As tax season approaches, many individuals and businesses are gearing up to file their income taxes. One of the key components of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits to the IRS. Fortunately, the IRS provides a variety of printable income tax forms that can be easily accessed and completed.

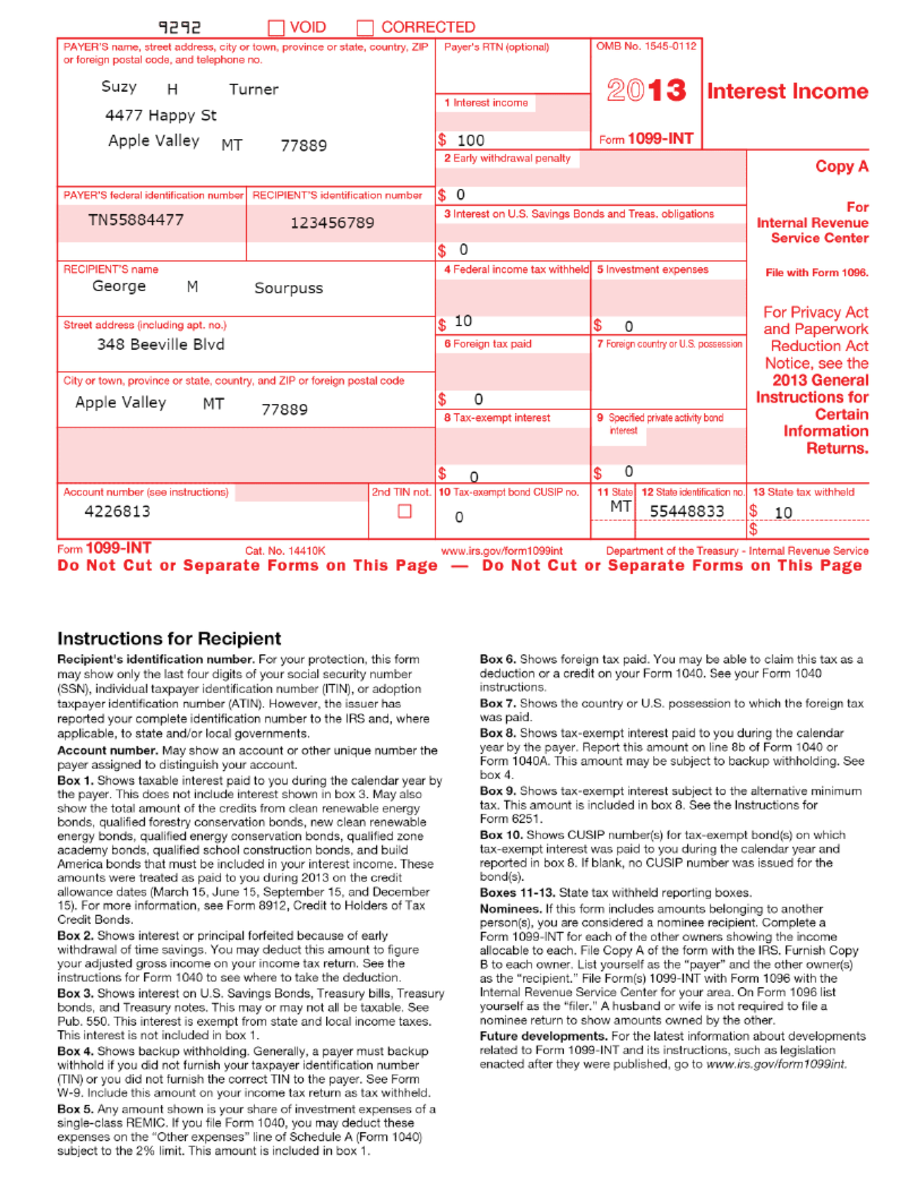

Printable IRS income tax forms are essential for those who prefer to file their taxes manually or for those who may not have access to online filing options. These forms cover a range of tax situations, including individual income tax returns, business tax returns, and forms for reporting various types of income such as dividends, capital gains, and rental income.

Printable Irs Income Tax Forms

Printable Irs Income Tax Forms

When it comes to individual income tax returns, the most commonly used form is the Form 1040. This form is used to report income, deductions, and credits for individuals and households. The IRS provides a printable version of Form 1040 on their website, along with instructions on how to complete it accurately.

For businesses, there are a variety of forms available depending on the type of entity and how it is structured for tax purposes. Small businesses may use Form 1120S for S corporations, Form 1065 for partnerships, or Schedule C for sole proprietors. These forms can also be easily printed from the IRS website.

It’s important to note that some tax forms may require additional schedules or worksheets to be completed in conjunction with the main form. For example, individuals who have income from rental properties may need to fill out Schedule E along with their Form 1040. These additional forms can also be found on the IRS website and printed as needed.

In conclusion, printable IRS income tax forms are a valuable resource for individuals and businesses who need to file their taxes accurately and on time. By accessing these forms online, taxpayers can ensure that they have all the necessary documentation to report their income, deductions, and credits to the IRS. Whether you’re a first-time filer or a seasoned taxpayer, having access to printable tax forms can make the filing process much easier and less stressful.