As tax season approaches, many individuals are gearing up to file their income tax returns. Filing taxes can be a daunting task, but with the help of printable forms, the process can be made much easier. Printable forms provide a convenient way for taxpayers to organize their information and ensure that they are completing their tax returns accurately.

Whether you are self-employed, a business owner, or an employee, printable forms can help you gather all the necessary information needed to file your taxes. These forms typically include sections for personal information, income sources, deductions, and credits. By filling out these forms in advance, you can streamline the tax filing process and avoid any last-minute scrambling to find important documents.

Income Tax Filing With Printable Forms

Income Tax Filing With Printable Forms

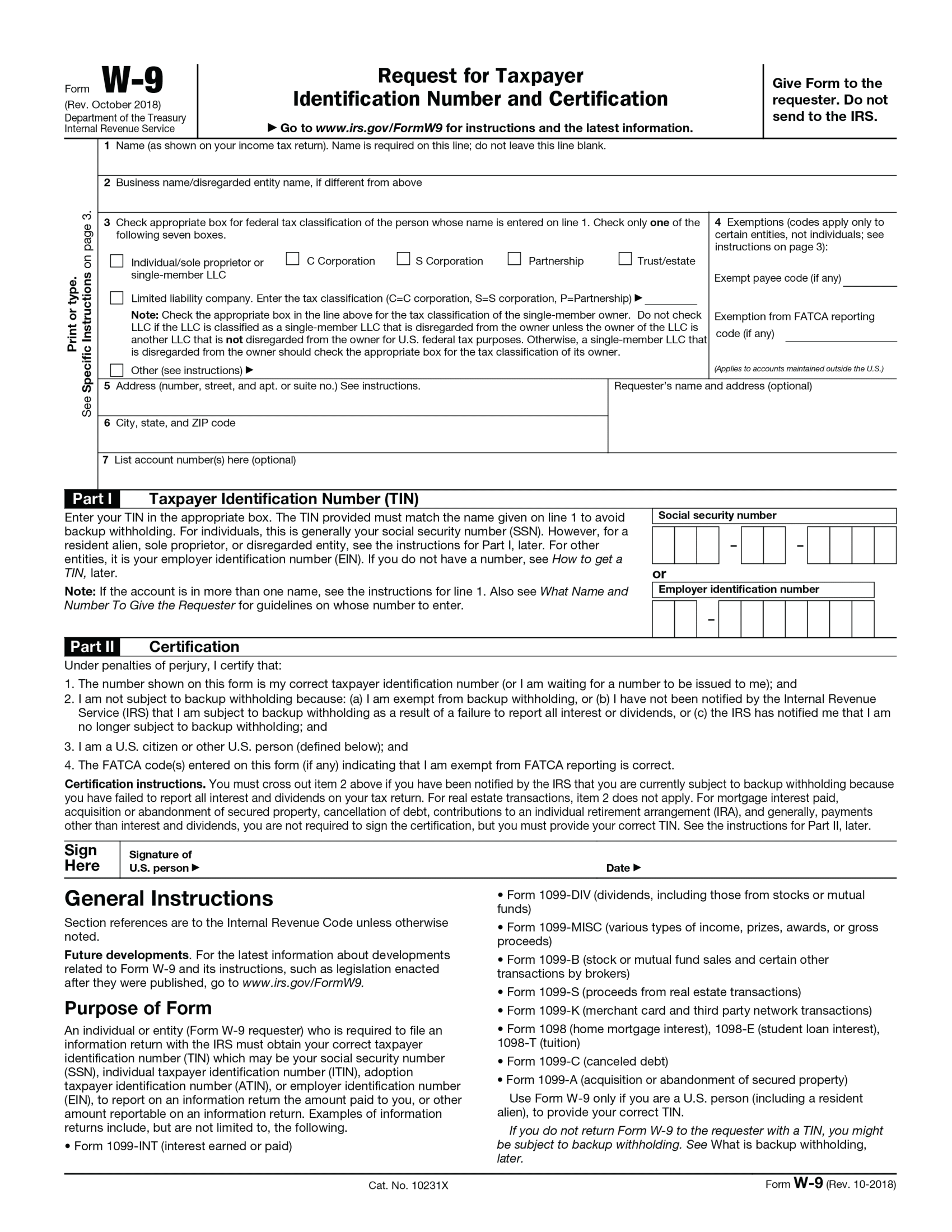

One of the most common printable forms used for income tax filing is the Form 1040, which is the standard tax form used by individuals to report their income and claim deductions and credits. This form is available for download on the IRS website and can be easily filled out either electronically or by hand. Additionally, printable forms for various schedules and attachments, such as Schedule A for itemized deductions, can also be found online.

When using printable forms for income tax filing, it is important to double-check all information before submitting your return. Make sure that all figures are accurate and that you have included any necessary supporting documentation. Once you have completed the forms, you can either mail them to the IRS or file electronically through an authorized e-file provider.

Overall, printable forms offer a convenient and organized way to file your income taxes. By utilizing these forms, you can ensure that you are providing all the necessary information to the IRS and maximizing your deductions and credits. So, as tax season approaches, consider using printable forms to make the tax filing process a little less stressful.

In conclusion, income tax filing with printable forms can simplify the process of completing your tax returns. By utilizing these forms, you can gather all the necessary information in an organized manner and ensure that you are accurately reporting your income and claiming deductions and credits. So, take advantage of printable forms this tax season to make filing your taxes a breeze.