Are you in need of a W-9 form but don’t know where to start? Look no further! A blank W-9 form is a document that is used by businesses to request taxpayer identification information from individuals or companies they plan to do business with. This form is essential for reporting payments made to contractors, freelancers, and other non-employees to the IRS.

It’s important to have a W-9 form on file for each vendor you work with, as it helps ensure compliance with tax laws and regulations. By having this information readily available, you can avoid potential penalties and fines for failing to report payments made to these individuals or entities.

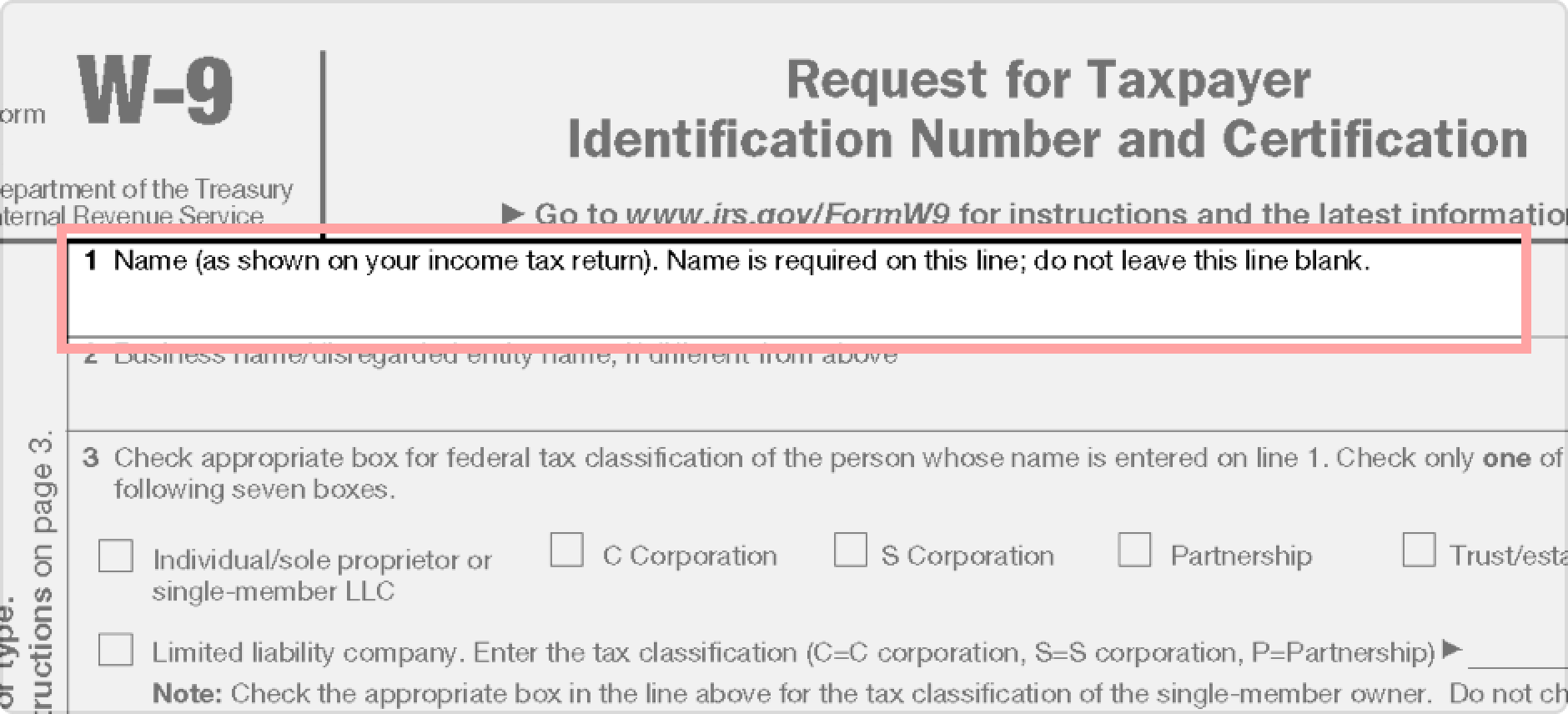

When it comes to filling out a W-9 form, it’s essential to provide accurate information, including your legal name, business name (if applicable), address, and taxpayer identification number. Once completed, the form should be signed and dated to certify the accuracy of the information provided.

Having a blank W-9 form printable can save you time and hassle when it comes to collecting the necessary information from your vendors. You can easily download and print the form from the IRS website or other reputable sources online. This way, you can have the form readily available whenever you need to request taxpayer information from a new vendor.

By using a blank W-9 form printable, you can streamline the process of collecting taxpayer information from your vendors and ensure that you have all the necessary documentation on file. This can help you avoid potential issues with the IRS and maintain compliance with tax laws and regulations.

Overall, having a blank W-9 form printable on hand is essential for any business that works with contractors, freelancers, or other non-employees. By using this form, you can easily collect the necessary taxpayer information from your vendors and ensure that you are in compliance with tax laws and regulations.

Don’t wait until it’s too late – download a blank W-9 form printable today and stay ahead of the game when it comes to reporting payments to the IRS!