When tax season rolls around, one of the most important documents you’ll need is your W-2 form. This form, provided by your employer, outlines how much you earned and how much tax was withheld from your paychecks throughout the year. It’s essential for accurately filing your taxes and ensuring you don’t overpay or underpay the IRS.

While many employers now provide digital copies of W-2 forms, having a printable version can be helpful for various reasons. Whether you prefer to keep physical copies for your records or need to provide a copy to a tax professional, having a printed W-2 form on hand can make the tax filing process much smoother.

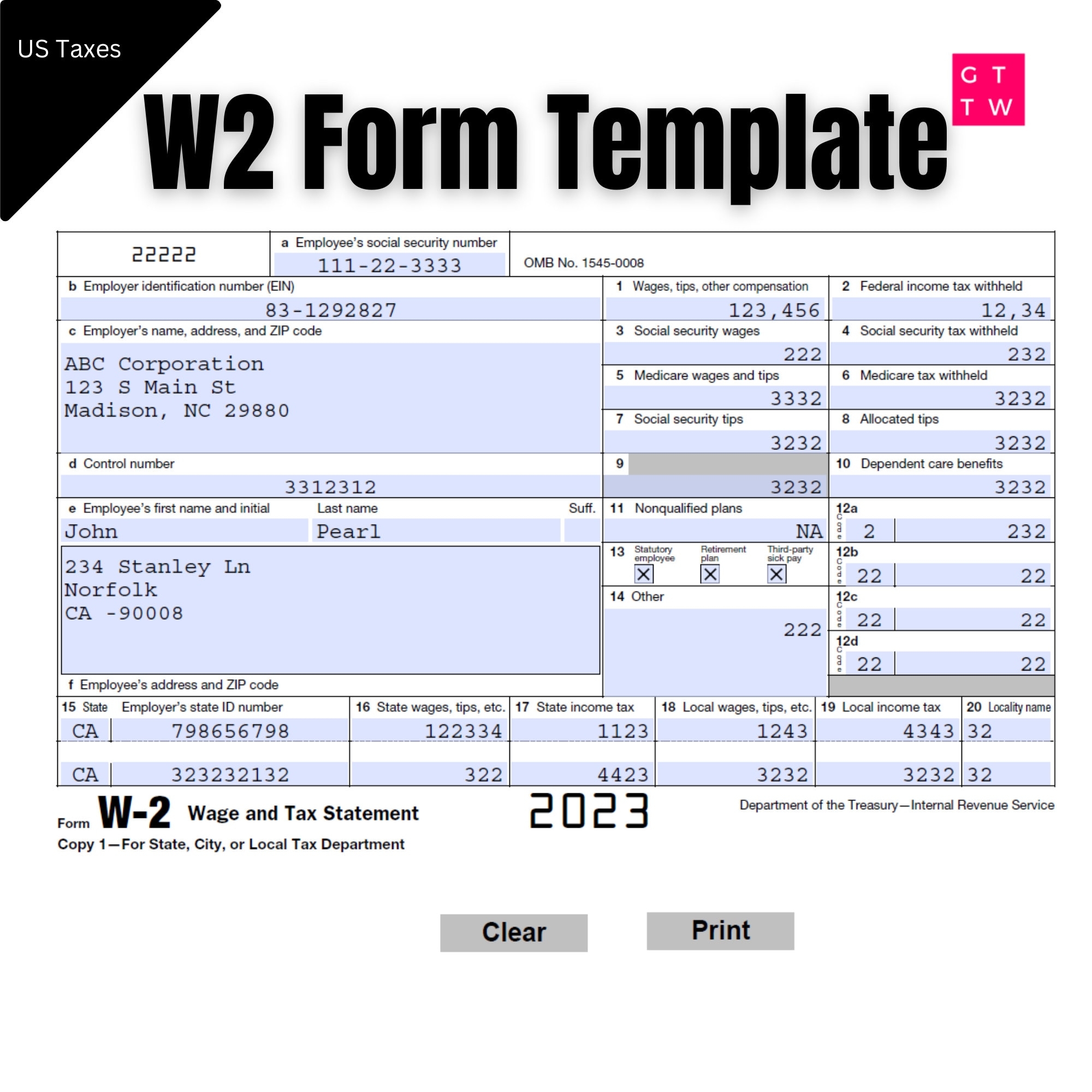

Irs W2 Form Printable

Fortunately, the IRS offers a printable version of the W-2 form on their official website. This form is easily accessible and can be downloaded and printed at your convenience. Having a physical copy of your W-2 form can also help prevent any potential issues that may arise from digital copies getting lost or misplaced.

When printing your W-2 form, be sure to use a high-quality printer and paper to ensure that all information is clear and legible. It’s also important to keep your printed W-2 form in a secure location to protect your sensitive financial information.

Having a printable version of your W-2 form can also be beneficial if you need to provide it to other entities, such as lenders or landlords, when applying for loans or rental agreements. Being able to easily access and print your W-2 form can streamline these processes and help you meet any necessary documentation requirements.

In conclusion, having a printable version of your W-2 form is essential for efficiently filing your taxes and providing necessary documentation for various financial transactions. By utilizing the IRS’s printable W-2 form, you can ensure that you have all the information you need at your fingertips come tax time.