When it comes to filing taxes, having the right forms is essential. One form that many individuals may need is the Printable Boi Form IRS PDF. This form is used to report income earned from sources outside the United States. It is important to have this form filled out correctly to avoid any potential issues with the IRS.

Whether you are a U.S. citizen living abroad or a foreign national earning income in the U.S., the Printable Boi Form IRS PDF is a crucial document that must be filed accurately and on time. This form helps the IRS track income earned outside the country and ensure that individuals are paying their fair share of taxes.

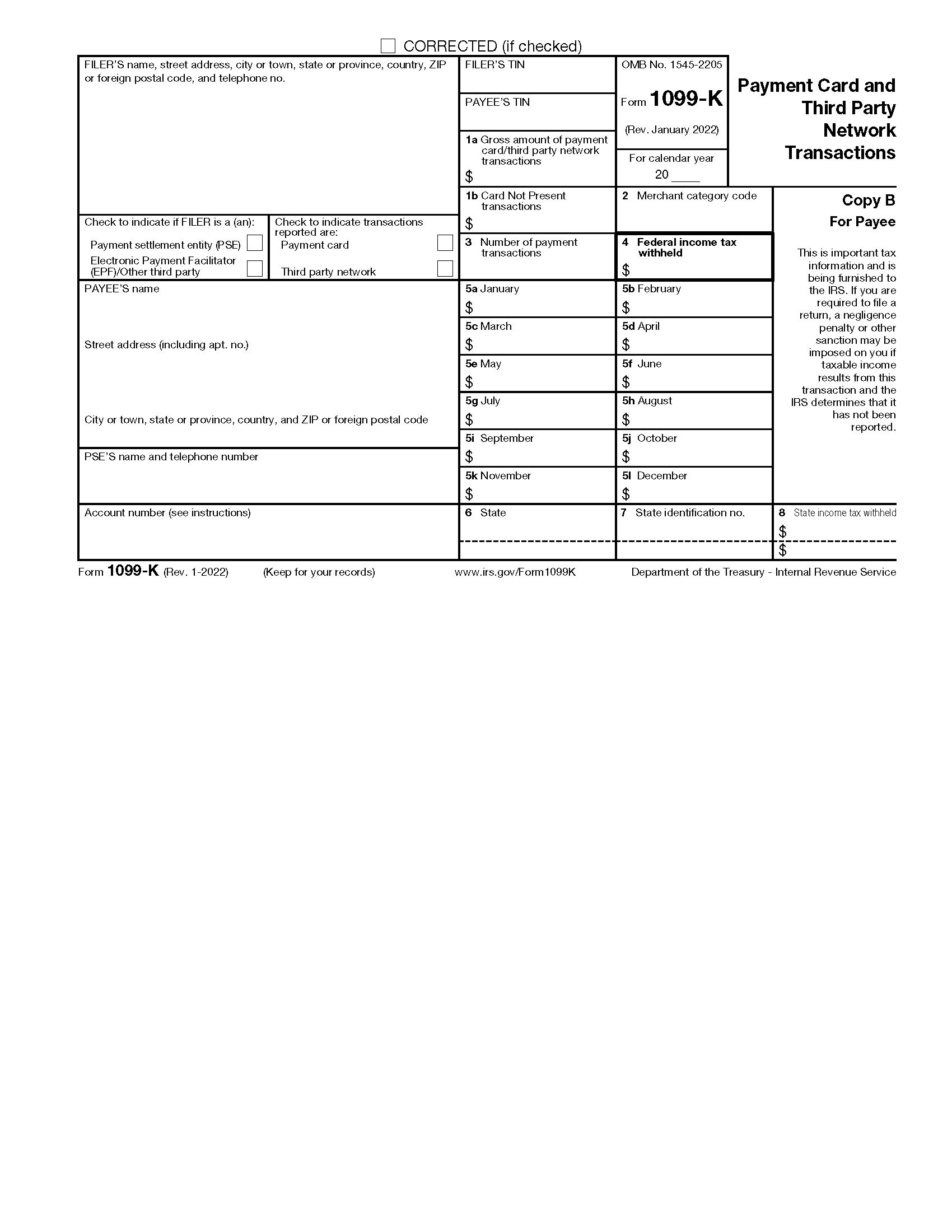

Printable Boi Form IRS PDF

When it comes to filling out the Printable Boi Form IRS PDF, it is important to gather all the necessary information before starting the process. This includes details about your income earned abroad, any taxes paid to foreign governments, and any deductions or credits you may be eligible for.

Once you have all the information needed, you can easily download the Printable Boi Form IRS PDF from the official IRS website. This form is available in a PDF format, making it easy to fill out electronically or print out and complete by hand. Be sure to follow the instructions carefully and double-check all the information before submitting the form.

After completing the Printable Boi Form IRS PDF, you can either file it electronically or mail it to the IRS. Make sure to keep a copy of the form for your records and any supporting documents that may be required. It is essential to file this form accurately and on time to avoid any penalties or issues with the IRS.

In conclusion, the Printable Boi Form IRS PDF is a critical document for individuals with income earned abroad. By filling out this form accurately and submitting it on time, you can ensure compliance with IRS regulations and avoid any potential issues. Make sure to gather all the necessary information, follow the instructions carefully, and file the form correctly to stay in good standing with the IRS.