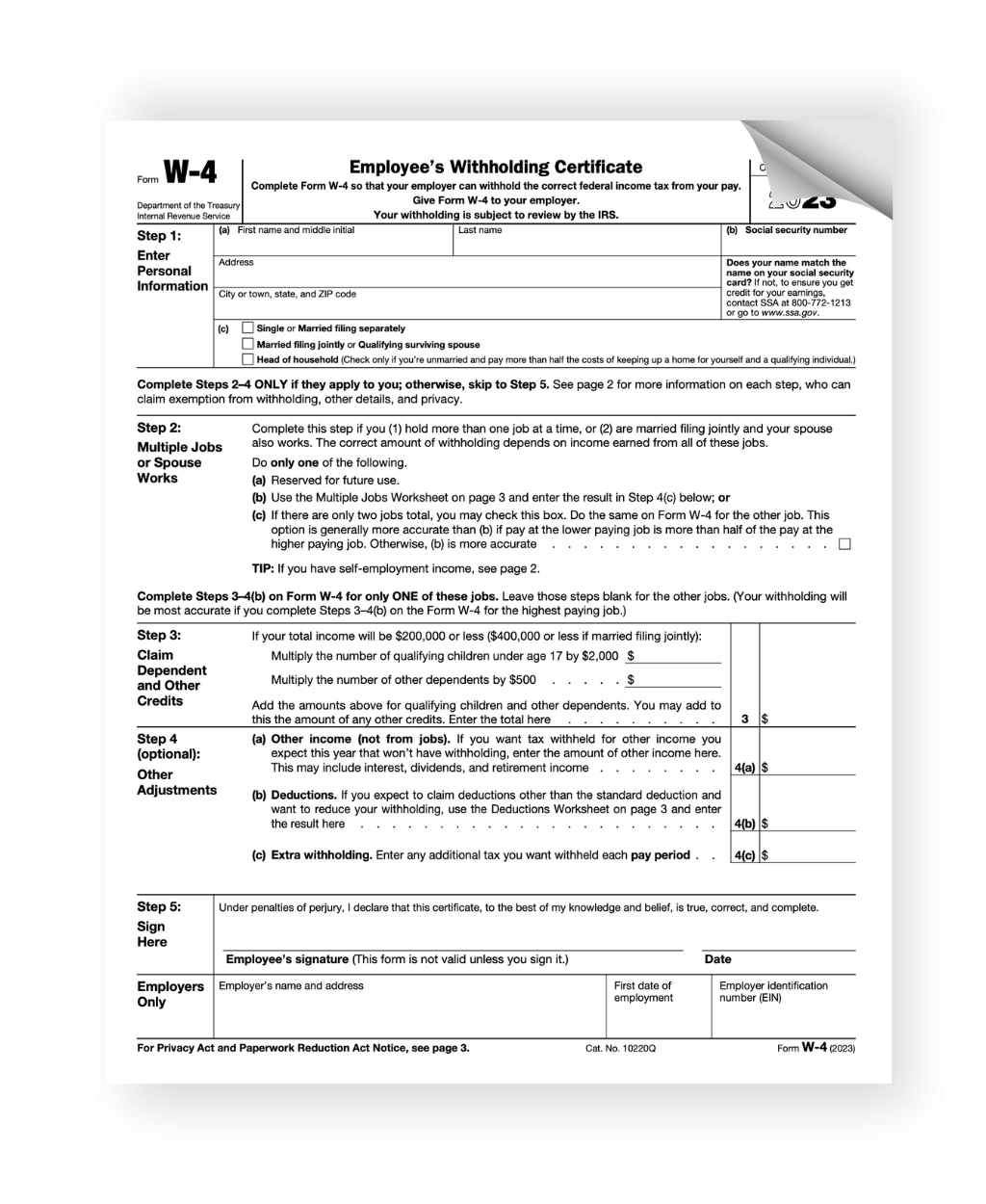

Completing your W-4 form is an essential part of starting a new job. The form, issued by the Internal Revenue Service (IRS), helps your employer determine how much federal income tax to withhold from your paycheck. It is important to fill out this form accurately to avoid any discrepancies in your tax withholding.

For the year 2025, the IRS has made some changes to the W-4 form to make it simpler and more user-friendly. The new form includes straightforward questions about your filing status, dependents, and any additional income you may have. This updated version aims to make it easier for employees to calculate the correct amount of tax withholding.

When filling out the W-4 form for 2025, you will need to provide information such as your name, address, Social Security number, and filing status. You will also need to indicate any dependents you have and specify any additional income you may receive, such as interest, dividends, or retirement income. Based on this information, your employer will be able to calculate the appropriate amount of tax to withhold from your paycheck.

It is important to review your W-4 form regularly, especially if your financial situation changes. If you get married, have a child, or experience any other significant life events, you may need to update your W-4 form to ensure that the correct amount of tax is being withheld. By staying on top of your tax withholding, you can avoid any surprises come tax time.

Overall, the IRS W-4 form for 2025 is designed to make the tax withholding process easier for employees. By providing accurate information on this form, you can ensure that the correct amount of tax is being withheld from your paycheck. Remember to review your W-4 form regularly and make any necessary updates to reflect changes in your financial situation.

Completing the W-4 form may seem like a daunting task, but it is an important step in ensuring that your taxes are handled correctly. By taking the time to fill out this form accurately, you can avoid any potential issues with your tax withholding and stay on top of your financial responsibilities.