As we approach tax season, it’s important to stay informed about the latest updates from the IRS. One key aspect of filing your taxes is knowing which forms you need to complete. With the rise of electronic filing, many taxpayers may opt to fill out their forms online. However, having printable IRS tax forms on hand can be useful for those who prefer to file by mail or keep physical records.

Printable IRS tax forms for 2025 will be essential for taxpayers to accurately report their income, deductions, and credits. These forms provide a structured way to organize financial information and ensure compliance with tax laws. Whether you’re an individual, business owner, or tax professional, having access to printable forms can simplify the filing process and help you avoid errors.

When it comes to tax forms, the IRS releases updated versions each year to reflect changes in tax laws and regulations. For the tax year 2025, taxpayers can expect to see revisions to existing forms as well as the introduction of new forms to accommodate any legislative changes. It’s crucial to use the most current forms to prevent delays in processing your tax return and potentially facing penalties for inaccuracies.

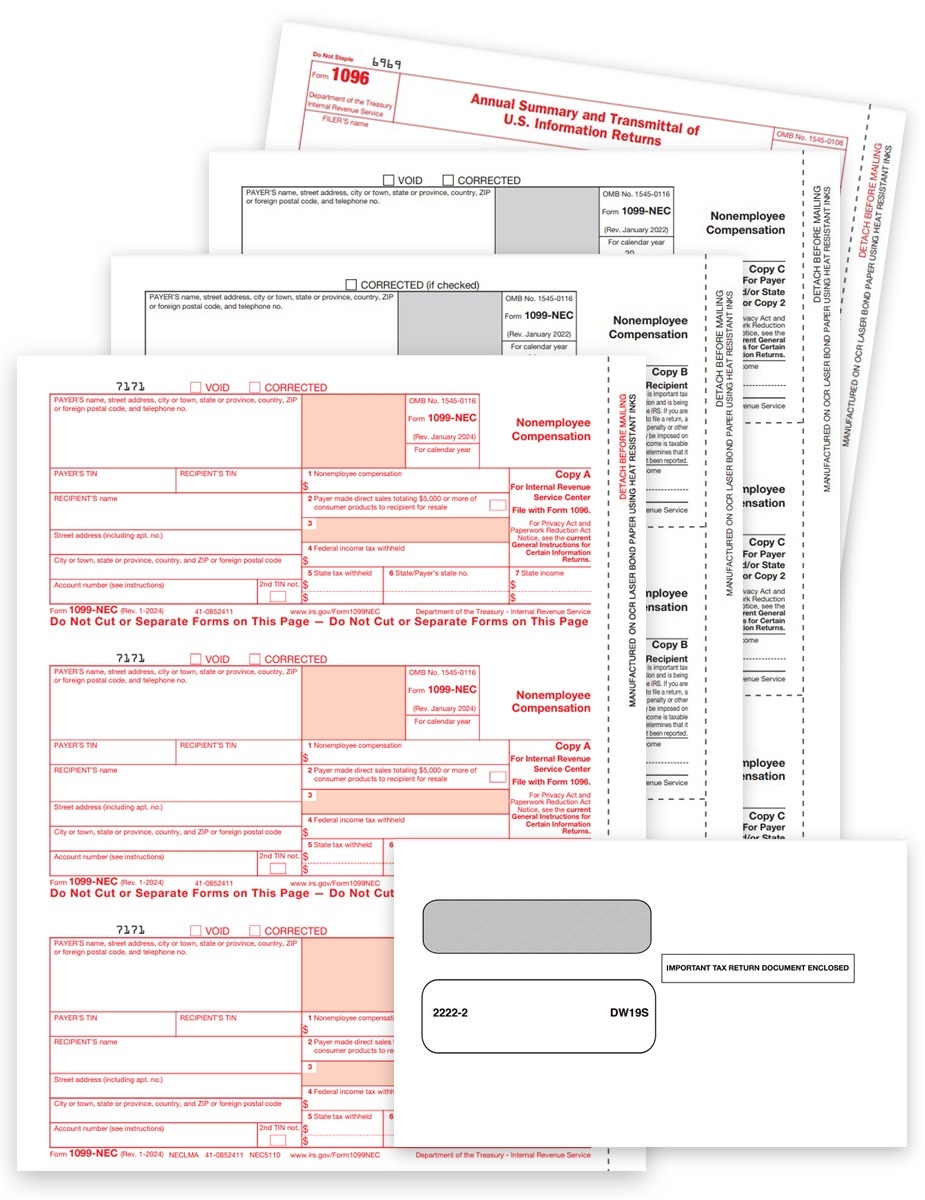

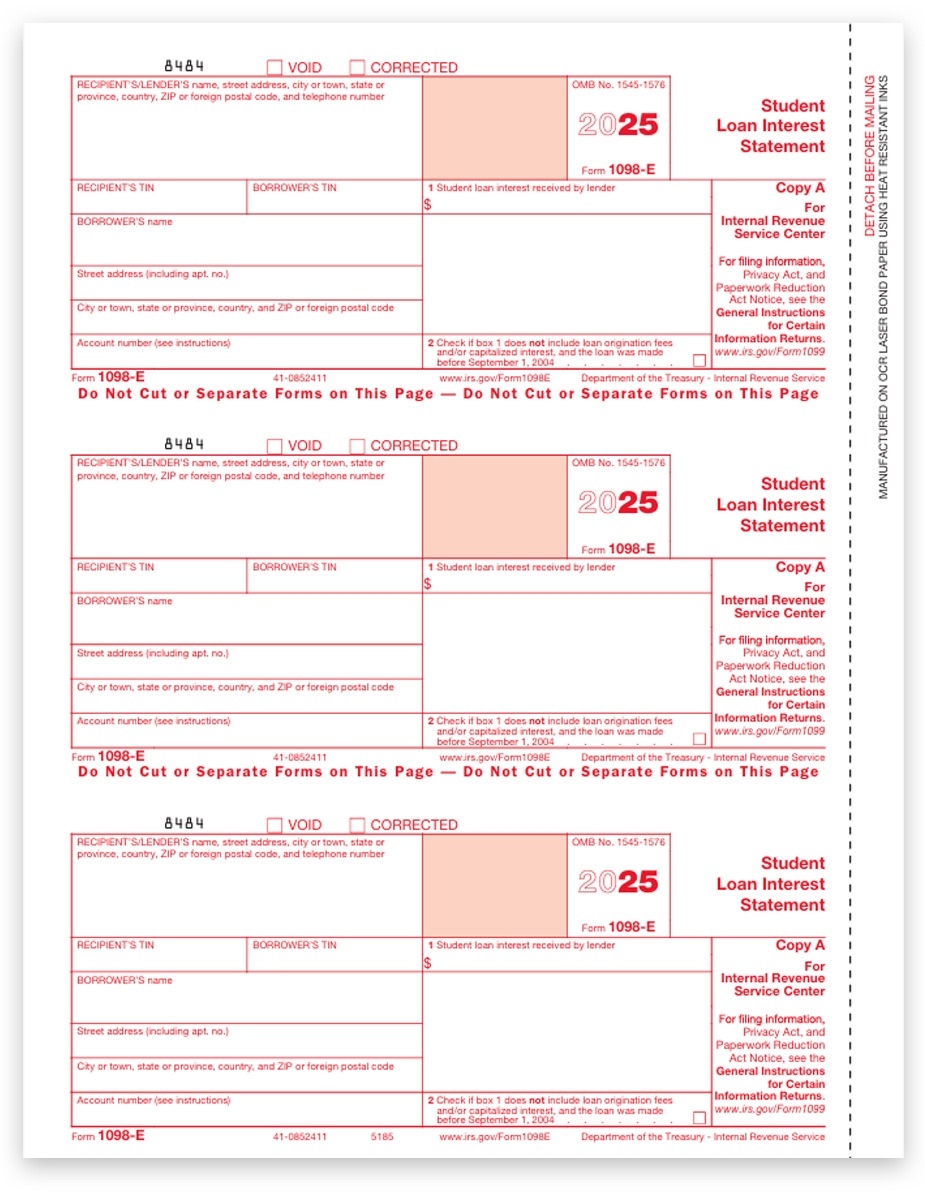

Some common IRS tax forms that individuals may need for the 2025 tax year include Form 1040 for filing individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salaries. Business owners may need forms such as Schedule C for reporting business income and expenses, Form 941 for reporting payroll taxes, and Form 1120 for filing corporate tax returns.

As you prepare to file your taxes for the 2025 tax year, be sure to stay up to date with the latest IRS tax forms and instructions. By having printable forms on hand, you can streamline the filing process and ensure accurate reporting of your financial information. Remember to review the requirements for each form carefully and seek assistance from a tax professional if needed to avoid any potential issues with your tax return.

In conclusion, printable IRS tax forms for 2025 are essential tools for taxpayers to accurately report their income and deductions. By staying informed about the latest updates from the IRS and using the correct forms, you can ensure a smooth and timely filing process. Whether you choose to file electronically or by mail, having printable forms on hand can help you navigate the complexities of the tax system and fulfill your obligations as a taxpayer.

Download and Print Printable Irs Tax Forms 2025

Printable payroll form are ideal for businesses that prefer paper documentation or need physical copies for staff files. Most forms include fields for staff name, pay period, gross pay, withholdings, and net pay—making them both comprehensive and easy to use.

Take control of your payment tracking today with a trusted Printable Irs Tax Forms 2025. Save time, minimize mistakes, and maintain clear records—all while keeping your employee payment data clear.

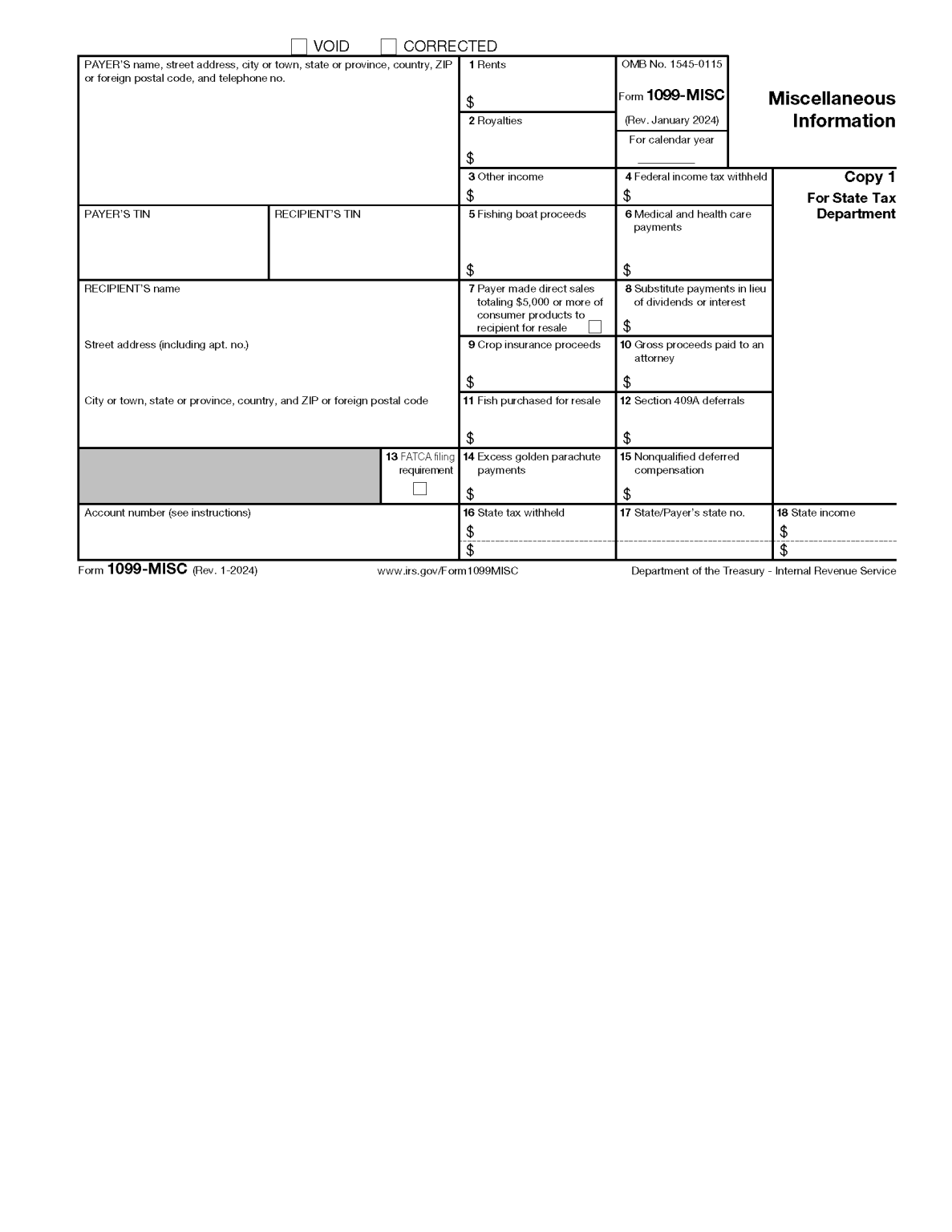

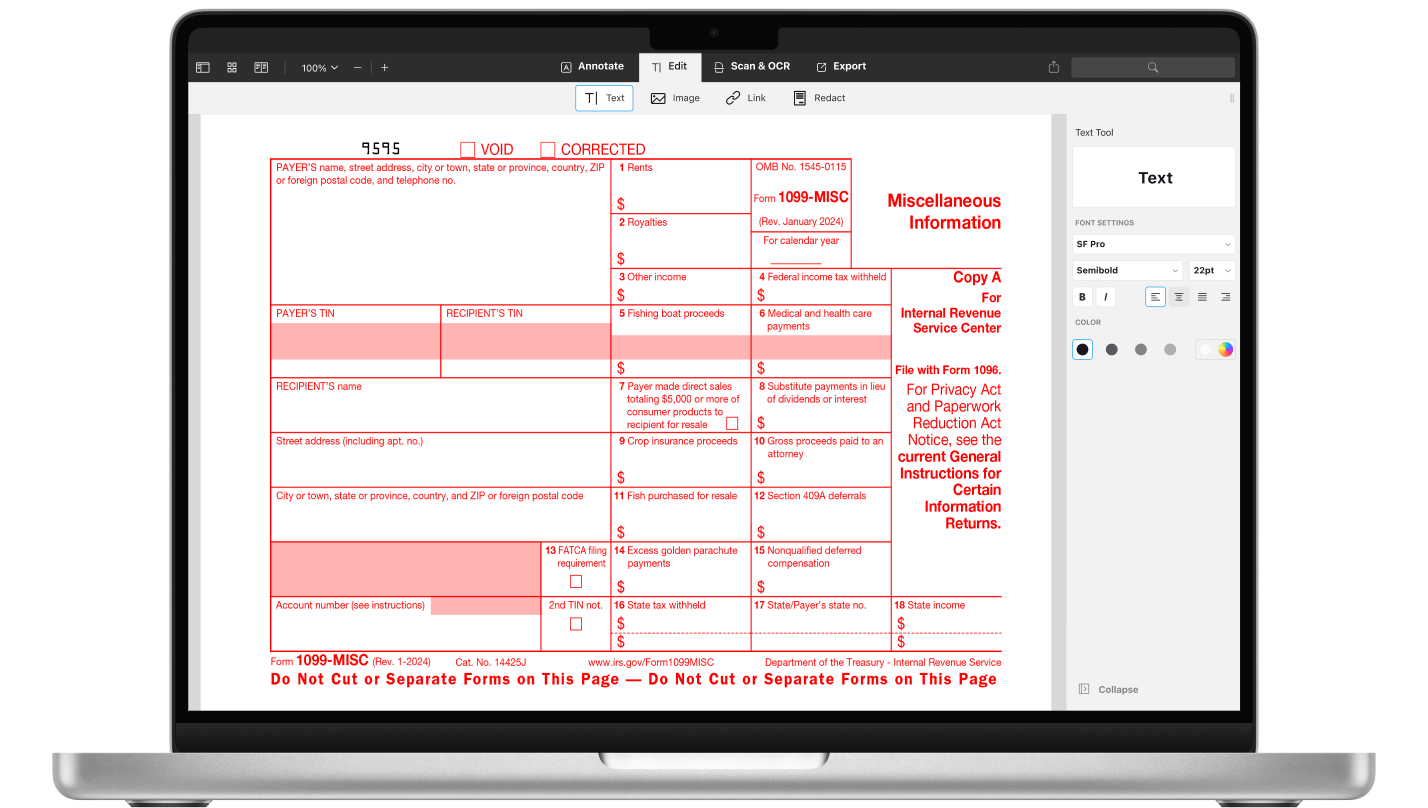

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

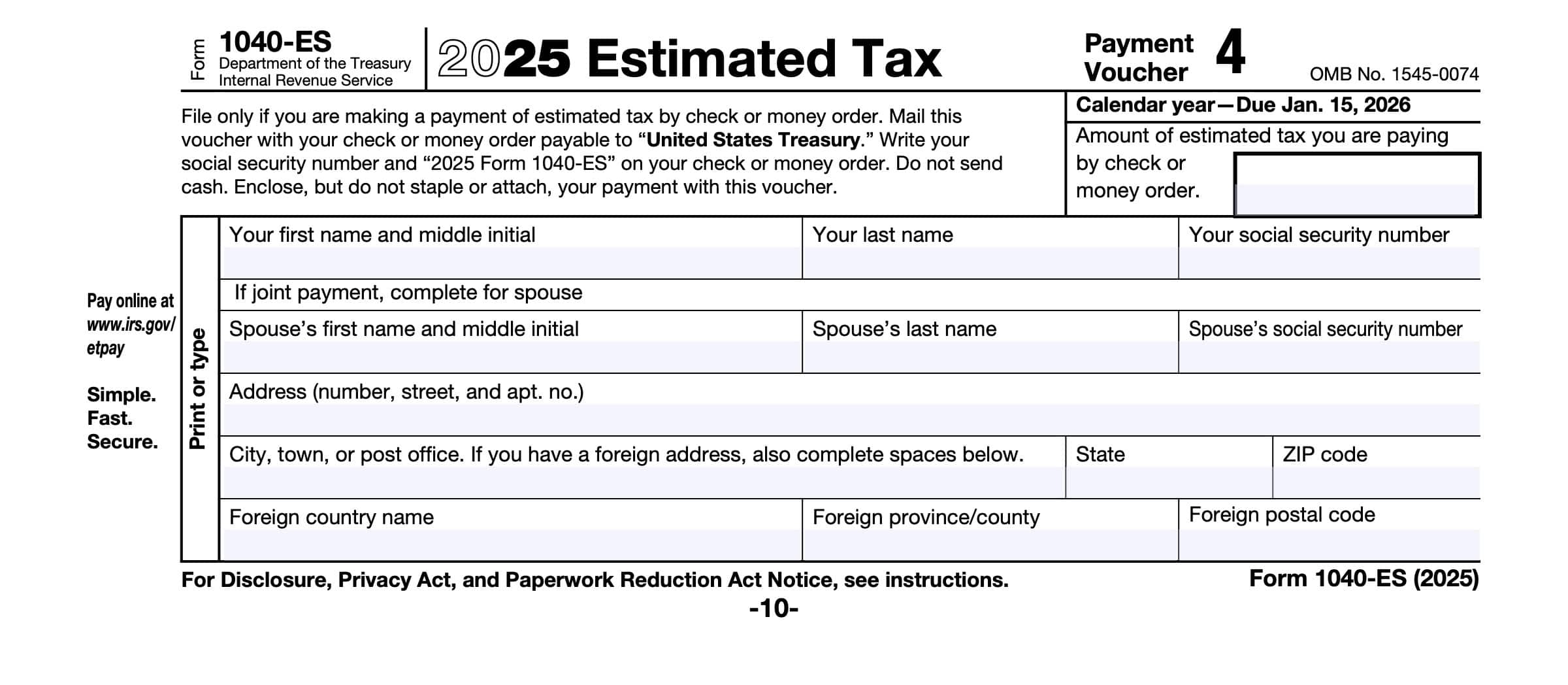

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

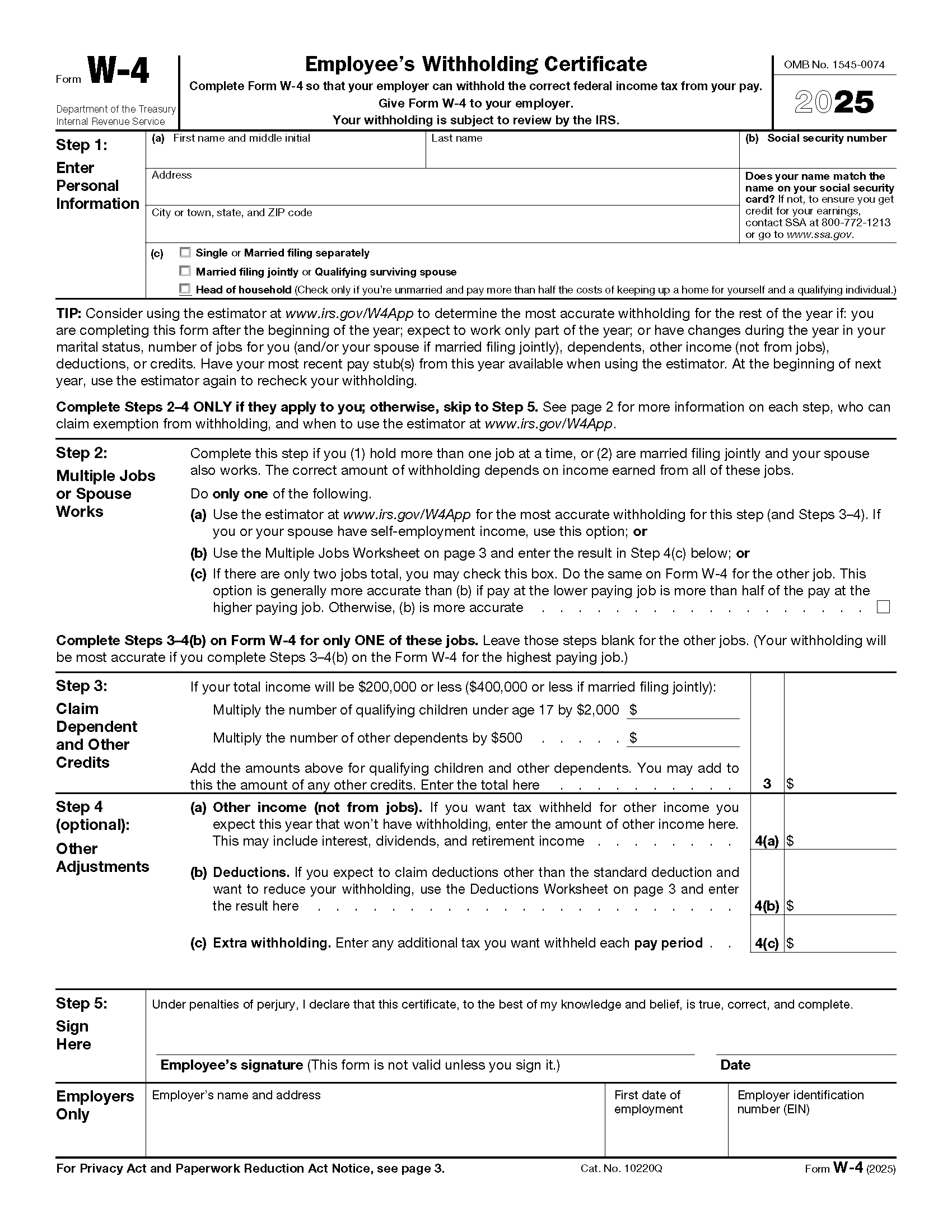

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

Processing payroll tasks doesn’t have to be complicated. A printable payroll offers a speedy, dependable, and straightforward method for tracking wages, hours, and withholdings—without the need for complicated tools.

Whether you’re a small business owner, HR professional, or sole proprietor, using apayroll template helps ensure compliance with regulations. Simply download the template, print it, and complete it by hand or edit it digitally before printing.