As we approach the tax season for the year 2025, it is essential to familiarize yourself with the IRS tax forms that you may need to file your taxes. The IRS provides a variety of forms for different types of income, deductions, and credits, so it is crucial to understand which forms are applicable to your financial situation.

Whether you are an individual taxpayer, a small business owner, or a corporation, the IRS tax forms for 2025 are essential documents that you will need to accurately report your income and expenses to the government. These forms provide a standardized way to report financial information and ensure compliance with tax laws.

Irs Tax Forms For 2025 Printable

Irs Tax Forms For 2025 Printable

Irs Tax Forms For 2025 Printable

One of the most commonly used IRS tax forms is the Form 1040, which is used by individual taxpayers to report their income, deductions, and credits. This form has several schedules that may need to be attached depending on the taxpayer’s financial situation. It is crucial to review the instructions for each form to ensure that you are completing them accurately.

For small business owners, the IRS provides forms such as the Form 1065 for partnerships, Form 1120 for corporations, and Form 1040-ES for estimated tax payments. These forms are essential for reporting business income and expenses and calculating the amount of taxes owed to the government.

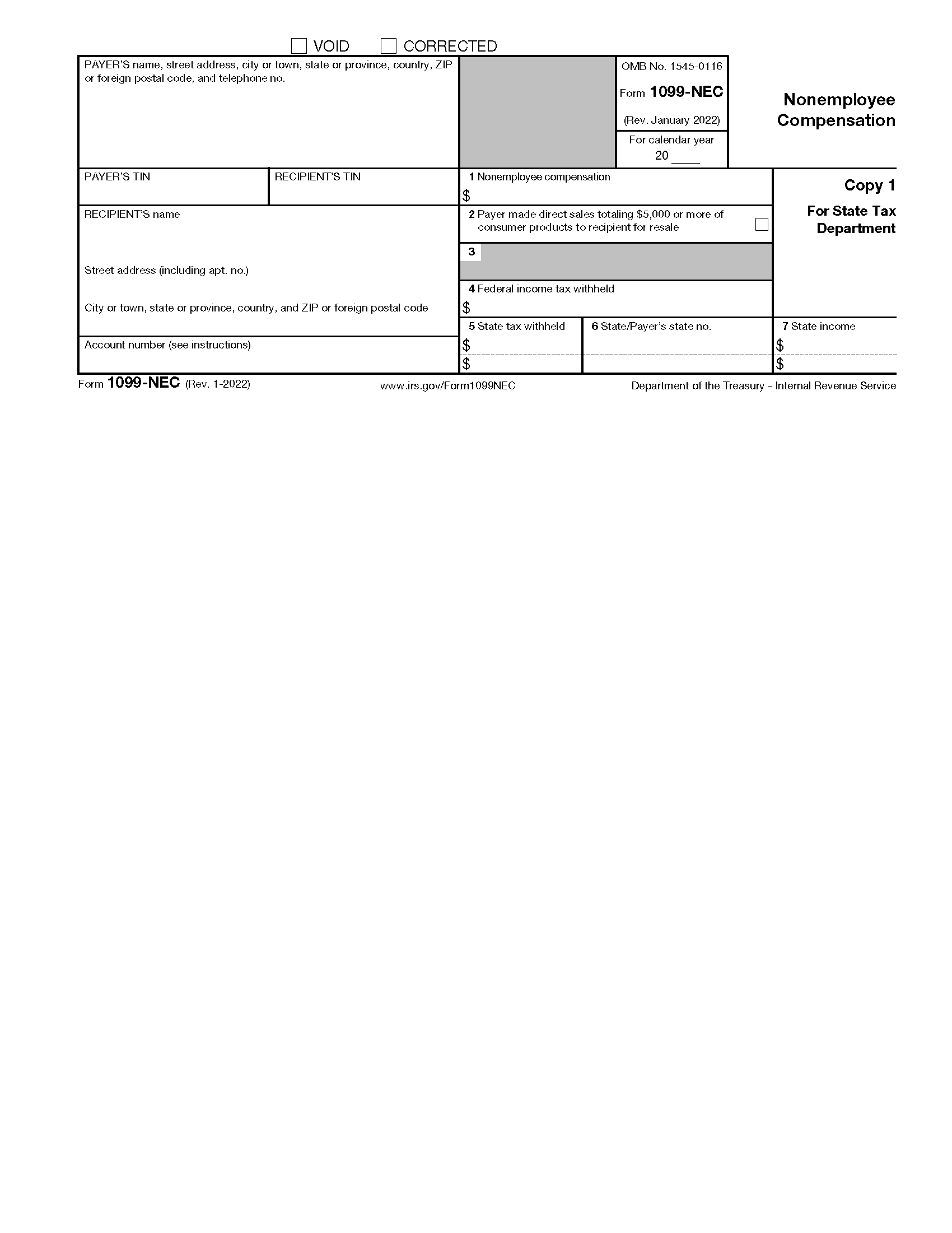

In addition to income tax forms, the IRS also provides forms for reporting other types of income, such as rental income, capital gains, and self-employment income. These forms, such as Form 1099-MISC and Form 1099-NEC, are necessary for accurately reporting all sources of income to the government.

It is important to start gathering all necessary documents and forms early in the tax season to avoid any last-minute rush or potential errors in your tax return. The IRS provides printable versions of all tax forms on their website, making it easy for taxpayers to access and fill out the necessary forms.

In conclusion, understanding the IRS tax forms for 2025 is essential for accurately reporting your financial information to the government and avoiding any potential penalties or audits. By familiarizing yourself with the applicable forms and starting the tax filing process early, you can ensure a smooth and hassle-free tax season.