Are you looking for a way to claim the Recovery Rebate Credit on your taxes this year? The Recovery Rebate Credit is a refundable tax credit for individuals who did not receive the full amount of their Economic Impact Payments in 2020. If you are eligible, you can claim this credit on your 2020 tax return using the Recovery Rebate Credit Form.

It’s important to note that the Recovery Rebate Credit is different from the Economic Impact Payments themselves. The credit is designed to ensure that individuals receive the full amount of the stimulus payments they were entitled to, even if they did not receive them in full initially.

Recovery Rebate Credit Form Printable

Recovery Rebate Credit Form Printable

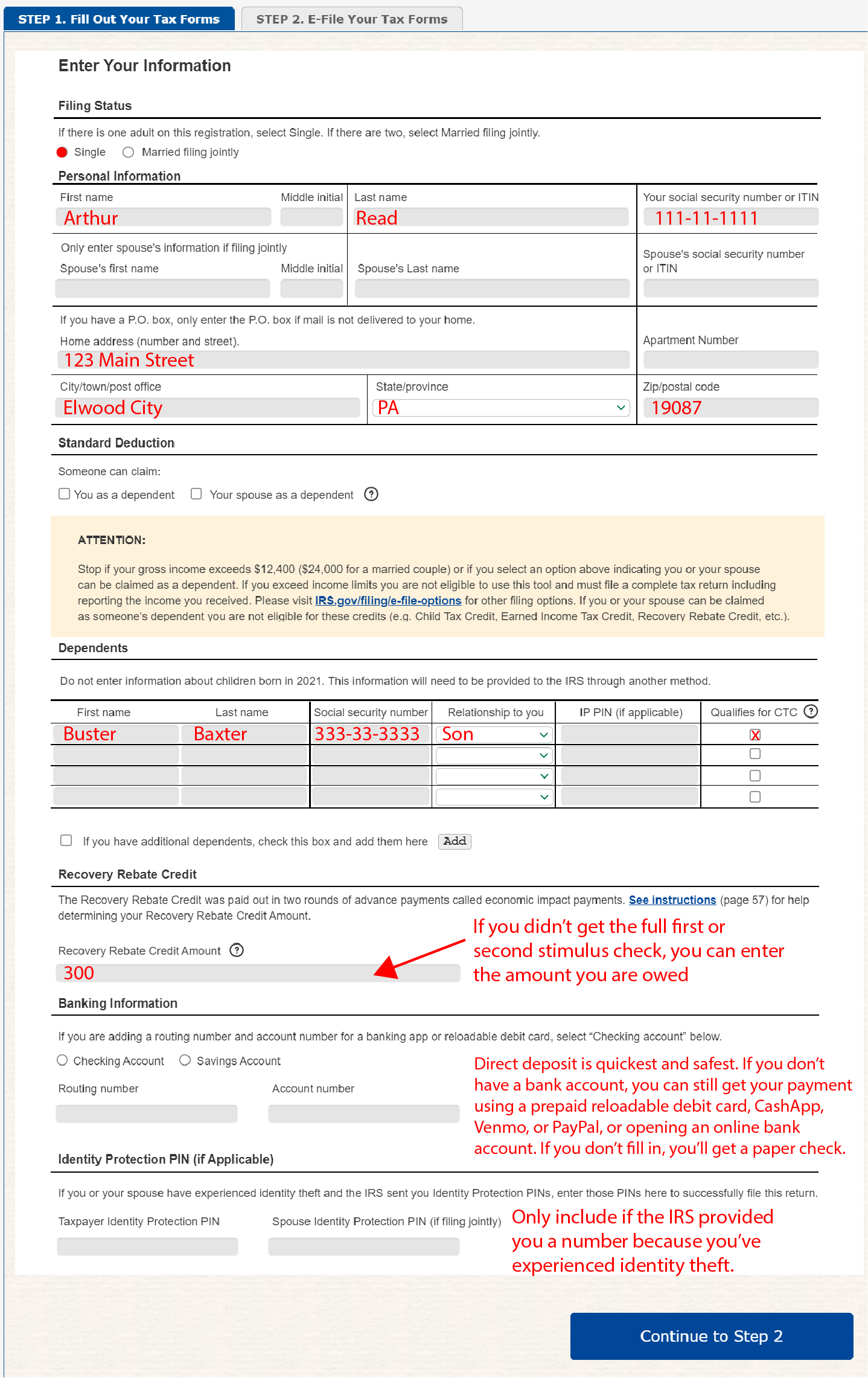

When claiming the Recovery Rebate Credit, you will need to fill out the Recovery Rebate Credit Form, which is available for download and printing on the IRS website. This form will require you to provide information about your eligibility for the credit and any Economic Impact Payments you may have received.

Once you have completed the form, you can include it with your tax return to claim the Recovery Rebate Credit. Be sure to carefully follow the instructions provided on the form to ensure that your claim is processed correctly and you receive the credit you are entitled to.

If you are unsure about whether you are eligible for the Recovery Rebate Credit or how to fill out the form, consider seeking assistance from a tax professional or using tax preparation software to guide you through the process. It’s important to claim all the credits and deductions you are entitled to in order to maximize your tax refund.

Claiming the Recovery Rebate Credit can help ensure that you receive the full amount of the stimulus payments you were entitled to in 2020. By using the Recovery Rebate Credit Form, you can easily claim this credit on your tax return and potentially increase your tax refund.