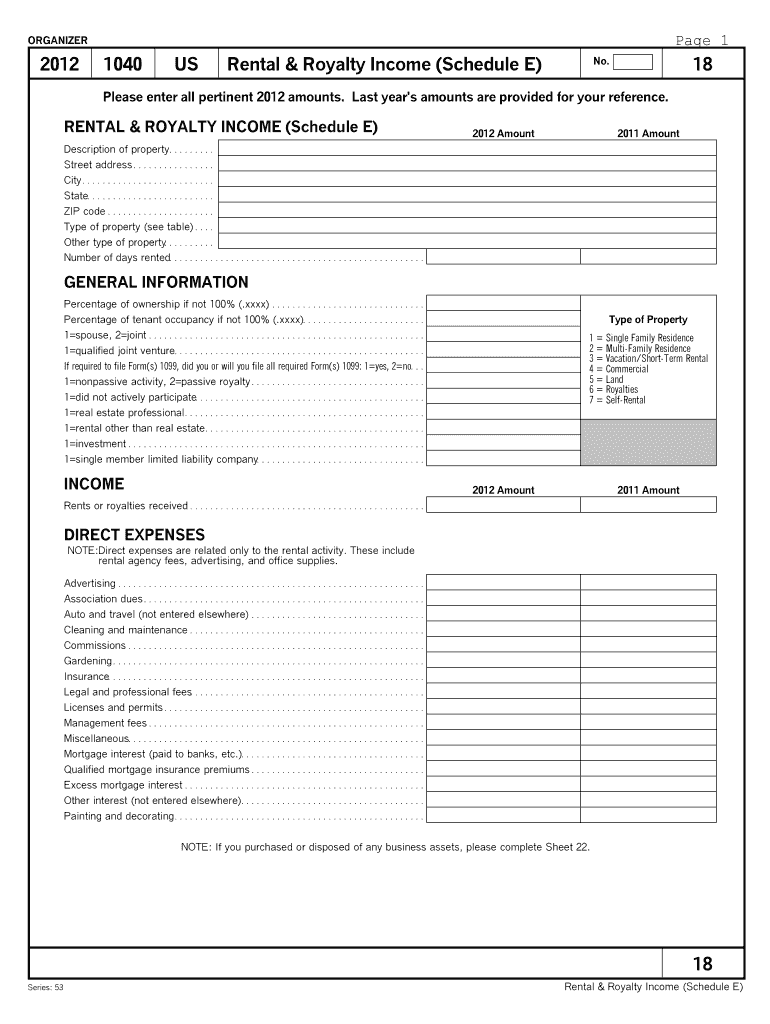

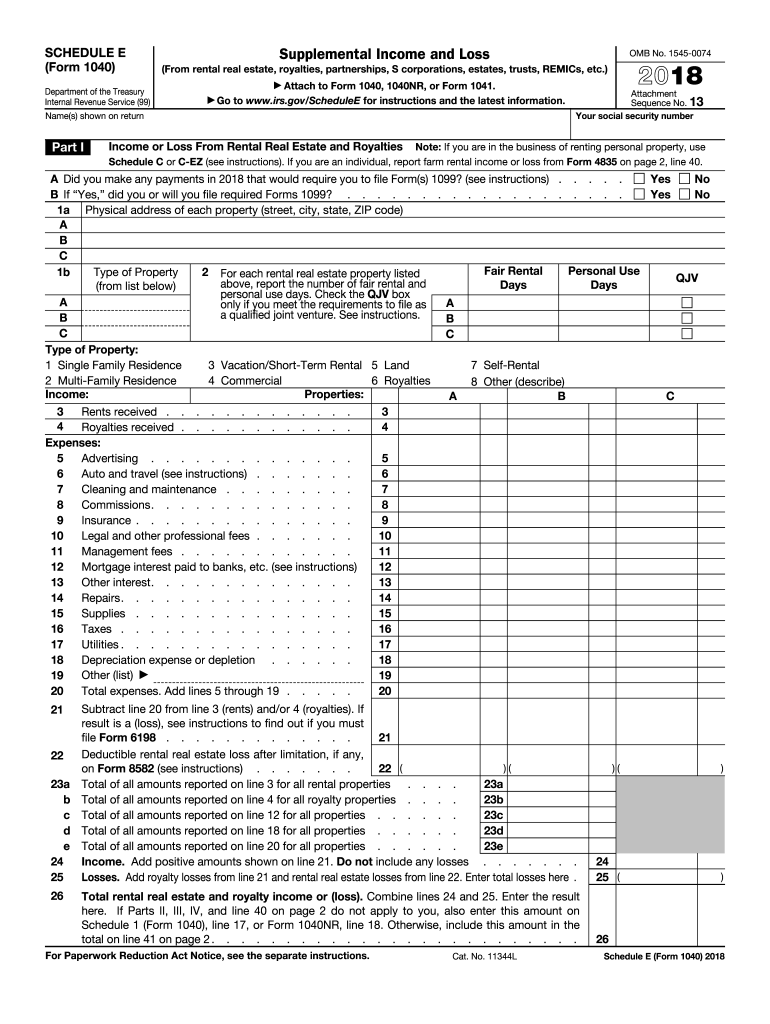

For those who own rental properties or have income from royalties, partnerships, S corporations, estates, trusts, or real estate mortgage investment conduits, the IRS Form Schedule E is a crucial document to include when filing taxes. This form allows individuals to report income and expenses related to these types of income streams, providing a comprehensive overview of their financial activities for the year.

One of the key advantages of the IRS Form Schedule E is that it allows taxpayers to deduct expenses related to their rental properties or other income-generating activities. This can help reduce taxable income and potentially lower tax liability. By accurately completing this form, individuals can ensure that they are taking advantage of all available deductions and credits, maximizing their tax savings.

When it comes to filing taxes, accuracy is paramount. The IRS Form Schedule E provides a clear and organized way for individuals to report their income and expenses, making it easier for both taxpayers and the IRS to verify the information provided. By using the printable version of this form, individuals can easily fill it out by hand or use software to complete it electronically, ensuring that all necessary information is included.

It is important to note that the IRS Form Schedule E must be attached to the individual’s tax return when filing. Failure to include this form could result in delays in processing the tax return or potential penalties from the IRS. By using the printable version of the form, individuals can ensure that they have all the necessary documentation in order to file their taxes accurately and on time.

In conclusion, the IRS Form Schedule E is a valuable tool for individuals who have rental properties or other income-generating activities. By accurately completing this form and including it with their tax return, individuals can ensure that they are taking advantage of all available deductions and credits, reducing their tax liability and potentially saving money. The printable version of this form makes it easy for individuals to report their income and expenses in a clear and organized manner, ensuring that they are in compliance with IRS regulations.

Download and Print Irs Form Schedule E Printable

Printable payroll form are ideal for businesses that prefer non-digital systems or need hard copies for audit purposes. Most forms include fields for employee name, pay period, gross pay, withholdings, and final salary—making them both complete and easy to use.

Start simplifying your payroll system today with a trusted payroll template. Reduce admin effort, minimize mistakes, and maintain clear records—all while keeping your payroll records professional.

Irs Schedule E 2024 Printable Karry Marylee

Irs Schedule E 2024 Printable Karry Marylee

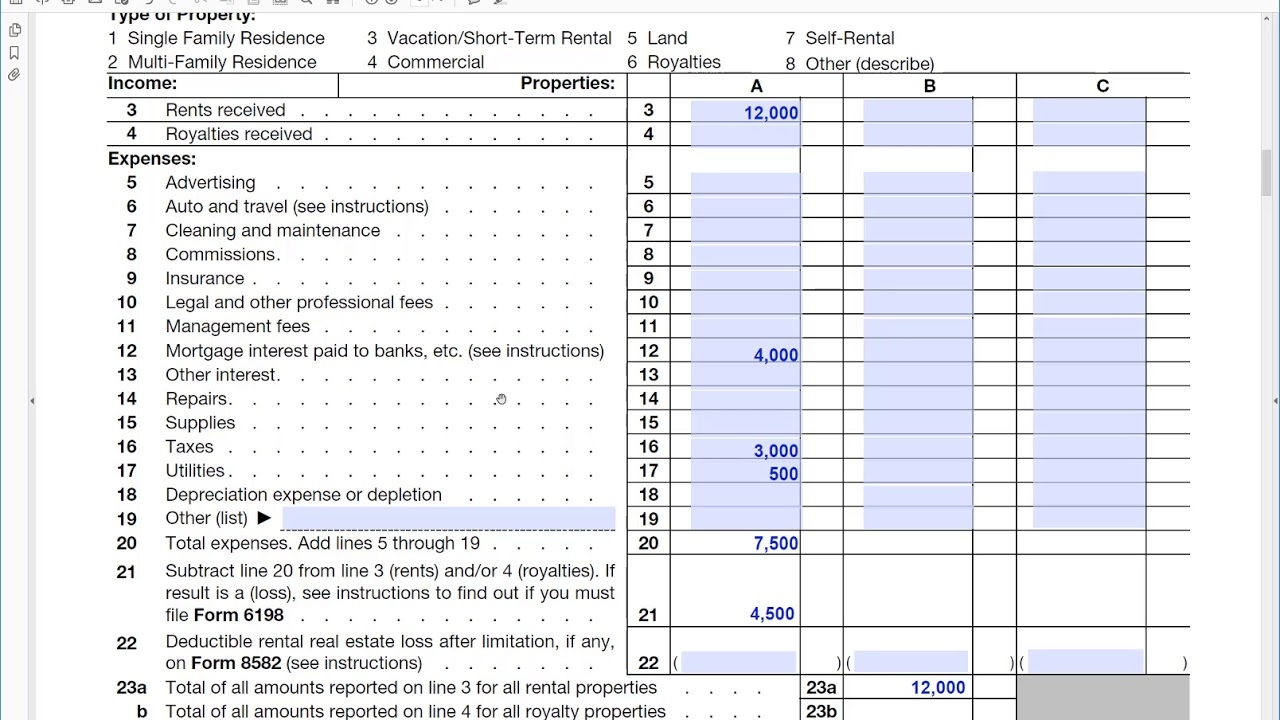

Rental Taxes Using IRS Form 1040 Schedule E

Rental Taxes Using IRS Form 1040 Schedule E

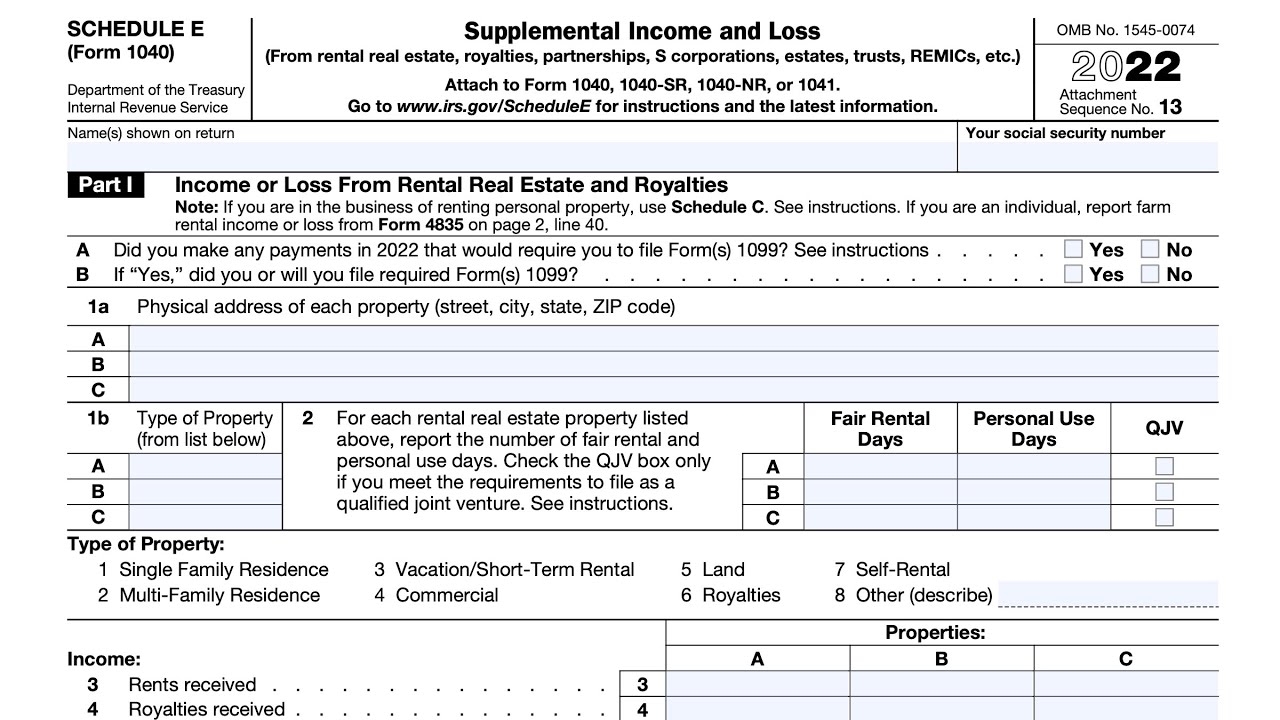

Schedule E Tax Form Fill Online Printable Fillable Blank PdfFiller

Schedule E Tax Form Fill Online Printable Fillable Blank PdfFiller

2018 Form IRS 1040 Schedule E Fill Online Printable Fillable Blank

2018 Form IRS 1040 Schedule E Fill Online Printable Fillable Blank

Processing payroll tasks doesn’t have to be difficult. A printable payroll template offers a quick, dependable, and easy-to-use method for tracking wages, shifts, and withholdings—without the need for digital systems.

Whether you’re a startup founder, administrator, or sole proprietor, using apayroll printable helps ensure proper documentation. Simply download the template, produce a hard copy, and complete it by hand or edit it digitally before printing.