Ohio residents who are required to file their state income tax returns can easily access printable forms online. The Ohio Department of Taxation provides downloadable forms for individuals, businesses, and other entities to report their income and pay any taxes owed to the state.

Whether you are a full-time Ohio resident or a part-time resident with income earned in the state, you must file an Ohio income tax return if you meet certain income thresholds. Using the printable forms provided by the state can help simplify the process of filing your taxes and ensure that you are in compliance with state tax laws.

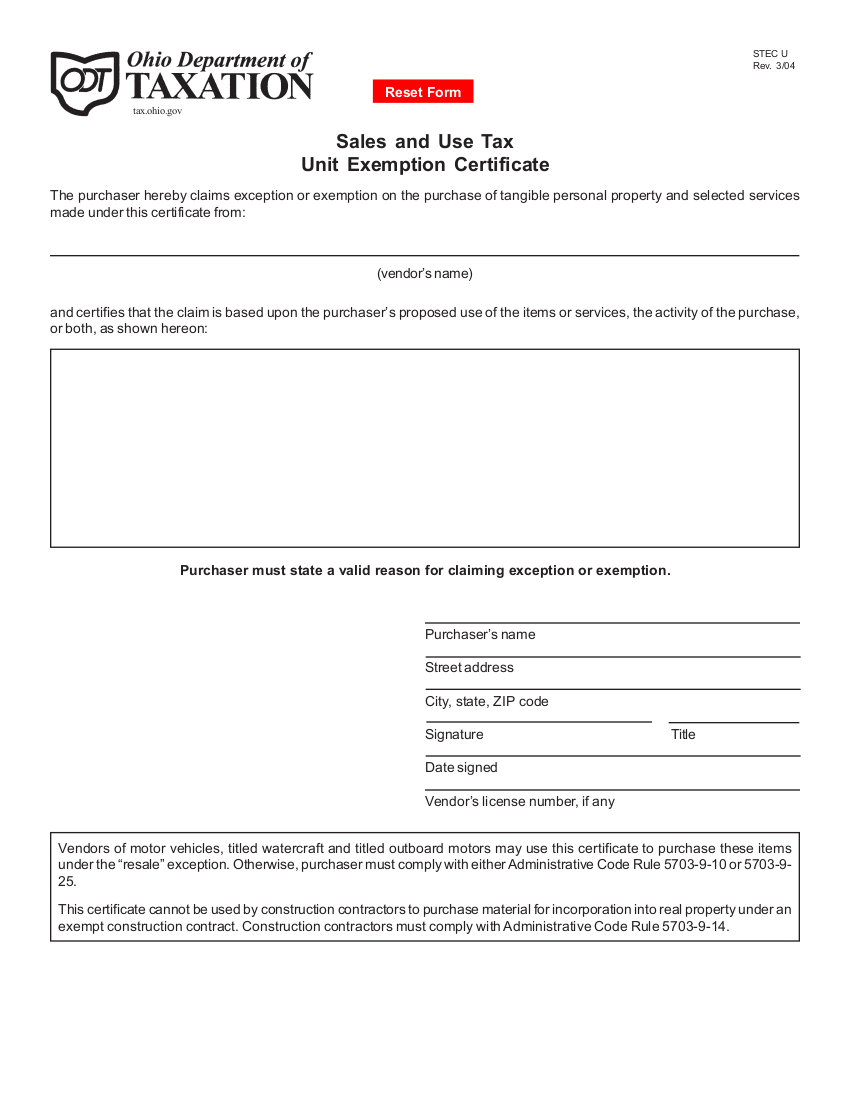

Ohio Income Tax Form Printable Form

Ohio Income Tax Form Printable Form

When accessing the Ohio Department of Taxation website, you will find a variety of printable forms available for different types of taxpayers. Individuals can download Form IT 1040, which is the standard income tax return form for residents. There are also separate forms for non-residents and part-year residents, as well as forms for businesses, estates, and trusts.

In addition to the income tax return forms, Ohio taxpayers can also access printable instructions and schedules to help them complete their returns accurately. These instructions provide guidance on how to report different types of income, deductions, and credits, as well as how to calculate any tax owed or refund due.

It is important to note that while printable forms are available for convenience, taxpayers also have the option to file their Ohio income tax returns electronically. E-filing can often be faster and more secure than filing a paper return, and it may also result in faster processing and a quicker refund, if applicable.

Overall, using printable forms to file your Ohio income tax return can be a convenient and efficient way to fulfill your tax obligations to the state. Whether you prefer to file electronically or by mail, having access to printable forms can help make the process smoother and ensure that you are meeting your tax responsibilities as an Ohio taxpayer.