When it comes to tax forms, the W-9 is one that many people are familiar with. This form is used by businesses to request taxpayer identification numbers from individuals and other businesses. The information provided on the W-9 is used to report income paid to the IRS. While the W-9 form may seem simple, it is important to fill it out correctly to avoid any potential issues with the IRS.

One of the key things to note about the W-9 form is that it is not submitted to the IRS directly. Instead, it is kept on file by the business or individual who requested it. The information provided on the form is used for tax reporting purposes, so it is important to ensure that the information is accurate and up to date.

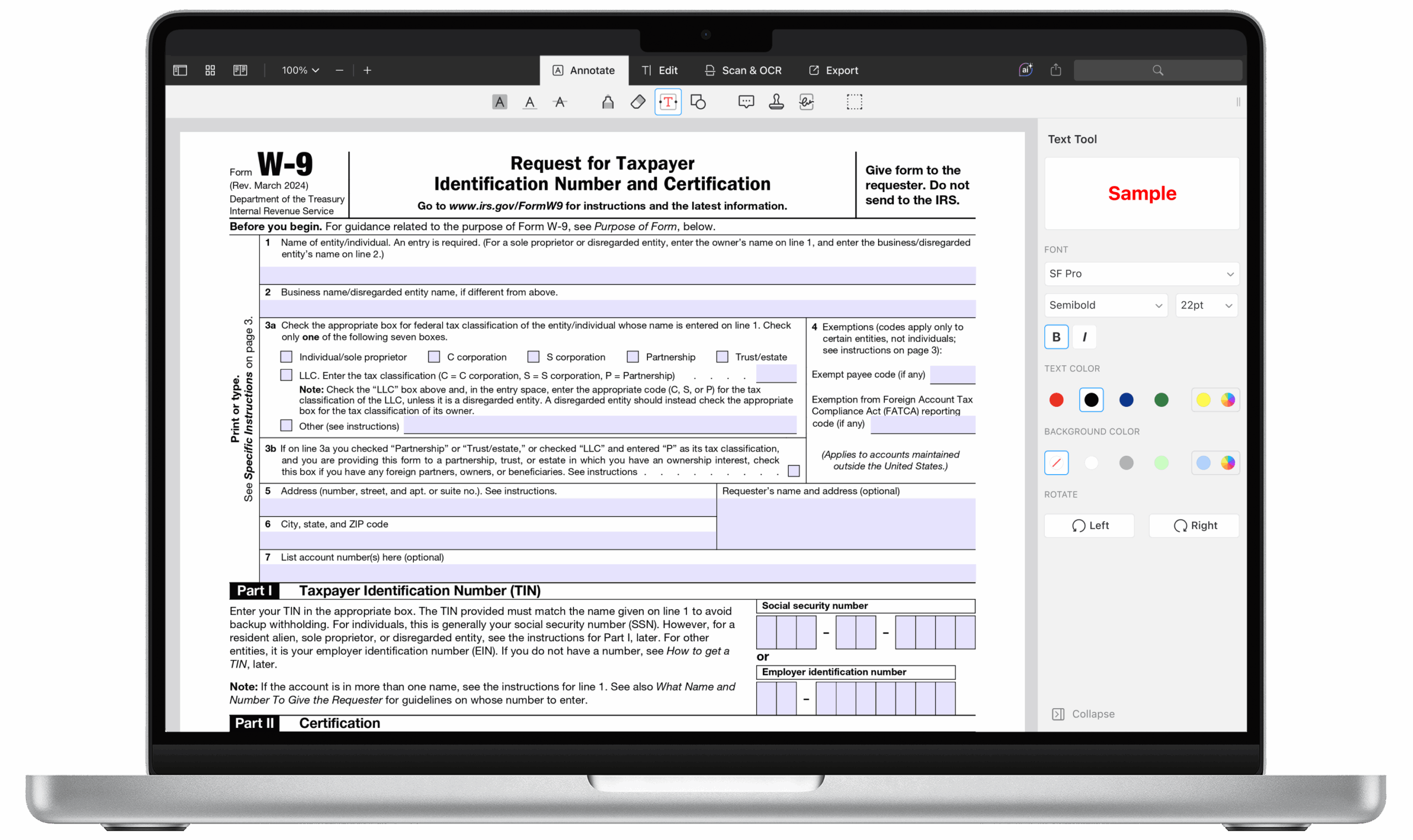

IRS Printable W-9 Form

If you find yourself in need of a W-9 form, you can easily access a printable version on the IRS website. The form is available in PDF format, making it easy to fill out and print. When completing the form, be sure to provide your name, address, and taxpayer identification number. You will also need to indicate your tax classification, such as individual, corporation, or partnership.

It is important to note that the W-9 form is not just for individuals. Businesses may also be required to provide a W-9 form to vendors or contractors that they work with. This helps ensure that the business has the necessary information to report income paid to the IRS accurately.

Once you have completed the W-9 form, be sure to keep a copy for your records. This will come in handy if you need to provide the information to multiple businesses or individuals. Remember, it is always better to be proactive and provide the necessary information upfront to avoid any potential issues down the line.

In conclusion, the IRS printable W-9 form is a simple yet important document that is used for tax reporting purposes. By filling out the form accurately and keeping a copy for your records, you can ensure that your tax information is up to date and accurate. Whether you are an individual or a business, it is important to understand the purpose of the W-9 form and how to correctly fill it out.