Before diving into the details of a printable W9 form IRS, it is important to understand what a W9 form actually is. A W9 form is an official document issued by the Internal Revenue Service (IRS) that is used to collect information about a taxpayer. It is typically requested by businesses or individuals who need to report payments made to the taxpayer to the IRS.

When you are asked to fill out a W9 form, it means that the person or business requesting it plans to report the payments they make to you to the IRS. This is important for tax reporting purposes and helps ensure that all income is properly documented.

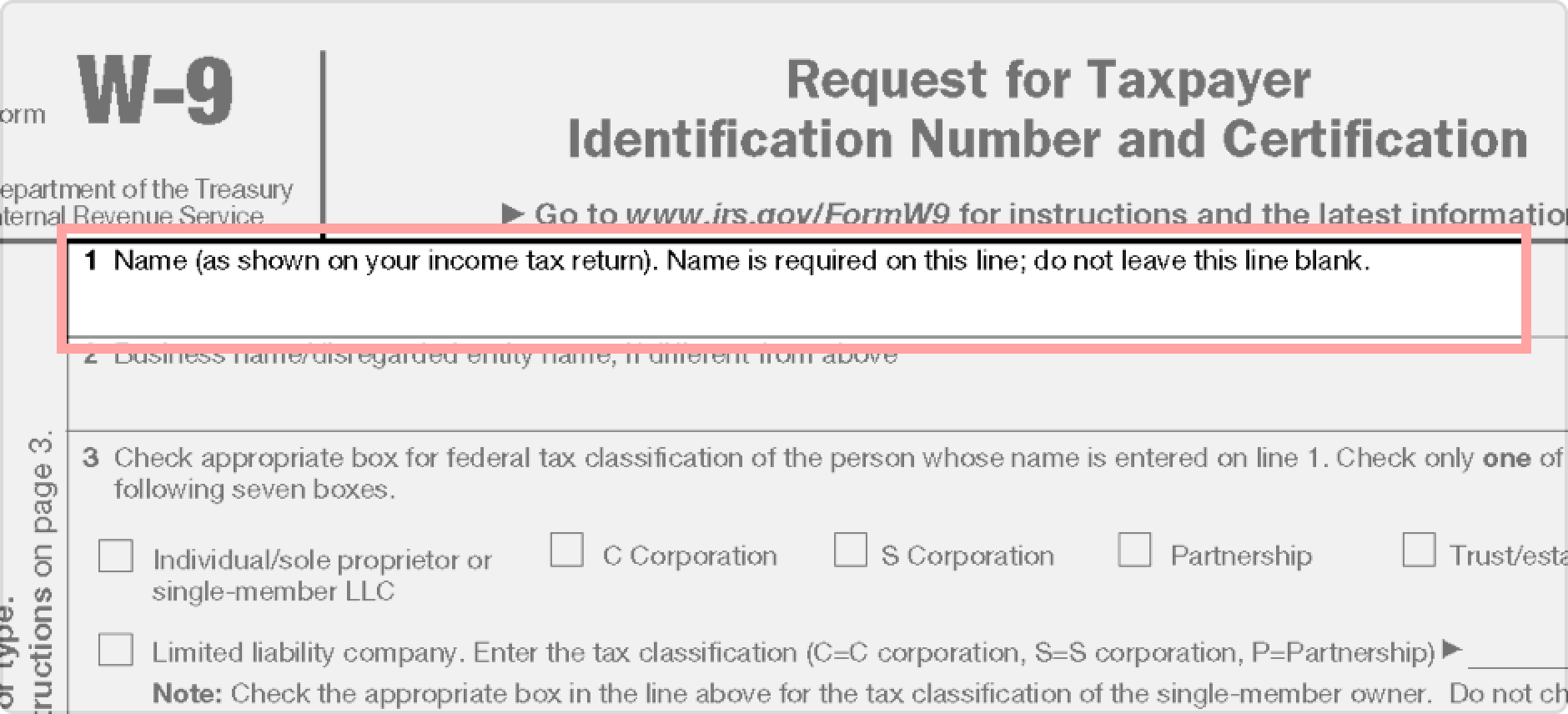

Printable W9 Form IRS

If you find yourself in need of a W9 form, you can easily access a printable version online. The IRS website offers a downloadable PDF version of the form that you can fill out digitally or print and complete by hand. Having a printable W9 form on hand can be convenient for when you need to provide your taxpayer information to a requester.

When filling out a W9 form, you will need to provide your name, address, taxpayer identification number (usually your Social Security number), and certification of your taxpayer status. It is important to fill out the form accurately and completely to avoid any issues with tax reporting in the future.

Once you have completed the W9 form, you can submit it to the requester who asked for your taxpayer information. They will use the information provided on the form to report any payments made to you to the IRS. It is important to keep a copy of the form for your records in case you need to reference it in the future.

In conclusion, a printable W9 form IRS is a useful tool for ensuring that your taxpayer information is accurately reported to the IRS. By filling out the form completely and accurately, you can help avoid any potential issues with tax reporting. Having a printable version of the form on hand can make it easy to provide your taxpayer information when requested.