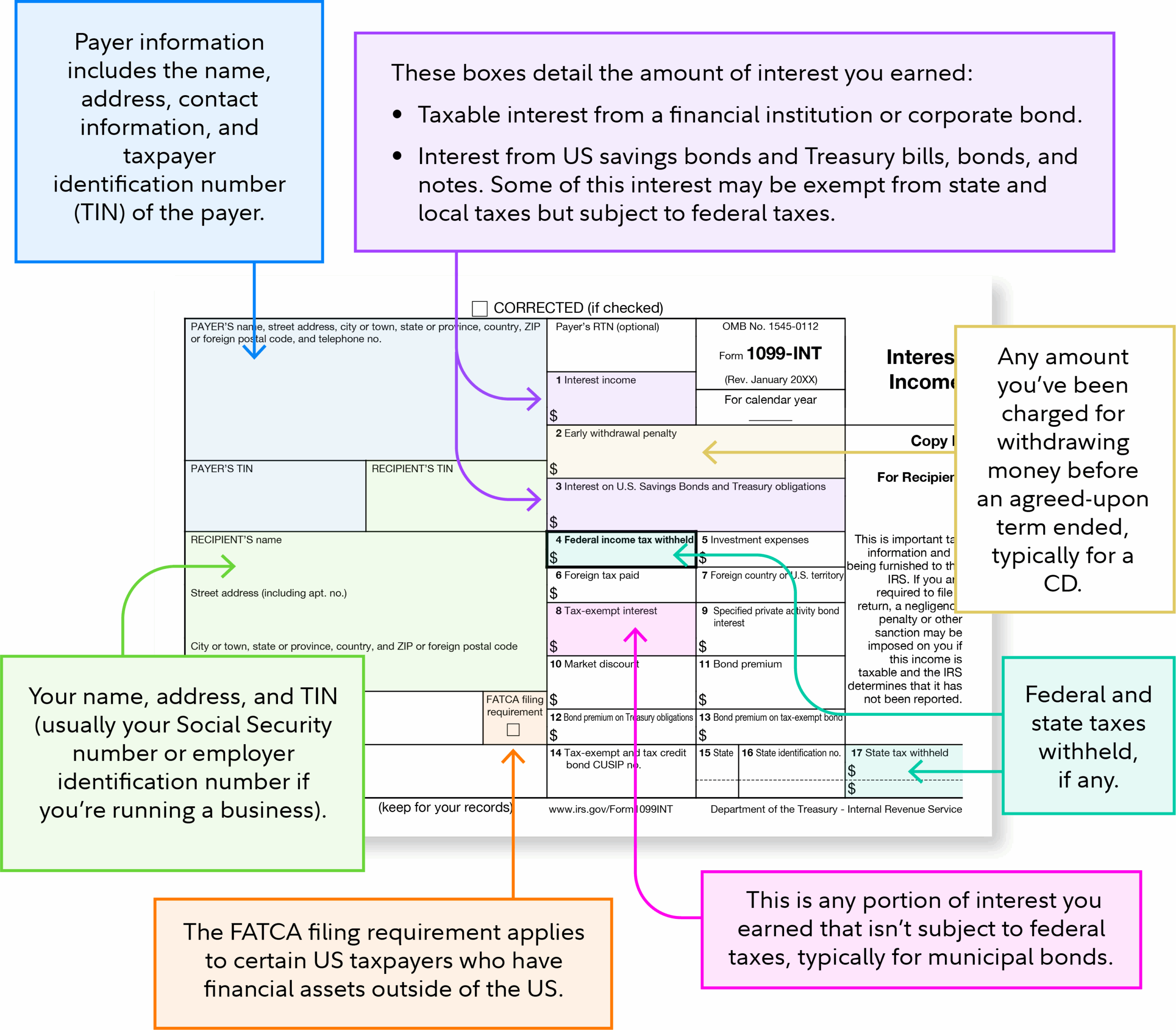

Interest income is a common form of income that many people earn from their investments or savings accounts. If you received interest income in the form of dividends, you may receive a Form 1099-Int from your financial institution. This form is used to report the amount of interest income you earned during the tax year.

When it comes to tax time, it’s important to accurately report all of your income, including interest income. The Form 1099-Int provides the necessary information to report this income on your tax return. If you received interest income in both 2019 and 2017, you may need to reference different forms for each year.

Interest Income Form 1099-Int From 2019 And 2017 Printable

Interest Income Form 1099-Int From 2019 And 2017 Printable

When you receive your Form 1099-Int for 2019 or 2017, it will include important information such as the amount of interest income earned, the name of the payer, and the payer’s identification number. This information is necessary for accurately reporting your income to the IRS.

It’s important to keep track of your Form 1099-Int for both 2019 and 2017, as this income must be reported on your tax return. If you misplaced or did not receive your form, you may be able to download a printable version from your financial institution’s website or contact them directly for a copy.

When reporting your interest income on your tax return, be sure to carefully follow the instructions provided on the Form 1099-Int. Failing to accurately report this income could result in penalties or interest owed to the IRS. It’s always best to consult with a tax professional if you have any questions or concerns about reporting your interest income.

In conclusion, if you earned interest income in 2019 or 2017, you will need to reference the Form 1099-Int provided by your financial institution. This form contains important information about your interest income that must be reported on your tax return. Be sure to keep track of your forms and accurately report your income to avoid any potential issues with the IRS.

Quickly Access and Print Interest Income Form 1099-Int From 2019 And 2017 Printable

Interest Income Form 1099-Int From 2019 And 2017 Printable are ideal for teams that prefer paper documentation or need physical copies for staff files. Most forms include fields for employee name, pay period, gross pay, taxes, and final salary—making them both detailed and practical.

Take control of your payment tracking today with a trusted printable payroll. Reduce admin effort, reduce errors, and stay organized—all while keeping your employee payment data professional.

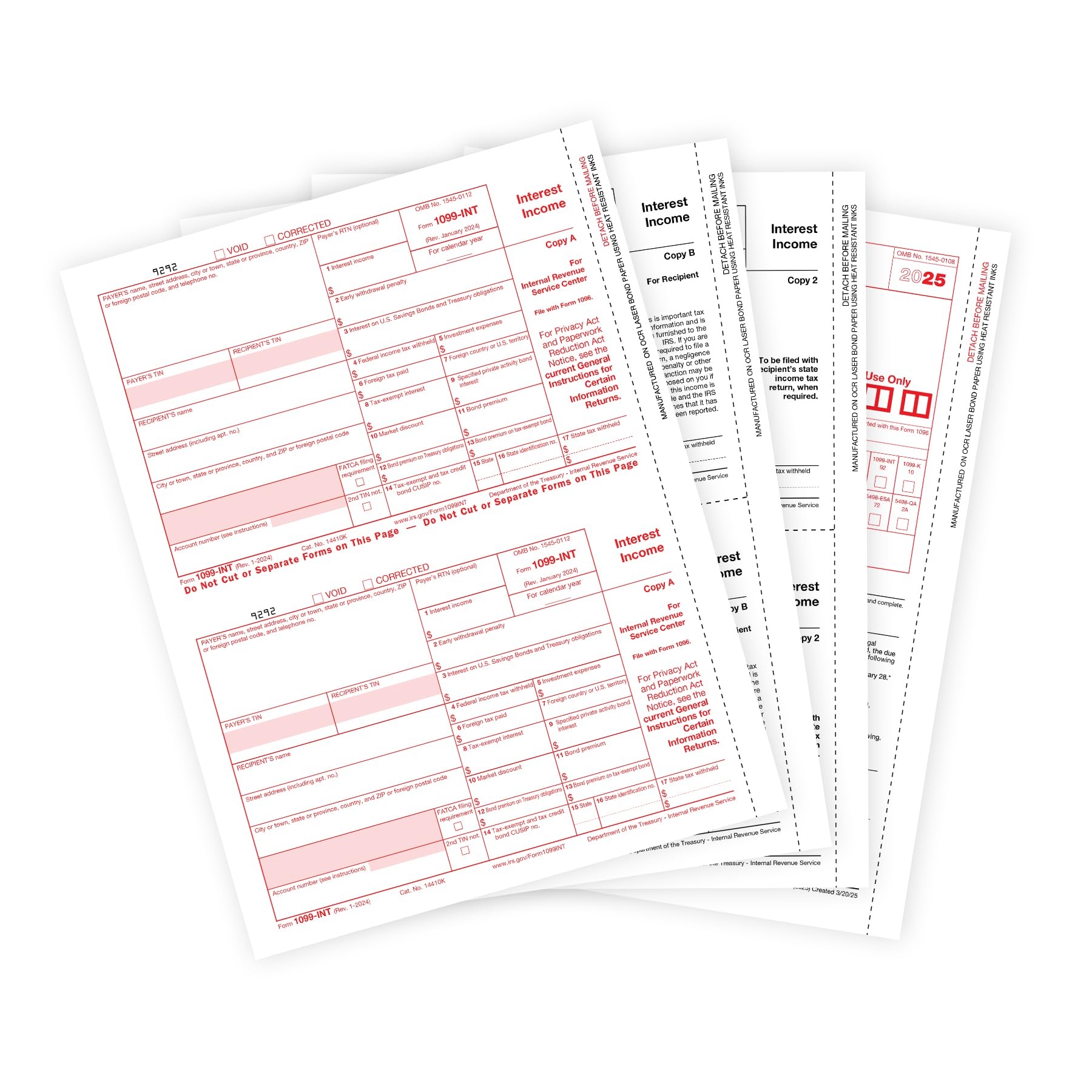

Amazon 2025 1099 INT 4 Part Interest Tax Forms 25 Laser Form Sets For Interest Income Compatible With QuickBooks And Accounting Software 25 Pack Office Products

Amazon 2025 1099 INT 4 Part Interest Tax Forms 25 Laser Form Sets For Interest Income Compatible With QuickBooks And Accounting Software 25 Pack Office Products

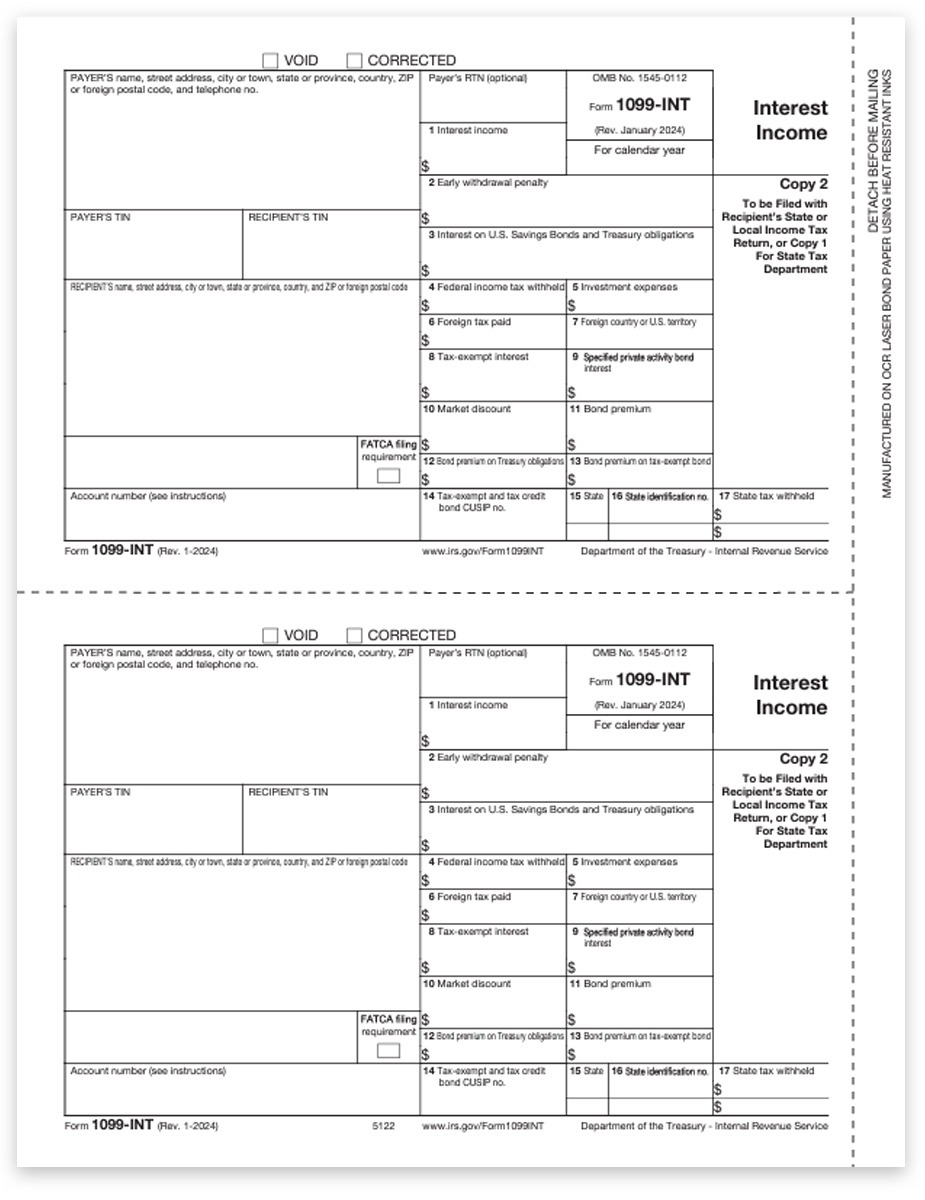

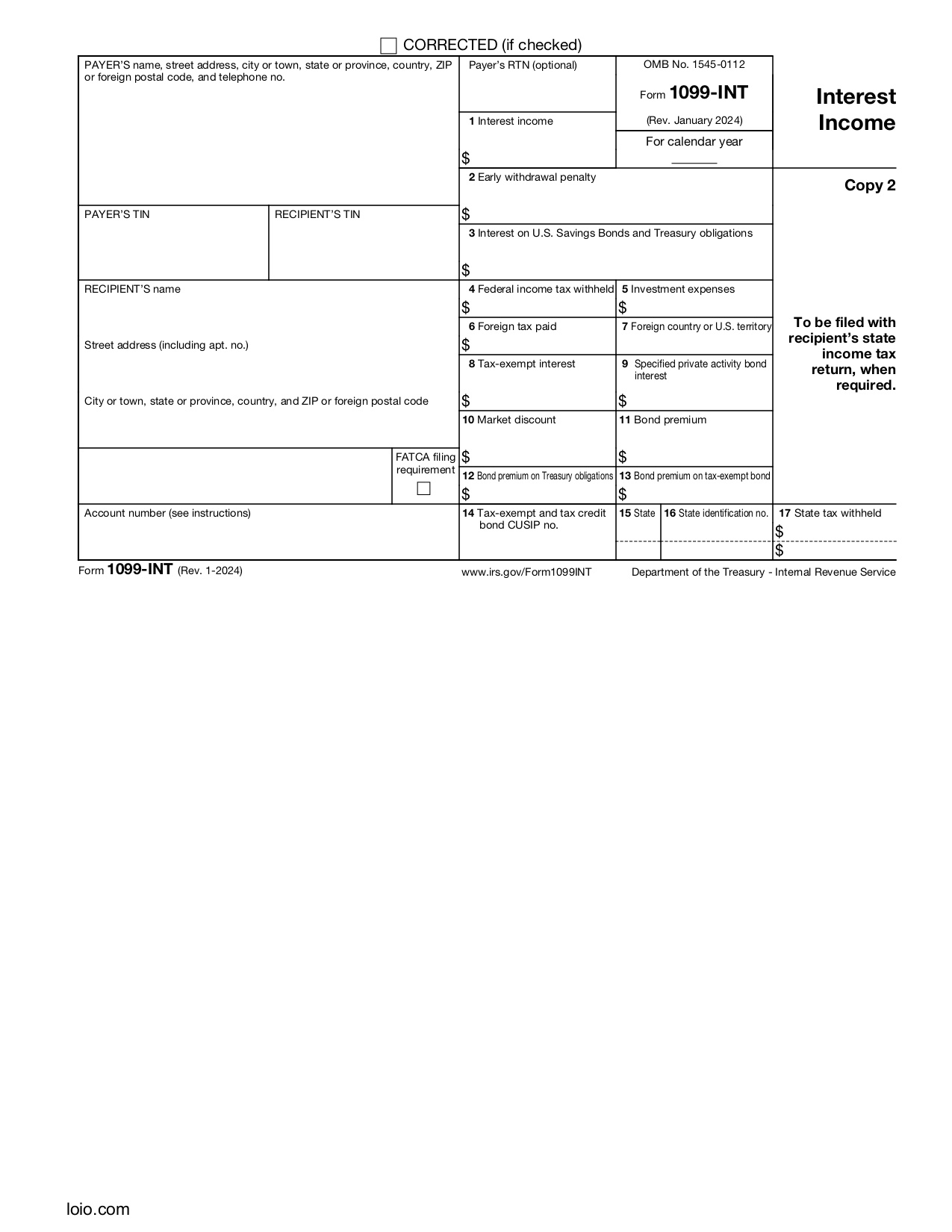

1099INT Forms Copy 2 For State Local File DiscountTaxForms

1099INT Forms Copy 2 For State Local File DiscountTaxForms

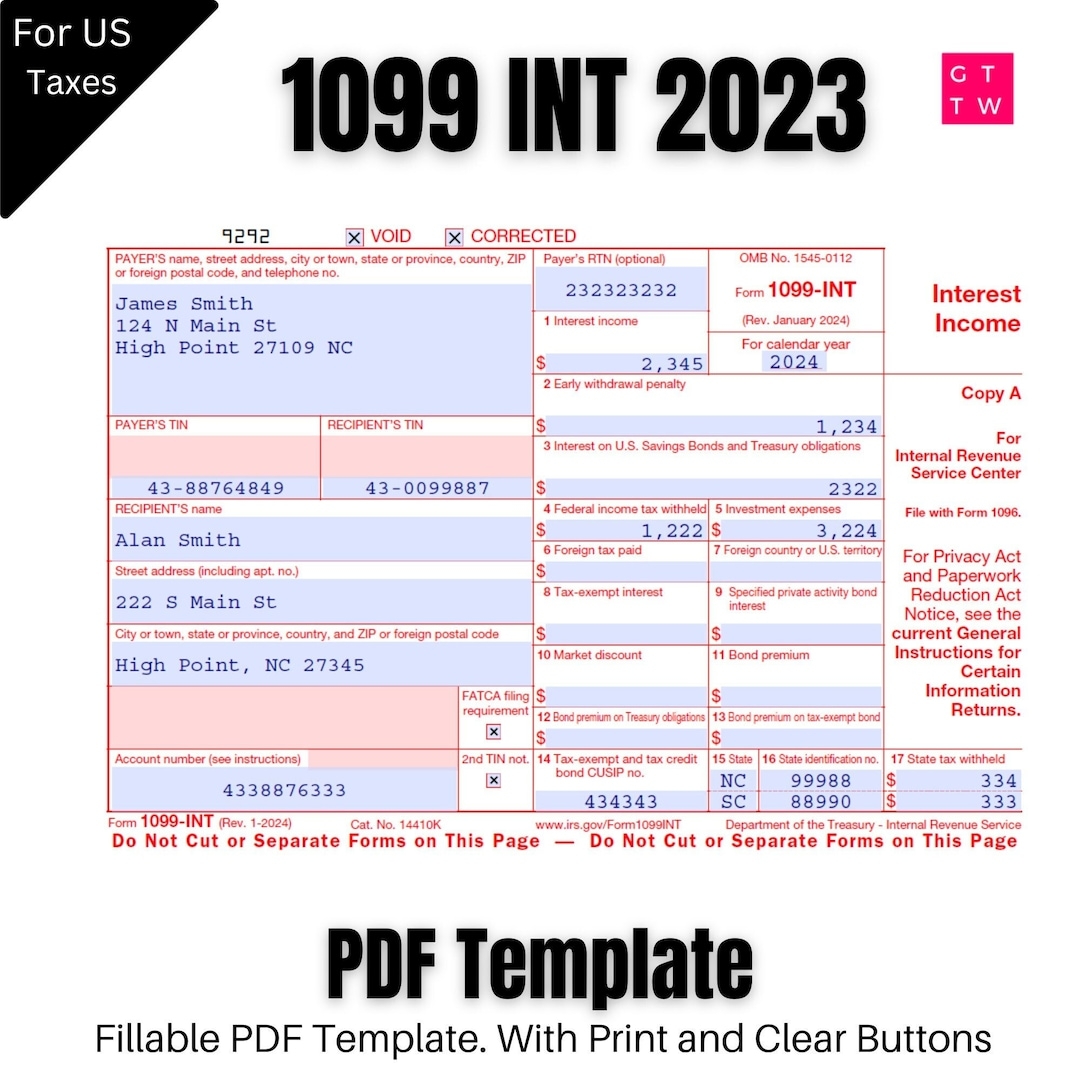

1099 INT Form PDF Template 2024 2023 With Print And Clear Buttons Etsy

1099 INT Form PDF Template 2024 2023 With Print And Clear Buttons Etsy

Form 1099 INT Essential Guide To Reporting Interest Income

Form 1099 INT Essential Guide To Reporting Interest Income

Processing payroll tasks doesn’t have to be difficult. A printable payroll form offers a quick, dependable, and straightforward method for tracking wages, shifts, and withholdings—without the need for complicated tools.

Whether you’re a freelancer, HR professional, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply access the template, print it, and complete it by hand or edit it digitally before printing.