As tax season approaches, it’s important for businesses and individuals to gather the necessary documents to file their taxes accurately. One essential form that many individuals and businesses need is the 1099 form. This form is used to report various types of income, such as freelance earnings, contract work, rental income, and more. Having a printable 1099 form in PDF format from the IRS can make the process of filing taxes much easier and more efficient.

With the convenience of a printable 1099 form in PDF format, individuals and businesses can easily fill out the necessary information, such as their name, address, taxpayer identification number, and the amount of income earned. This form is essential for reporting income to the IRS and ensuring that taxes are paid accurately and on time. By having access to a printable 1099 form in PDF format, individuals and businesses can save time and avoid potential errors that could result in penalties or fines.

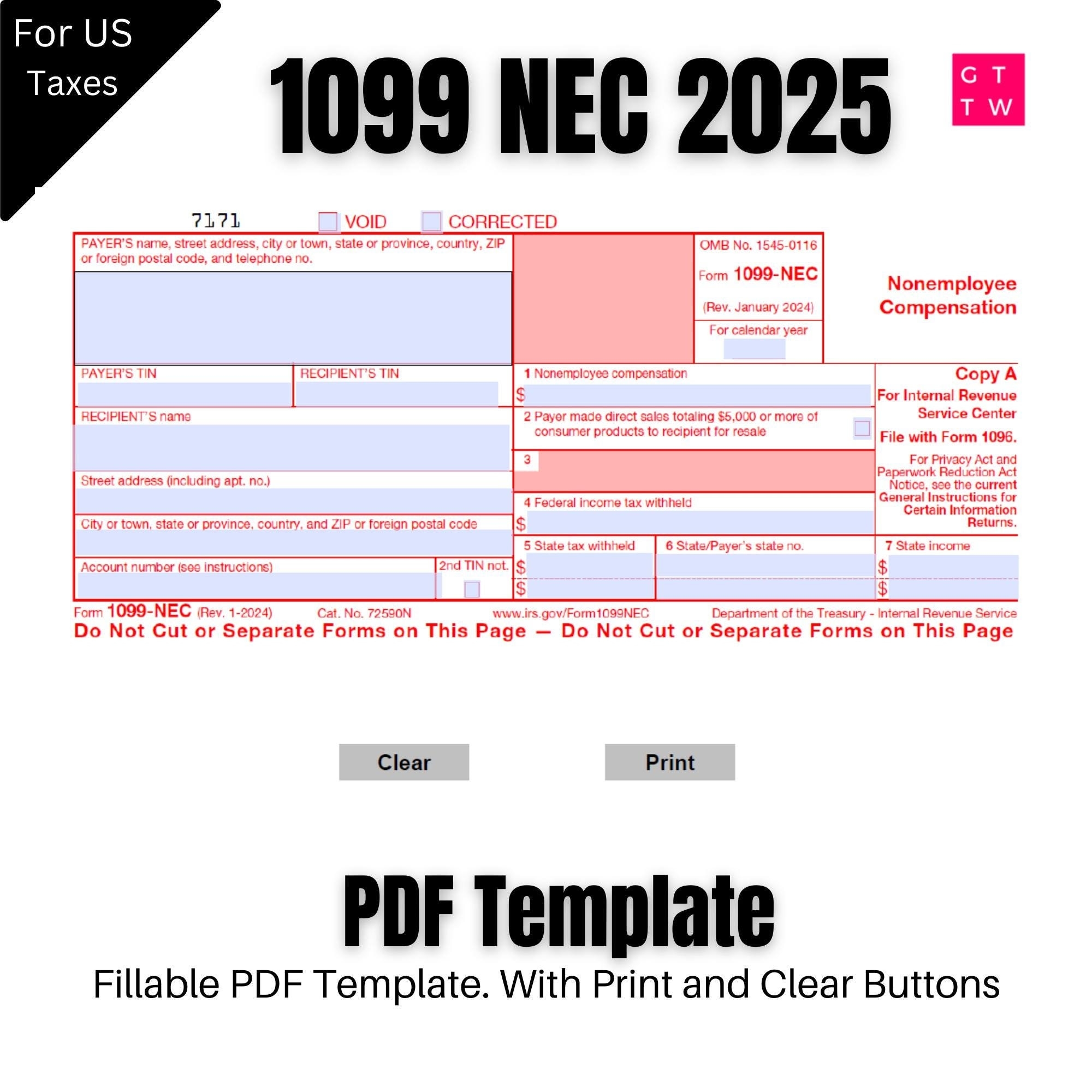

Printable 1099 Form 2025 Pdf Irs

Printable 1099 Form 2025 Pdf Irs

When it comes to tax preparation, having the right tools and resources can make a significant difference in the overall process. A printable 1099 form in PDF format from the IRS provides individuals and businesses with a reliable and easy-to-use document for reporting income. This form can be easily downloaded and printed, allowing for quick and efficient completion. Additionally, having a digital copy of the form can also be beneficial for record-keeping purposes.

Whether you’re a freelancer, independent contractor, landlord, or business owner, having a printable 1099 form in PDF format can simplify the process of filing taxes and ensure that your income is accurately reported to the IRS. By utilizing this form, you can streamline your tax preparation efforts and avoid potential issues that could arise from incomplete or incorrect information. With the convenience of a printable 1099 form in PDF format, you can stay organized and compliant with tax regulations.

Overall, having access to a printable 1099 form in PDF format from the IRS is a valuable resource for individuals and businesses during tax season. By utilizing this form, you can accurately report your income, fulfill your tax obligations, and avoid potential penalties or fines. Make sure to download and use the official IRS 1099 form to ensure that your taxes are filed correctly and on time.