As tax season approaches, it’s essential to have all the necessary forms ready to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides a range of printable tax forms for taxpayers to use when preparing their returns. These forms are essential for reporting income, deductions, and other financial information to the IRS.

One of the most critical aspects of filing your taxes is ensuring you have the correct forms for the tax year you are reporting. For the tax year 2015, the IRS has specific forms that taxpayers must use to report their income, deductions, and credits accurately. By using the IRS printable tax forms for 2015, taxpayers can ensure they are complying with all necessary tax laws and regulations.

When it comes to IRS printable tax forms for 2015, taxpayers can find a variety of forms to meet their specific needs. Some of the most common forms include Form 1040, which is the standard individual income tax return form. Additionally, there are forms for reporting deductions, such as Form 1040 Schedule A for itemized deductions, and Form 1040 Schedule C for reporting business income and expenses.

For those with more complex tax situations, there are additional forms available, such as Form 1040 Schedule D for reporting capital gains and losses, and Form 1040 Schedule E for reporting rental income and expenses. By using these IRS printable tax forms for 2015, taxpayers can ensure they are accurately reporting all income and deductions to the IRS.

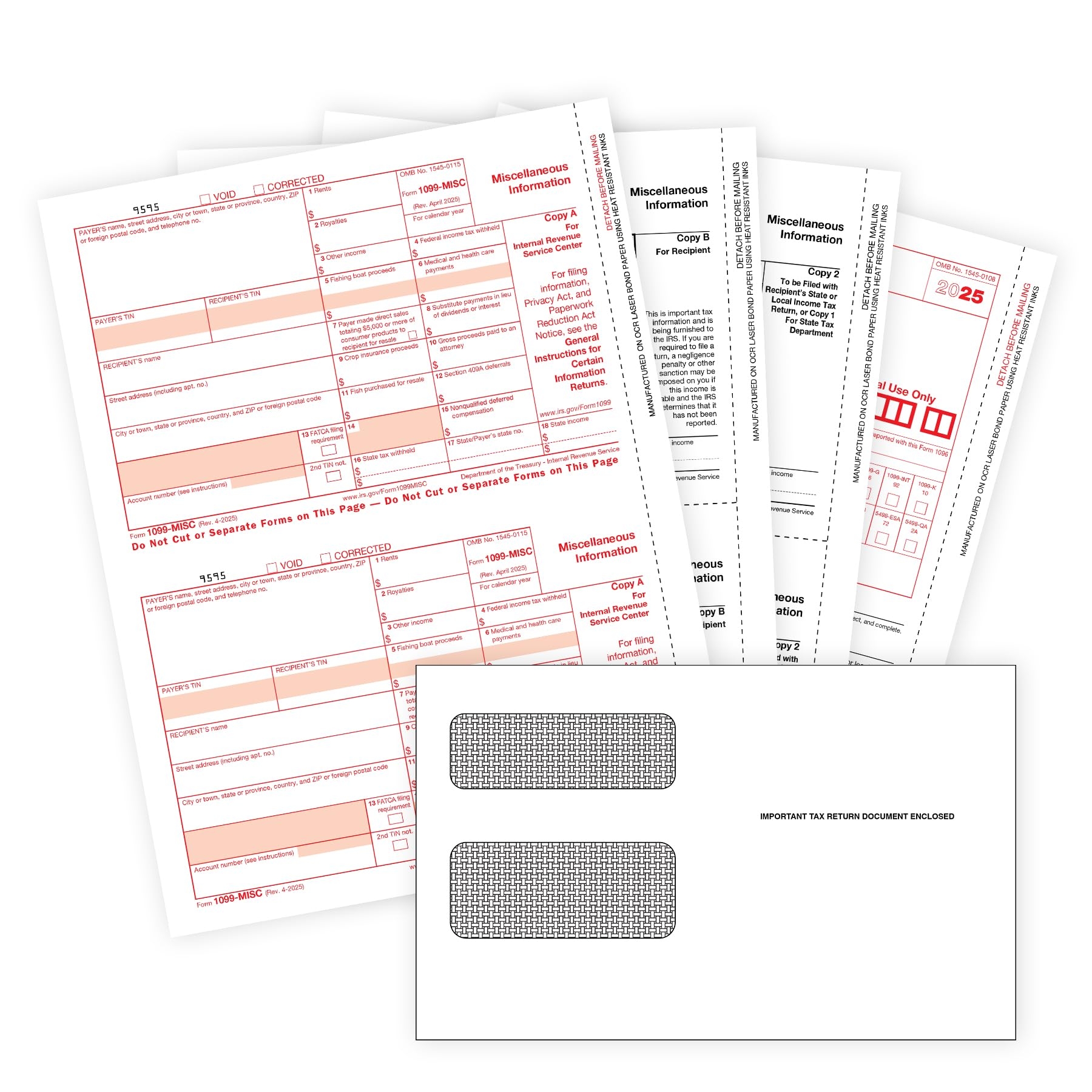

It’s essential for taxpayers to carefully review the instructions for each form to ensure they are completing them correctly. Additionally, taxpayers may need to include supporting documentation, such as W-2s, 1099s, and receipts, when submitting their tax forms to the IRS. By following the guidelines provided by the IRS and using the printable tax forms for 2015, taxpayers can avoid errors and potential audits.

In conclusion, IRS printable tax forms for 2015 are essential tools for taxpayers to use when filing their taxes. By using the correct forms and following the instructions provided by the IRS, taxpayers can accurately report their income, deductions, and credits to ensure they are compliant with tax laws. As tax season approaches, be sure to download and print the necessary IRS forms for the tax year 2015 to make the filing process as smooth as possible.