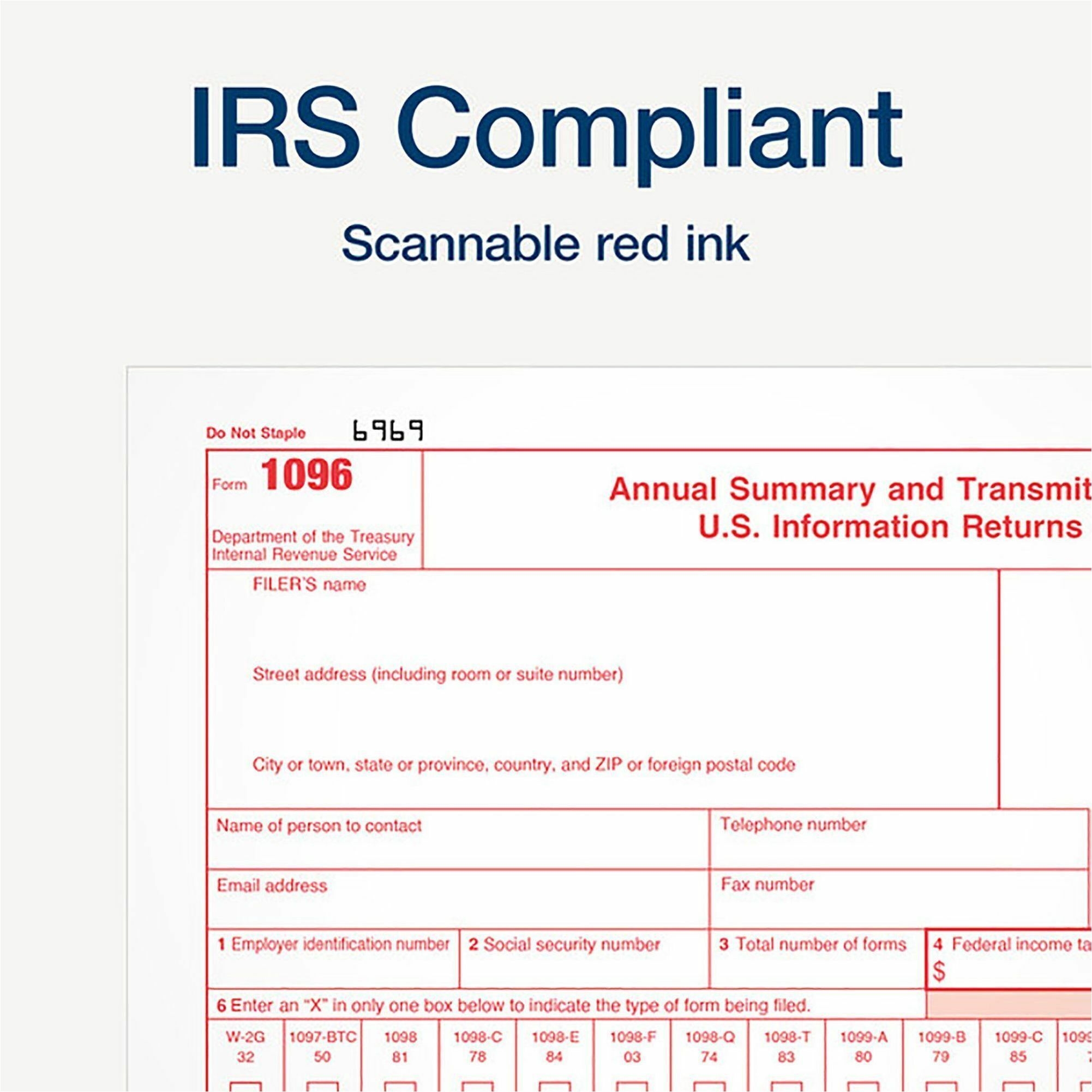

When it comes to tax season, keeping track of all the necessary forms can be overwhelming. One important form that businesses need to file is the 1096 IRS Form. This form is used to summarize and transmit information returns like 1099s to the IRS. It is crucial for businesses to accurately fill out and submit this form to avoid any penalties or fines.

Fortunately, there are printable versions of the 1096 IRS Form available online. This makes it easier for businesses to access and complete the form without having to worry about picking up physical copies from the IRS office. By utilizing printable forms, businesses can streamline the filing process and ensure that all necessary information is accurately reported.

When using a printable 1096 IRS Form, it is important to ensure that all fields are filled out correctly. This includes providing the correct tax year, business name, address, and taxpayer identification number. Any errors or omissions on the form can lead to delays in processing or even potential penalties from the IRS. It is always recommended to double-check the information before submitting the form.

Businesses can also save time and resources by using printable forms as they eliminate the need for manual data entry. By simply filling out the form electronically, businesses can avoid potential errors that may arise from handwriting or typos. This ensures that the information provided to the IRS is accurate and complete.

In conclusion, the printable 1096 IRS Form is a convenient tool for businesses to file their information returns accurately and efficiently. By utilizing these forms, businesses can simplify the filing process and avoid any potential penalties from the IRS. It is important for businesses to take the time to accurately complete the form and review it before submission to ensure compliance with IRS regulations.