As tax season approaches, it’s important to be prepared with all the necessary forms to file your taxes accurately and on time. The IRS provides a variety of tax forms for individuals and businesses to report their income, deductions, and credits. One of the most convenient ways to access these forms is through printable versions available for free on the IRS website.

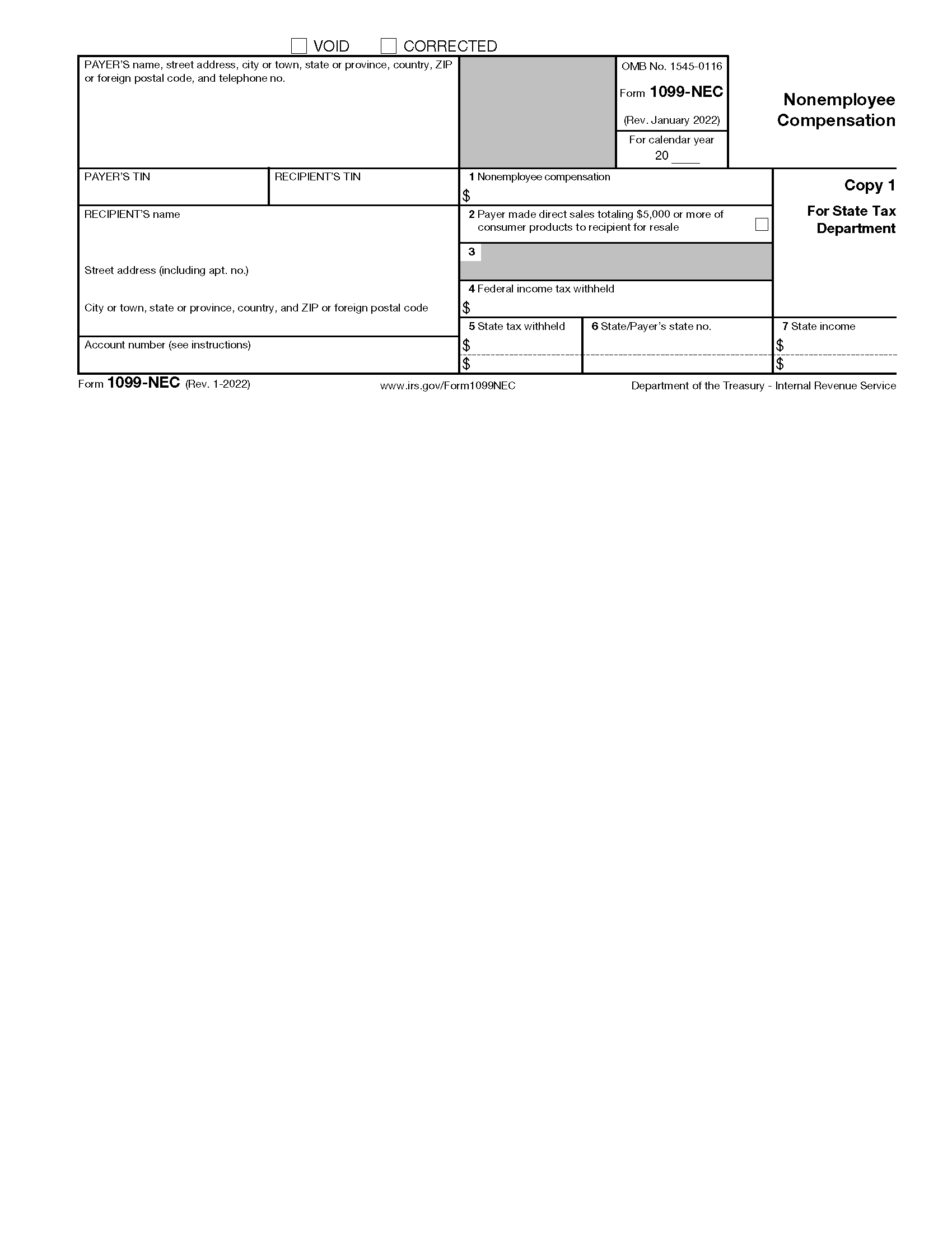

Printable tax forms make it easy for taxpayers to fill out their information offline, without the need for expensive software or professional assistance. The IRS offers a wide range of forms for different types of income and deductions, including W-2s, 1099s, Schedule A for itemized deductions, and more. These forms can be easily downloaded and printed from the IRS website, saving taxpayers time and money.

Irs Tax Forms 2025 Printable Free

Irs Tax Forms 2025 Printable Free

For the tax year 2025, taxpayers can expect to find all the necessary forms for filing their taxes accurately. Whether you are a salaried employee, self-employed individual, or business owner, there are specific forms available to meet your needs. By utilizing printable tax forms, you can ensure that you are providing the IRS with the correct information required to process your tax return.

In addition to printable tax forms, the IRS website also offers instructions and guidelines to help taxpayers fill out their forms correctly. These resources can be invaluable for those who are filing their taxes for the first time or have questions about specific deductions or credits. By taking advantage of these free resources, taxpayers can avoid common errors and delays in processing their tax returns.

In conclusion, Irs Tax Forms 2025 Printable Free are a valuable resource for taxpayers looking to file their taxes accurately and efficiently. By accessing and printing these forms from the IRS website, individuals and businesses can save time and money while ensuring that they are providing the necessary information to the IRS. Be sure to take advantage of these free resources when preparing your tax return for the 2025 tax year.