Sales tax exemption forms are used by individuals and organizations to claim exemption from paying sales tax on certain purchases. These forms are typically provided by the state or local government and must be filled out and submitted to the seller at the time of purchase.

One common reason for claiming a sales tax exemption is for purchases made for resale. In this case, the buyer intends to resell the item and therefore should not have to pay sales tax on it. Other reasons for exemption may include purchases made for certain non-profit organizations, government agencies, or for specific types of products or services.

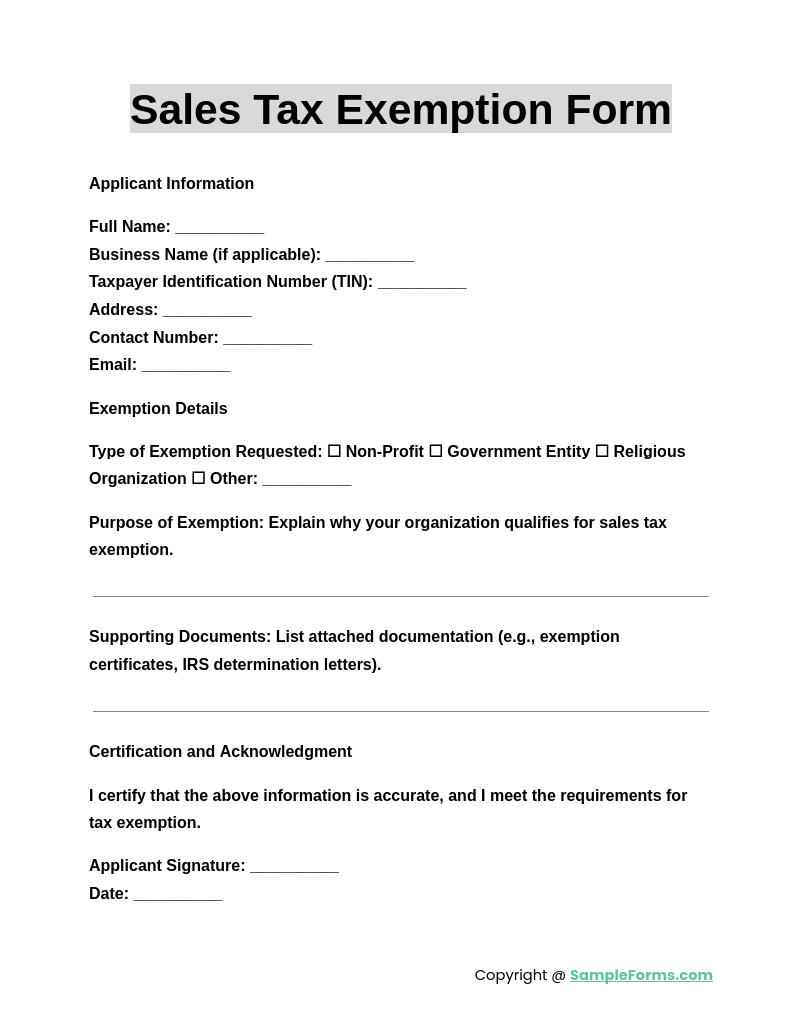

Printable Sales Tax Exemption Form

Printable Sales Tax Exemption Form

It is important to note that not all purchases are eligible for sales tax exemption, and each state has its own rules and regulations regarding who qualifies for exemption and what types of purchases are exempt. It is important to carefully review the requirements and guidelines provided by the state or local government before claiming an exemption.

Printable sales tax exemption forms make it easy for individuals and organizations to claim exemption without having to visit a government office or wait for a form to be mailed to them. These forms can typically be found on the state or local government’s website and can be easily downloaded and printed out for use.

When filling out a sales tax exemption form, it is important to provide accurate and complete information to ensure that the exemption is processed correctly. This may include providing information about the buyer, the seller, the items being purchased, and the reason for claiming exemption. Once the form is completed, it should be submitted to the seller at the time of purchase.

In conclusion, printable sales tax exemption forms are a convenient and efficient way for individuals and organizations to claim exemption from paying sales tax on certain purchases. By understanding the rules and regulations surrounding sales tax exemption and carefully filling out the necessary forms, buyers can save money on their purchases and ensure compliance with state and local tax laws.