Filing your taxes can be a daunting task, but having access to printable forms can make the process a bit easier. In New York State, residents are required to file their state income taxes each year. Fortunately, the state provides printable forms that can be easily accessed and filled out.

Whether you’re a full-time resident, part-time resident, or nonresident of New York State, you will need to file your state income taxes if you earned income in the state. Having access to printable forms can help streamline the process and ensure that you are fulfilling your tax obligations.

New York State Income Tax Forms 2024 Printable

New York State Income Tax Forms 2024 Printable

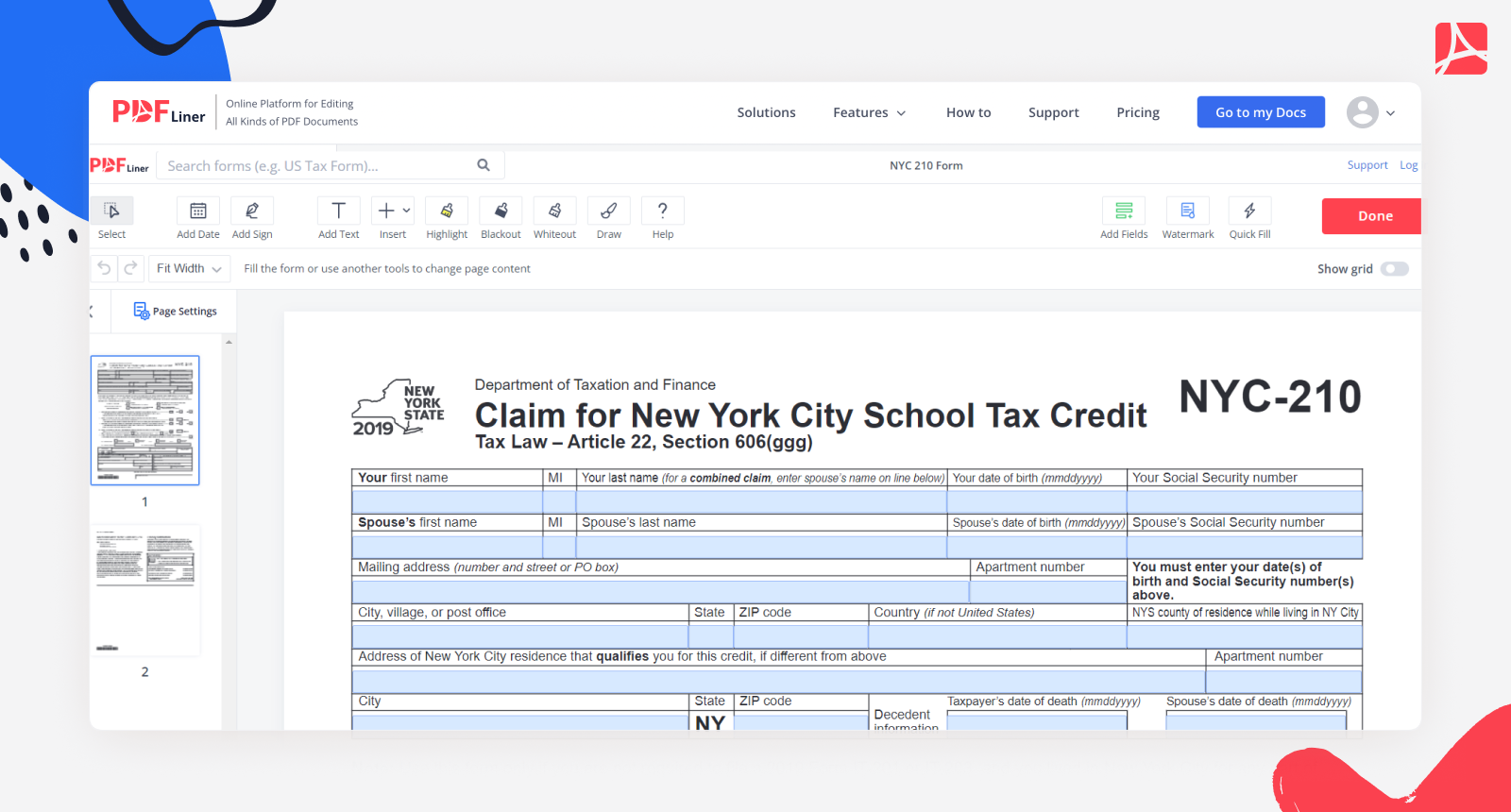

When it comes to filing your New York State income taxes, there are a variety of forms that may be required depending on your individual tax situation. Some common forms include the IT-201 Resident Income Tax Return, IT-203 Nonresident and Part-Year Resident Income Tax Return, and IT-214 Claim for Real Property Tax Credit.

These forms can be easily found on the New York State Department of Taxation and Finance website. Simply navigate to the forms section, locate the appropriate form for your tax situation, and download and print it for completion. Be sure to carefully follow the instructions provided on the form to ensure accurate filing.

It’s important to note that the deadline for filing your New York State income taxes is typically April 15th of each year. However, this date may vary slightly depending on weekends and holidays. Make sure to check the current year’s filing deadline to avoid any penalties or late fees.

In conclusion, having access to New York State income tax forms that are printable can make the process of filing your taxes much more manageable. By utilizing these forms and following the instructions provided, you can ensure that you are meeting your tax obligations and avoiding any potential issues with the state tax authorities.