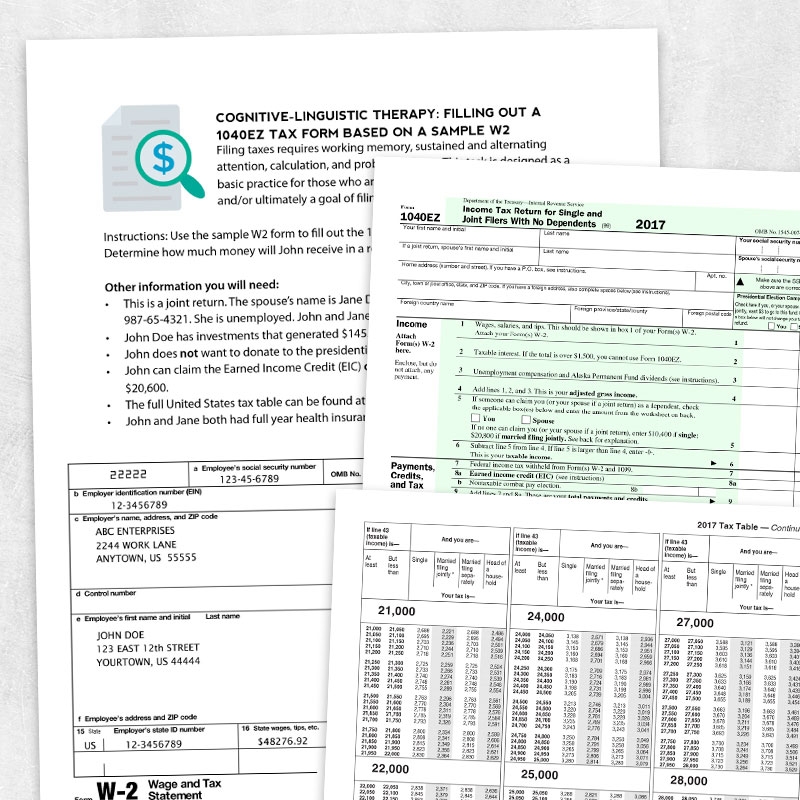

As tax season approaches, many Americans are gearing up to file their taxes and ensure they are in compliance with the IRS regulations. One of the most commonly used forms for individuals filing their taxes is the IRS Printable Tax Form 1040ez. This form is designed for taxpayers with straightforward tax situations and can be easily filled out and submitted.

With the IRS Printable Tax Form 1040ez, individuals can report their income, claim any deductions or credits they are eligible for, and calculate their tax liability. This form is particularly popular among those who do not have many deductions or credits to claim and have a simple tax situation.

Irs Printable Tax Forms 1040ez

Irs Printable Tax Forms 1040ez

Irs Printable Tax Forms 1040ez

When using the IRS Printable Tax Form 1040ez, taxpayers must ensure they meet the eligibility requirements to use this form. For example, individuals must have a taxable income of less than $100,000, have no dependents, and have only income from wages, salaries, tips, and taxable scholarships or grants. Additionally, taxpayers cannot itemize deductions when using this form.

One of the benefits of using the IRS Printable Tax Form 1040ez is its simplicity and ease of use. This form has a straightforward layout and includes clear instructions to help taxpayers accurately report their income and calculate their tax liability. Additionally, the form can be easily downloaded from the IRS website and printed for convenience.

After completing the IRS Printable Tax Form 1040ez, taxpayers can submit their form electronically or mail it to the IRS. It is important to ensure all information is accurate and complete before submitting the form to avoid any delays or issues with the IRS. Additionally, taxpayers should keep a copy of their completed form for their records.

In conclusion, the IRS Printable Tax Form 1040ez is a convenient and easy-to-use form for individuals with simple tax situations. By following the instructions provided and ensuring all information is accurate, taxpayers can successfully file their taxes and meet their obligations to the IRS. As tax season approaches, be sure to download and use the IRS Printable Tax Form 1040ez for a hassle-free tax filing experience.