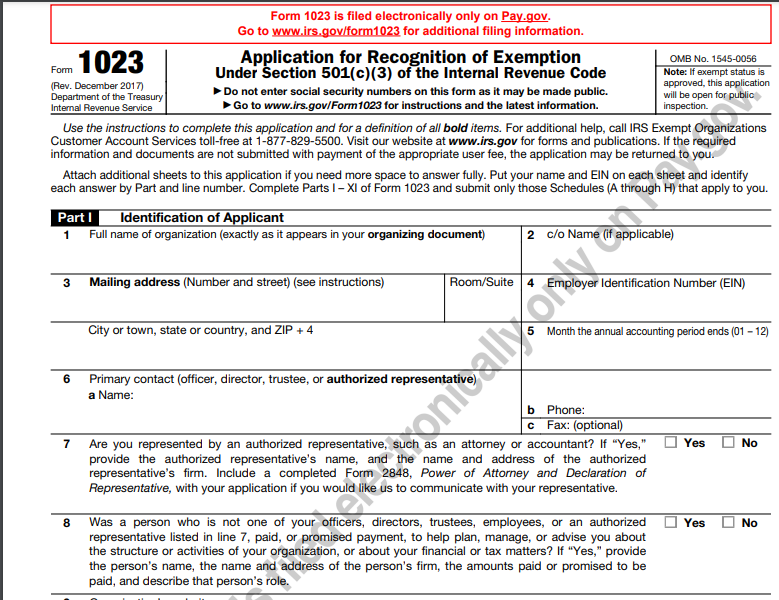

IRS Form 1023 is an important document for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is used to apply for recognition of exemption from federal income tax as a charitable organization. It is essential to fill out this form accurately and completely to ensure your organization meets the requirements for tax-exempt status.

One of the key aspects of IRS Form 1023 is that it must be filed within 27 months of the organization’s formation in order to be eligible for retroactive tax-exempt status. This form requires detailed information about the organization’s activities, finances, and governance structure, so it is essential to carefully review the instructions before completing the form.

When it comes to IRS Form 1023 Printable, there are several resources available online where you can easily access and download the form. This printable version allows organizations to fill out the form manually before submitting it to the IRS. It is important to note that the form must be submitted by mail to the appropriate IRS office along with the required fee.

Organizations should take the time to review the form thoroughly and gather all necessary information before starting to fill it out. It is also recommended to seek assistance from legal or financial professionals to ensure that the form is completed accurately. Any errors or omissions on the form could lead to delays in the approval process or even a rejection of the application.

After submitting IRS Form 1023, organizations should expect to receive a determination letter from the IRS within a few months. This letter will confirm whether the organization has been granted tax-exempt status or if further information is required. It is important to keep a copy of this letter for your records and to provide it to donors and other interested parties as needed.

In conclusion, IRS Form 1023 Printable is a crucial document for organizations seeking tax-exempt status. By carefully completing this form and following all instructions, organizations can ensure that they meet the requirements for tax-exempt status under section 501(c)(3). It is important to take the time to review the form, gather all necessary information, and seek professional assistance if needed to avoid any delays in the approval process.