When tax season rolls around, it’s important for businesses to accurately report payments made to independent contractors and freelancers. The IRS requires businesses to fill out Form 1099-MISC for each independent contractor to whom they have paid $600 or more in a year. This form is crucial for both the business and the contractor to report income and file their taxes correctly.

For those who need to file Form 1099-MISC, the IRS provides printable forms that can be easily accessed and filled out. These forms are essential for businesses to comply with tax regulations and avoid penalties for failure to report payments to independent contractors.

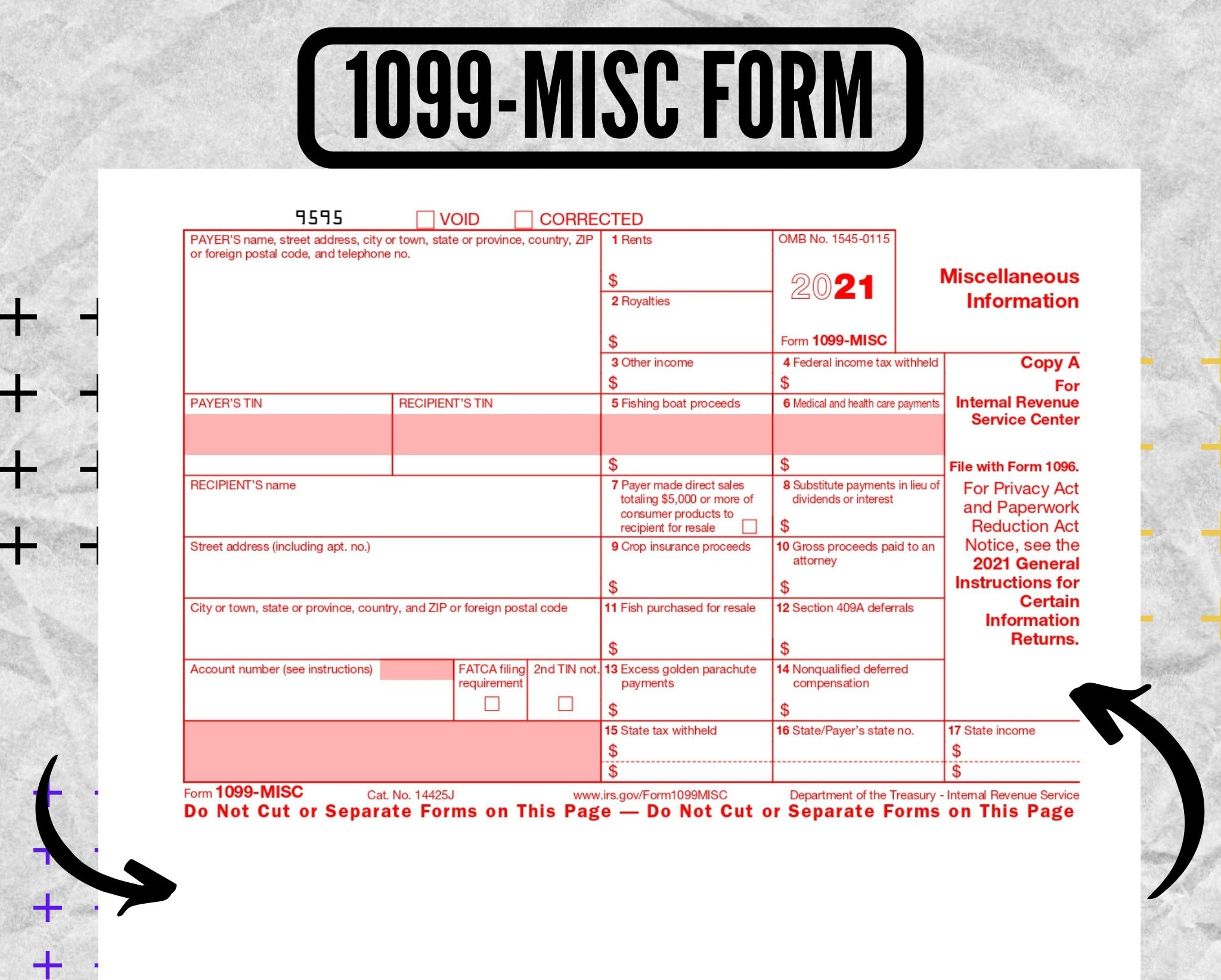

When filling out the 1099-MISC form, businesses will need to provide their information, the contractor’s information, and the total amount paid to the contractor during the tax year. This information is crucial for the contractor to accurately report their income on their tax return.

It’s important to note that businesses must send a copy of the completed Form 1099-MISC to both the contractor and the IRS by the designated deadline. Failure to do so can result in penalties and fines. By using the IRS printable forms, businesses can ensure that they are meeting their tax obligations and avoiding any potential issues with the IRS.

Overall, IRS printable 1099-MISC forms are essential for businesses to accurately report payments made to independent contractors and freelancers. By filling out these forms correctly and submitting them on time, businesses can avoid penalties and ensure compliance with tax regulations. It is crucial for businesses to stay organized and keep track of all payments made to contractors throughout the year to avoid any issues come tax season.

In conclusion, utilizing IRS printable 1099-MISC forms is essential for businesses to properly report payments to independent contractors and freelancers. By following the guidelines set forth by the IRS and submitting these forms on time, businesses can avoid potential penalties and ensure compliance with tax laws.