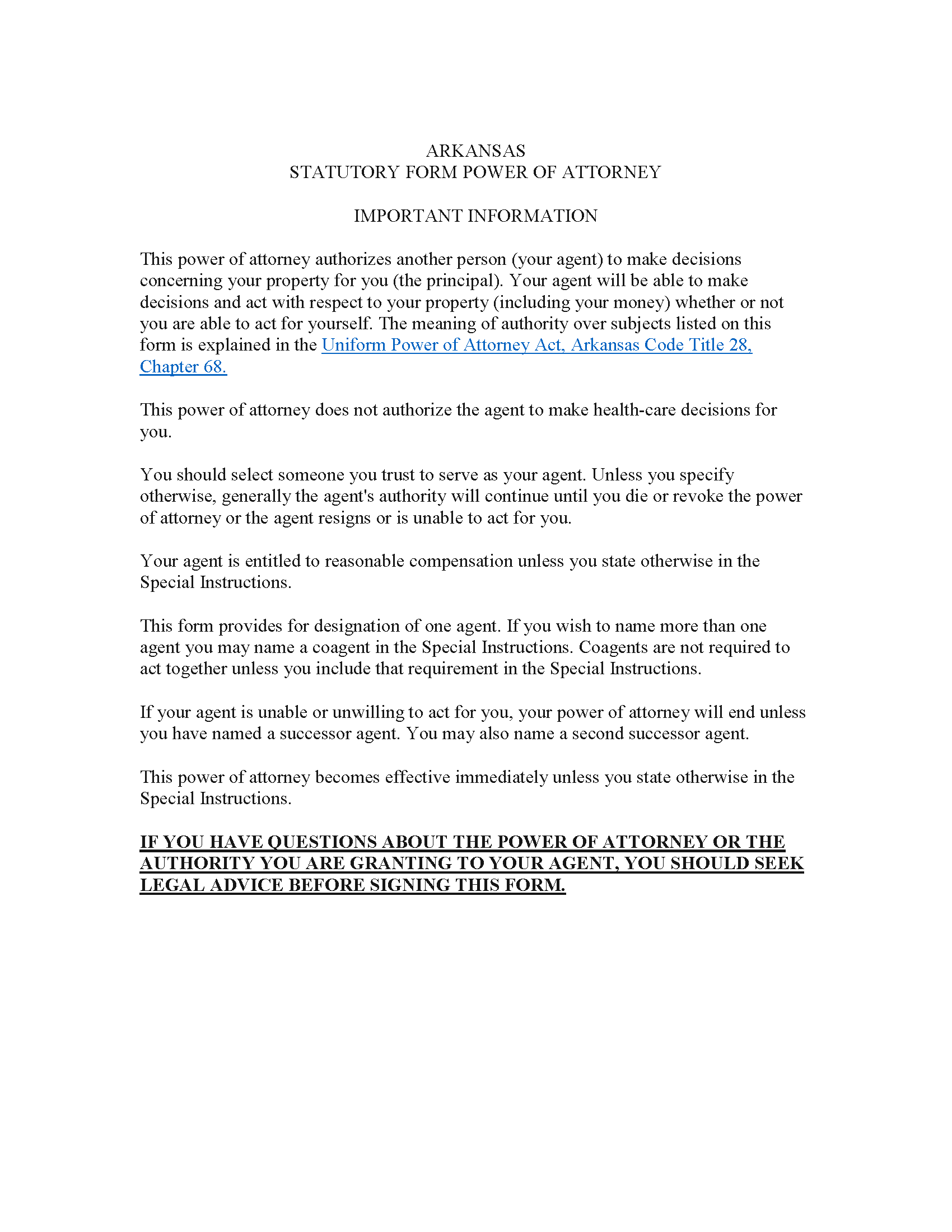

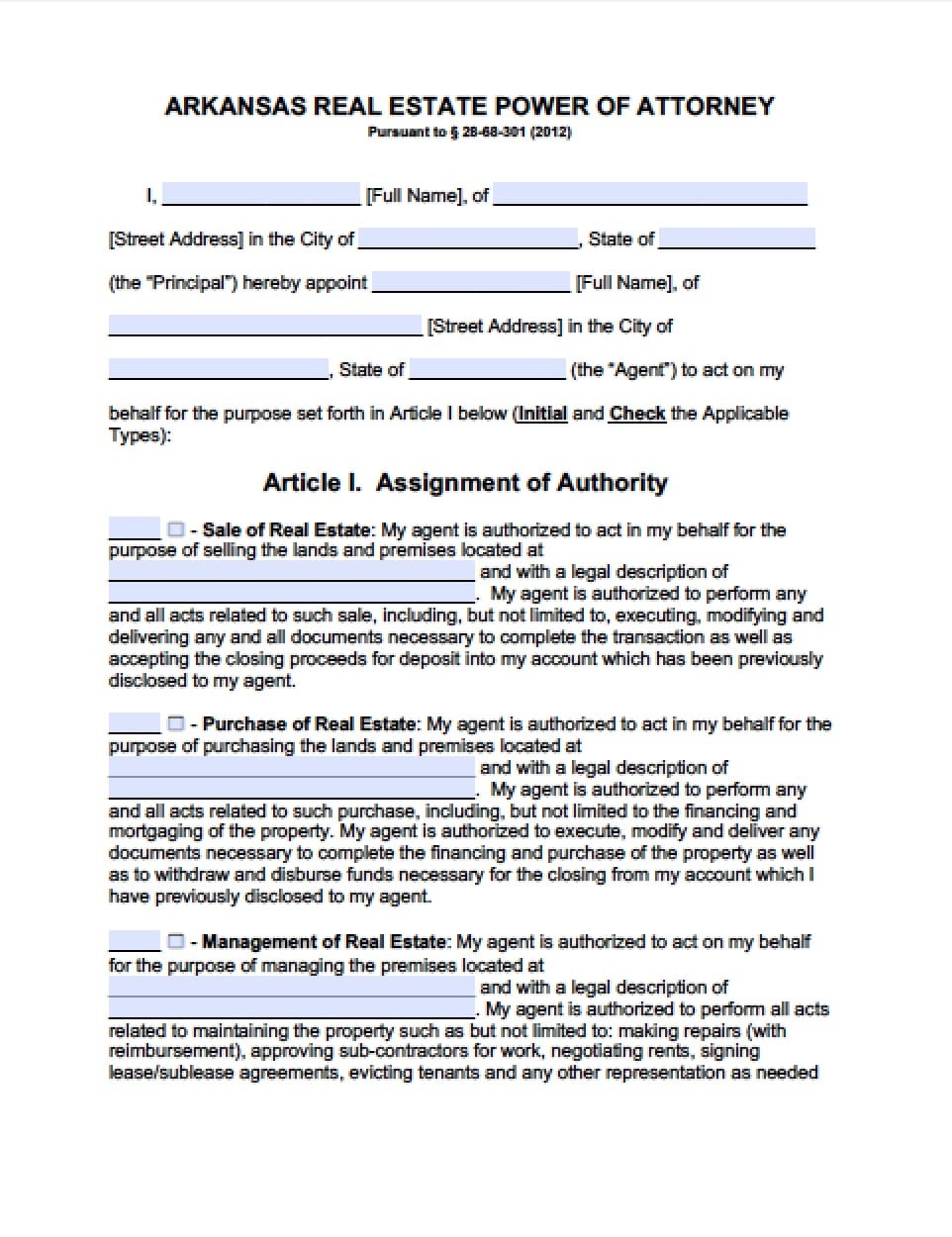

Free Arkansas Power Of Attorney Forms 9 Types Power Of Attorney

Free Arkansas Power Of Attorney Forms 9 Types Power Of Attorney

Free Arkansas Tax Credit For Replacement Vehicle Bill Of Sale PDF EForms

Free Arkansas Tax Credit For Replacement Vehicle Bill Of Sale PDF EForms

Processing staff wages doesn’t have to be overwhelming. A printable payroll template offers a quick, accurate, and user-friendly method for tracking salaries, hours, and withholdings—without the need for complicated tools.

Whether you’re a startup founder, payroll manager, or independent contractor, using aprintable payroll form helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.