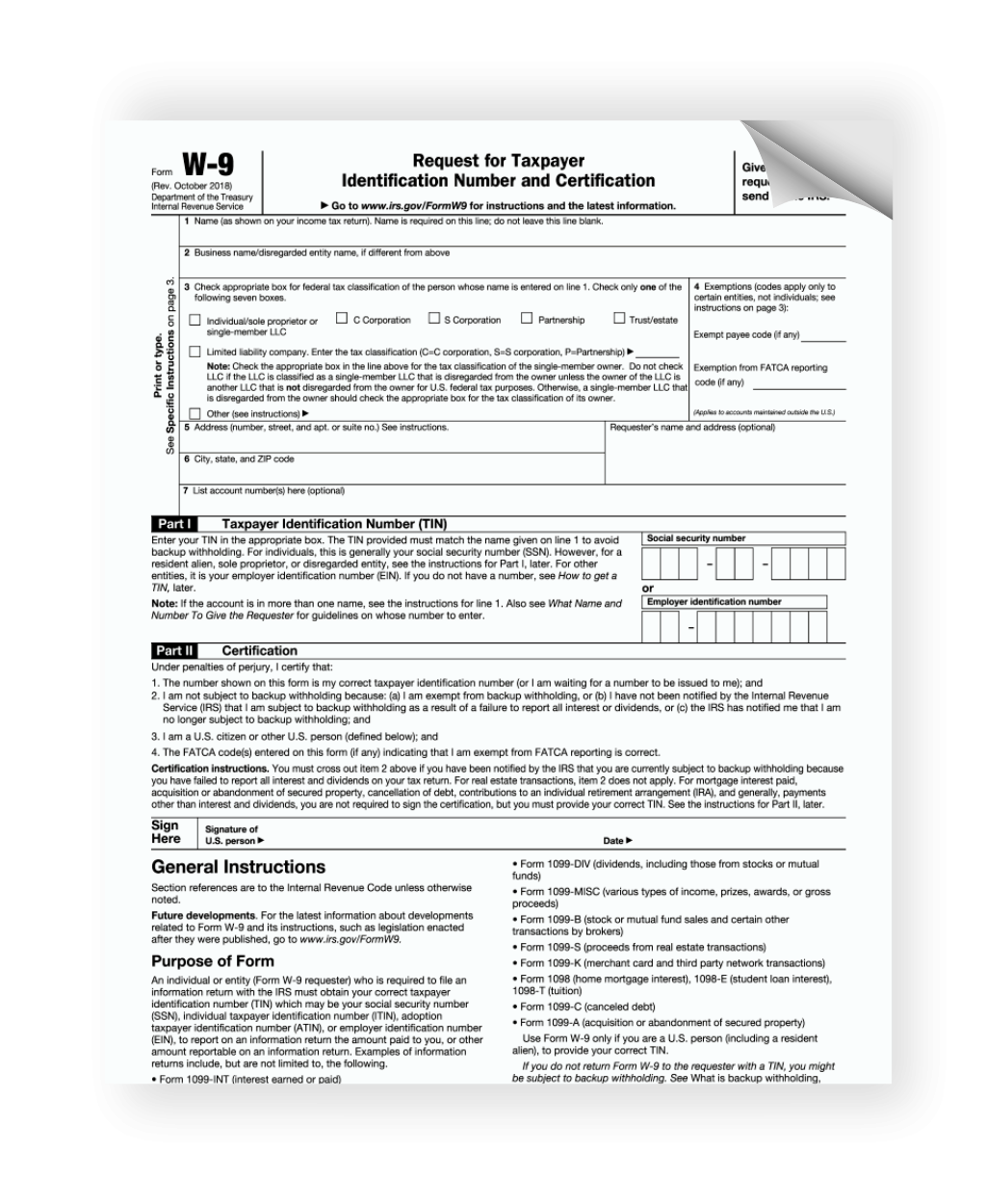

When it comes to tax season, one of the most important forms you may need to fill out is the W9 IRS form. This form is used by businesses to gather information from independent contractors or freelancers they work with, in order to report their payments to the IRS. It is crucial to have this form filled out correctly to ensure accurate tax reporting.

Fortunately, the W9 IRS form is easily accessible and can be easily printed out for your convenience. Whether you are a business owner looking to collect information from your contractors or a freelancer needing to provide your information to your clients, having a printable W9 form on hand is essential.

When filling out the W9 form, it is important to provide accurate information such as your name, address, and taxpayer identification number. Failure to provide correct information can result in penalties from the IRS. By having a printable W9 form readily available, you can ensure that all the necessary information is filled out correctly and avoid any potential issues with the IRS.

Additionally, having a printable W9 form can save you time and hassle when it comes to tax season. Instead of having to search for the form online or request a copy from your clients, you can have it readily available whenever you need it. This can help streamline the tax reporting process and ensure that everything is in order when it comes time to file your taxes.

In conclusion, having a printable W9 IRS form is essential for both businesses and independent contractors. By having this form readily available, you can ensure that all the necessary information is filled out accurately and avoid any potential issues with the IRS. Make sure to keep a copy of the form on hand for easy access during tax season.