When it comes to tax season, it’s important to make sure you have all the necessary forms in order to accurately report your income. One of the most common forms that taxpayers receive is the IRS Form 1099-INT, which is used to report interest income earned throughout the year. This form is important for individuals who have earned interest from banks, credit unions, or other financial institutions.

Understanding how to properly fill out and submit the IRS Form 1099-INT is crucial for avoiding any potential issues with the IRS. Luckily, there are printable versions of this form available online, making it easy for taxpayers to access and complete the necessary documentation.

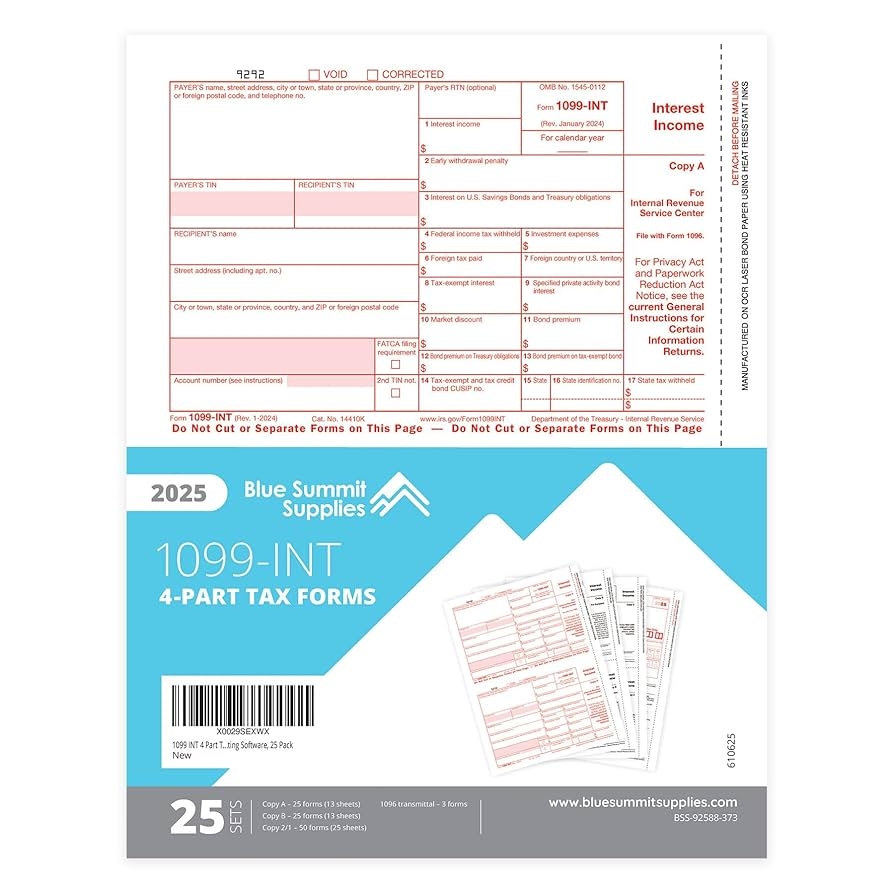

Printable IRS Form 1099-INT

Printable IRS Form 1099-INT is readily available on the IRS website, as well as on various tax preparation websites. This form is typically used by banks and other financial institutions to report interest income earned by individuals throughout the year. It includes information such as the recipient’s name, address, and taxpayer identification number, as well as the amount of interest income earned.

When filling out the form, it’s important to ensure that all information is accurate and up-to-date. Failure to report interest income can result in penalties and fines from the IRS. By using the printable IRS Form 1099-INT, taxpayers can easily input their information and submit the form in a timely manner.

Once the form is completed, it should be sent to both the recipient and the IRS by the designated deadline. This will ensure that all interest income is properly reported and accounted for on the recipient’s tax return. By utilizing the printable version of the form, taxpayers can streamline the process and avoid any potential errors or issues.

In conclusion, the IRS Form 1099-INT is an important document for reporting interest income earned throughout the year. By using the printable version of this form, taxpayers can easily access and complete the necessary documentation to ensure compliance with IRS regulations. It’s essential to accurately report all interest income to avoid any penalties or fines. Make sure to utilize the printable IRS Form 1099-INT for a smooth and hassle-free tax season.