When it comes to navigating the complexities of aged care, one of the key documents that individuals and families may encounter is the Residential Aged Care Fee Income Assessment Form. This form is designed to assess an individual’s income and assets to determine their eligibility for government-subsidized aged care services.

Completing the Residential Aged Care Fee Income Assessment Form can be a daunting task, but having a printable version of the form can make the process more manageable. Having a hard copy of the form allows individuals to take their time in gathering the necessary information and seek assistance if needed.

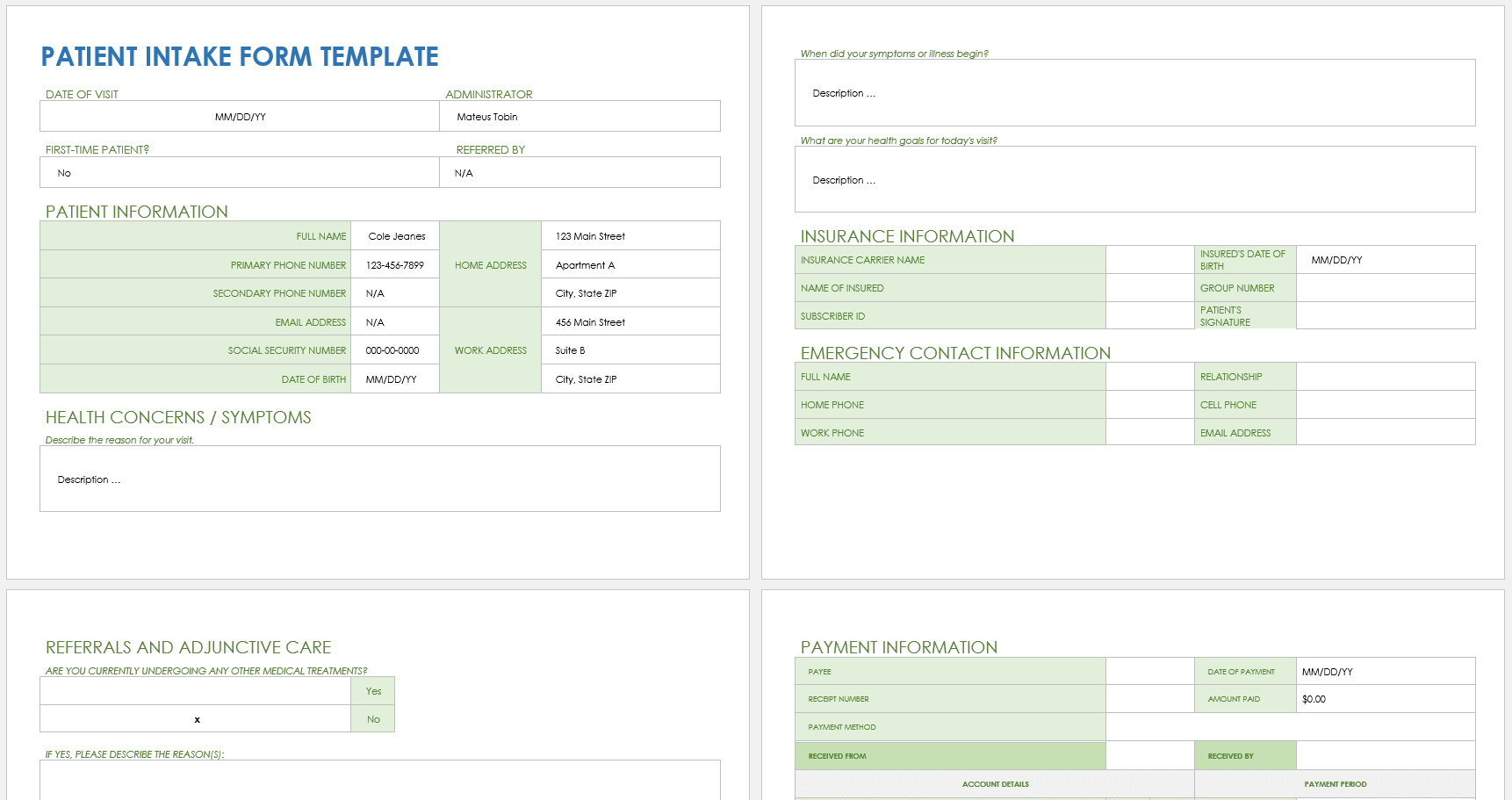

Residential Aged Care Fee Income Assessment Form Printable

Residential Aged Care Fee Income Assessment Form Printable

It is important to fill out the Residential Aged Care Fee Income Assessment Form accurately and honestly. Providing incorrect information could result in delays in accessing aged care services or even potential financial penalties. The form covers various aspects of an individual’s financial situation, including income, assets, and expenses.

Once the form is completed, it is submitted to the Department of Human Services for assessment. Based on the information provided, the department will determine the individual’s eligibility for government-subsidized aged care services and calculate any applicable fees.

Having a printable version of the Residential Aged Care Fee Income Assessment Form allows individuals to prepare in advance, gather all necessary documentation, and ensure that they are providing accurate information. It is a crucial step in the process of accessing aged care services and can help individuals plan for their future care needs.

In conclusion, the Residential Aged Care Fee Income Assessment Form is an essential document for individuals seeking government-subsidized aged care services. Having a printable version of the form can simplify the process and ensure that individuals are providing accurate information for assessment. It is a key step in planning for the future and accessing the care and support needed in later years.